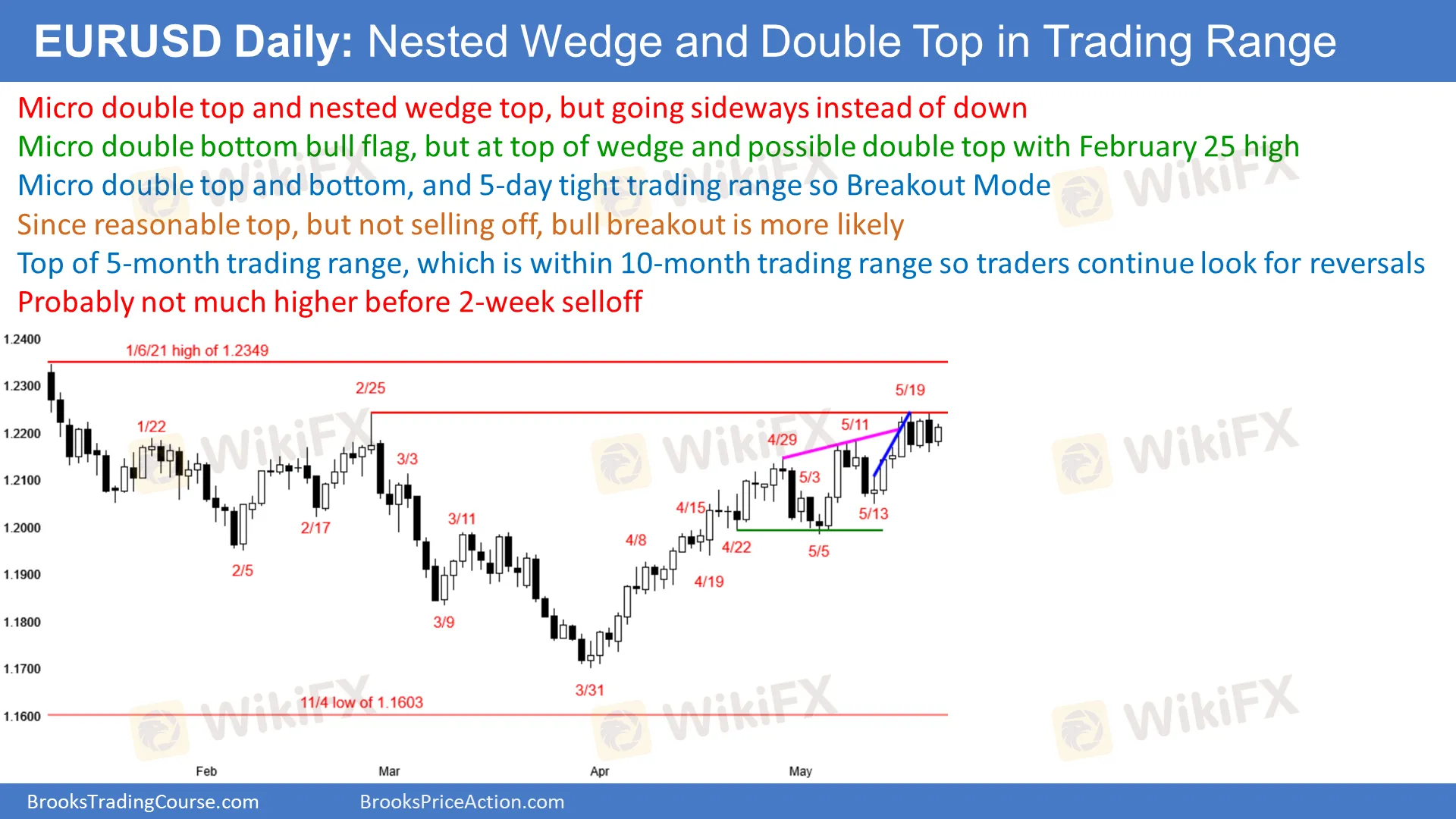

Friday was an outside down bar for EUR/USD. It formed a micro double top with Wednesdays high.

The rally up until May 19 was a nested wedge, with Friday sending a sell signal bar for the nested wedge and double top with the Feb. 25 high. Whenever there is a credible sell setup, and the market does not go down, it will probably go up.

We're in a 5-day tight trading range, so it's Breakout Mode.

Friday closed above Thursday's low, so there's a low probability a sell setup will occur; there may be more buyers than sellers.

So far, today is a bull inside day. There is a micro double bottom in the 5-day tight trading range and if today continues to be a bull day, it will be a buy signal bar for tomorrow, especially if today closes near its high. EUR/USD has been in a strong bull trend since the March low, so a reversal down will probably be minor. There might be a 2-week sideways to down pullback, but a bear trend is not likely this week.

EUR/USD might test down to the 1.20 Big Round Number, since it is also around the 50% pullback, and at the bottom of wedge.

Bulls want a breakout above the January high, which is at the top of the 2-year trading range. Most trading range breakouts fail, so we'll probably see sellers above or around the January high.

The 4-day tight trading range reduces the chance of big move up or down today.

