Abstract:India has successfully registered 28 crypto service providers, reinforcing compliance and fostering positive regulation of offshore exchanges.

The Indian government just announced that they have registered 28 cryptocurrency service providers with their Financial Intelligence Unit. Furthermore, the Ministry of Finance has said that anti-money laundering and reporting requirements apply to offshore cryptocurrency exchanges serving the Indian market.

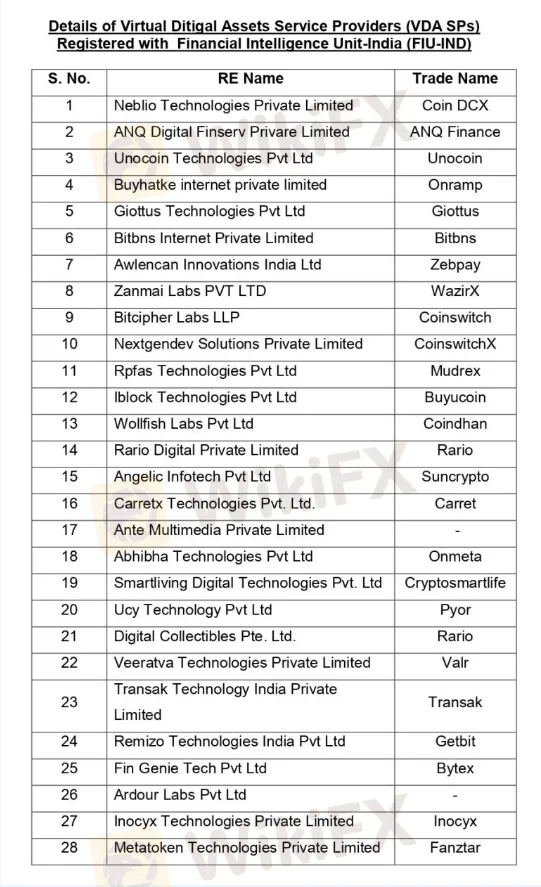

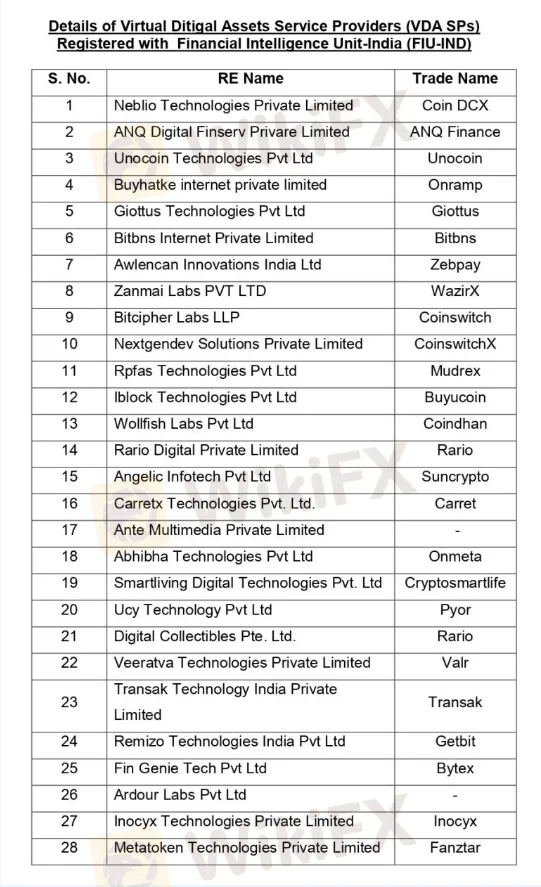

New Delhi, India The Indian Ministry of Finance provided important information on the Indian crypto sector during a session of the Lok Sabha, India's lower house of parliament. In response to a question from a parliament member about entities following Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) Guidelines for Reporting Entities Dealing with Virtual Digital Assets, Pankaj Chaudhary, Minister of State in the Ministry of Finance, shared a list of 28 Virtual Digital Assets Service Providers (VDA SPs) registered with India's Financial Intelligence Unit (FIU).

These registered entities include well-known names such as Coindcx, Unocoin, Giottus, Bitbns, Zebpay, Wazirx, Coinswitch, Mudrex, Buyucoin, Pyor, Valr, and Bytex, among others.

The Ministry of Finance emphasized earlier in March that entities involved in virtual digital assets, which include cryptocurrency exchanges and intermediaries, fall under the category of “reporting entities” as per the Prevention of Money Laundering Act (PMLA).

Furthermore, when questioned about whether the guidelines and reporting requirements extend to offshore cryptocurrency exchanges catering to the Indian market, Minister Pankaj Chaudhary confirmed, “Yes, Furthermore, when asked if the guidelines and reporting requirements apply to offshore cryptocurrency exchanges serving the Indian market, Minister Pankaj Chaudhary confirmed, ”Yes, the guidelines and reporting requirements apply to offshore crypto exchanges servicing the Indian market.“ The registration procedure for these VDA SPs has begun, and relevant steps under the Prevention of Money Laundering Act will be implemented in situations of noncompliance by offshore platforms.”

This announcement is a huge milestone in the Indian cryptocurrency market. The registration of crypto service providers with the FIU reflects the government's commitment to regulating and monitoring the cryptocurrency business in order to avoid illegal activities like as money laundering and terrorism funding.

The inclusion of offshore crypto exchanges under the regulatory framework guarantees that all firms participating in the Indian crypto industry follow the same AML and CFT requirements, promoting a safer and more transparent environment for investors and consumers.

Finally, the Indian government's move to register 28 crypto service providers and extend regulatory measures to offshore exchanges is a proactive step toward safeguarding the integrity and security of India's cryptocurrency sector.

To learn more about the newest advancements in the cryptocurrency business and to remain up to speed on regulatory changes, go to https://www.wikifx.com/en.

Bottom Line

The Indian government has registered 28 crypto service providers with the Financial Intelligence Unit, stressing compliance with anti-money laundering norms and reporting requirements for both local and offshore exchanges servicing the Indian market.