Abstract:Pedestrians are reflected in a window as they walk past an electronic stock board at the ASX Ltd. exchange centre in Sydney, Australia, on Thursday, Feb. 14, 2019.

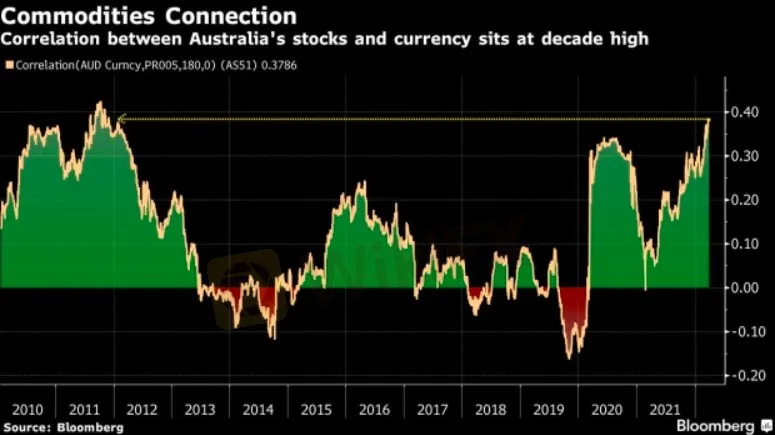

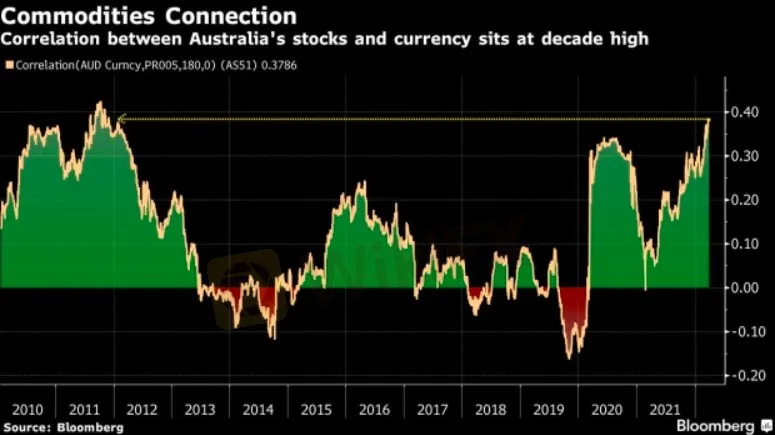

The relationship between Australias equities and currency has become the closest in a decade as commodity prices surge.

The 180-day correlation between the country‘s stock benchmark and the Australian dollar has climbed to the highest level since late 2011, according to data compiled by Bloomberg. The strengthened ties come as rallies in materials from oil to iron ore have boosted both the nation’s equities and the Aussie.

Commodity-price movements stand out as a “common theme” in times of high correlation between the two assets, said Carl Capolingua, an analyst at ThinkMarkets Australia. The connection between Australias shares and currency “tends to be the highest during some pretty significant macroeconomic dislocation,” he said.

Energy and materials stocks are among the top gainers this year on the S&P/ASX 200 Index, with the former surging 28% and the latter rising 11%. The two sectors make up almost 30% of the broader gauge, their highest weighting since 2011, data compiled by Bloomberg show.

While miners have long been one of the largest components in Australia‘s stock market, their weighting has increased following the unification of BHP Group Ltd. The world’s biggest miner became the indexs largest stock after the company scrapped its dual-listing structure in January.

Australias dollar has strengthened about 3% this year to make it the best-performing Group-of-10 currency over the period. The Aussie, which traded at 74.79 U.S. cents Friday, has surged more than 7% since touching its lowest in more than a year in late January.

‘Remain Elevated’

“With supply constraints and the Russia-Ukraine war continuing, commodity prices will remain elevated,” potentially pushing the Australian dollar up to 80 cents in the next six months, said Russel Chesler, head of investments and capital markets at VanEck Associates Corp. in Sydney.

Surging commodity prices arent the only things propelling both assets. Bets on tighter monetary policy have boosted the Aussie and share prices of local banks, the largest sub-group on the stock benchmark.

Still, a strong currency hasn‘t always been a boon for the economy or the nation’s stocks. It can reduce the value of earnings from commodity exports, which are priced in U.S. dollars, and hurt profitability at tourism and education companies by raising the costs for foreign purchasers.

In addition, the S&P/ASX 200 Index dropped 15% in 2011, its worst year outside the global financial crisis in 2008, after the Australian dollar rose above $1.10 for the first time since it was freely floated in 1983.