EUR/USD forex daily chart

EUR/USD Daily Chart

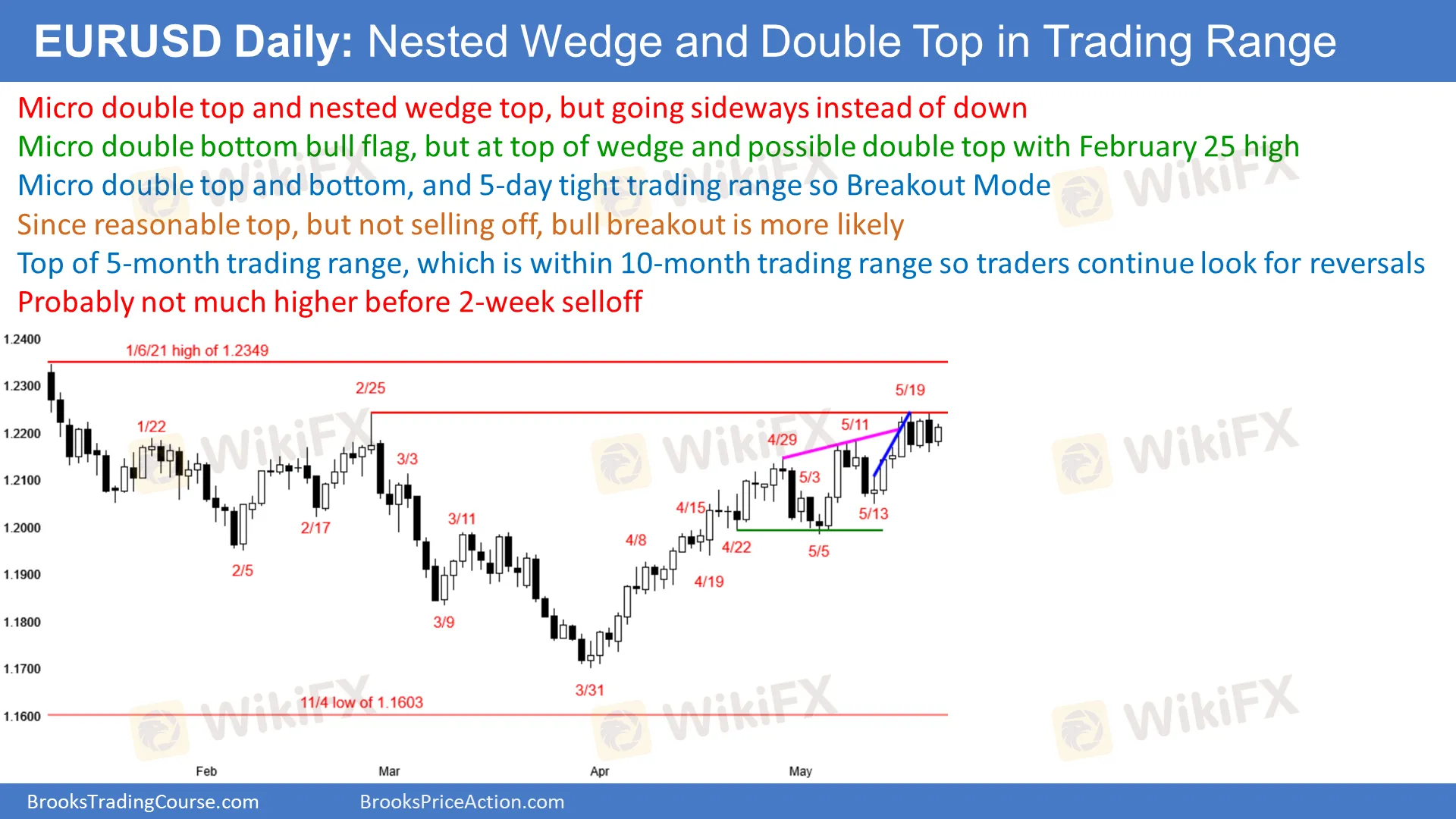

Overnight EUR/USD forex trading on the 5-minute chart

EUR/USD sold off sharply several hours ago, but reversed up just as sharply.

Bulls were prevented today from trading below yesterdays low, which would have triggered a daily sell signal.

Reversal up was strong enough to make a bear trend unlikely today.

Trading was sideways for 2 hours in the top half of the 5-day tight trading range.

Today will probably be a trading range day, and stay within the 5-day tight trading range.

If today breaks above Fridays high and the top of the range, the breakout will probably not be big. Therefore, today will probably not be a big bull day.

Since sideways to up is likely, day traders will scalp in both directions.

Trend day up or down is unlikely, but if there is a series of strong trend bars, traders will switch to swing trading.

The bulls want today to close nears its high, which would increase the chance of a breakout above the Feb. 25 high tomorrow.

The bears would like today to be a 2nd consecutive bear day, but the odds favor a bull day today. The bears instead will try to get today to close below the midpoint of the range, to continue the 5-day tight trading range and reduce the chance of a bull breakout.