Abstract:Two enemies have been controlling the Forex market for ages. We now break how these forces work.

Two enemies have been controlling the Forex market for ages. We now break how these forces work.

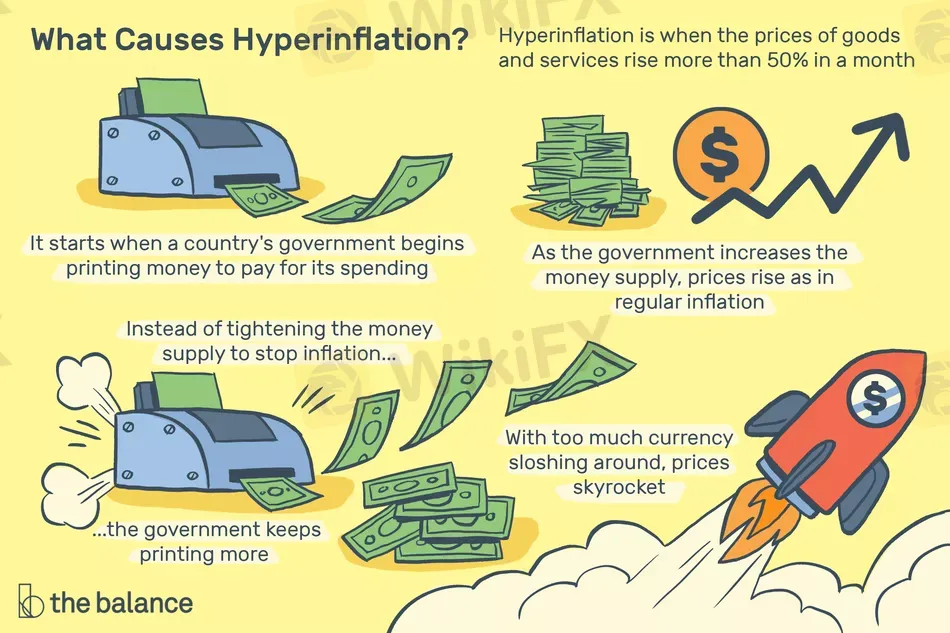

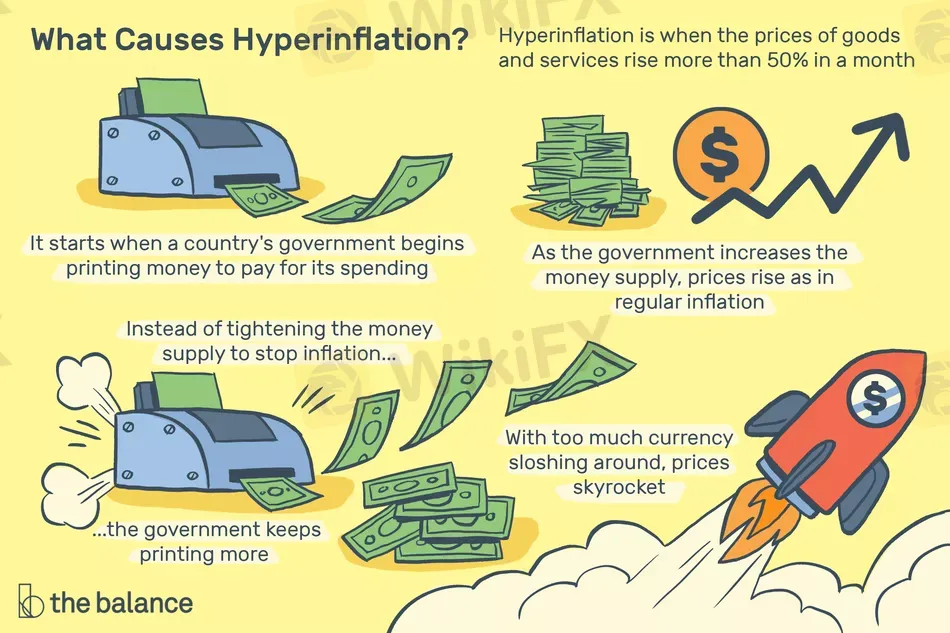

Hyperinflation

Before discussing the specific impact of inflation and deflation on the economy, we need to know about the background knowledge. Inflation and deflation are monetary phenomena. The fluctuation of commodity prices is mainly affected by market supply and demand. The well-known quantity theory of money in economics points out that the price index is determined by economic output, the stock of nominal money, and the velocity of money circulation. Therefore, when a country‘s economy has sustained inflation, it can be considered that the driving force is the continued rapid growth of the central bank’s money supply.

Deflation

In fact, the harm of deflation is simple. If everyone knew that commodity prices were to fall tomorrow, most people wouldnt consume or invest today. They might buy some commodities with relatively low demand elasticity, such as daily necessities and today's dinner, etc. But for some high-priced durable goods, consumers may have to carefully consider whether to consume them immediately or wait for a price reduction. This reflects the real interest rate mentioned above. Even if the bank deposit interest rate is zero (such as in Japan), if prices continue to fall, consumers will still hold on to their money. If consumers believe that deflation will exist for a long time, then the total economic demand will remain persistently below the equilibrium level, indicating a long-term recession.

It is not difficult to find that the harm of deflation is far greater than moderate inflation. The public's fear of inflation mostly stems from the illusion that real purchasing power has increased due to the economic crisis in hyperinflation countries and deflation. Hyperinflation is not the culprit of economic crises. Deep-seated economic problems are the driving force. In contrast, deflation can directly cause recession and decrease the effectiveness of the central bank's monetary policy. The outcome is beyond underestimation. When the macro economy is in recession, the small amount of additional purchasing power that individuals gain may not be enough to make up for the loss of unemployment and wage cuts. Deflation is even more terrifying both for the economy as well as for the individual.

This is the reason why the central banks of developed economies keep the CPI stable at 2%. So the movements of CPI and interest rate usually reflect the value of currencies.

WikiFX is a global Forex inquiry platform that provides real-time rankings of Forex brokers. So if you are seeking a broker to start your Forex trading journey, please search the detailed information about the broker on the WikiFX.