简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Questrade Trading Accounts: Comparing Demo vs Live Spreads & Fees

Abstract:A full breakdown of Questrade trading account types. Compare spreads, commissions, and fees. Learn how to open a free demo account.

What Account Types and Fees Can You Expect at Questrade?

Questrade offers various account types suited to different financial goals, such as retirement savings, education savings, and forex/CFD trading. The fees vary depending on the type of account and the product you are trading. Below is a breakdown of common account types and their associated fees:

- TFSA (Tax-Free Savings Account): Designed for tax-free growth and withdrawals.

- RRSP (Registered Retirement Plan): For retirement savers looking to benefit from tax deferrals.

- RESP (Registered Education Savings): For parents saving for their children's education.

- FHSA (First Home Savings Account): For first-time homebuyers saving for a down payment.

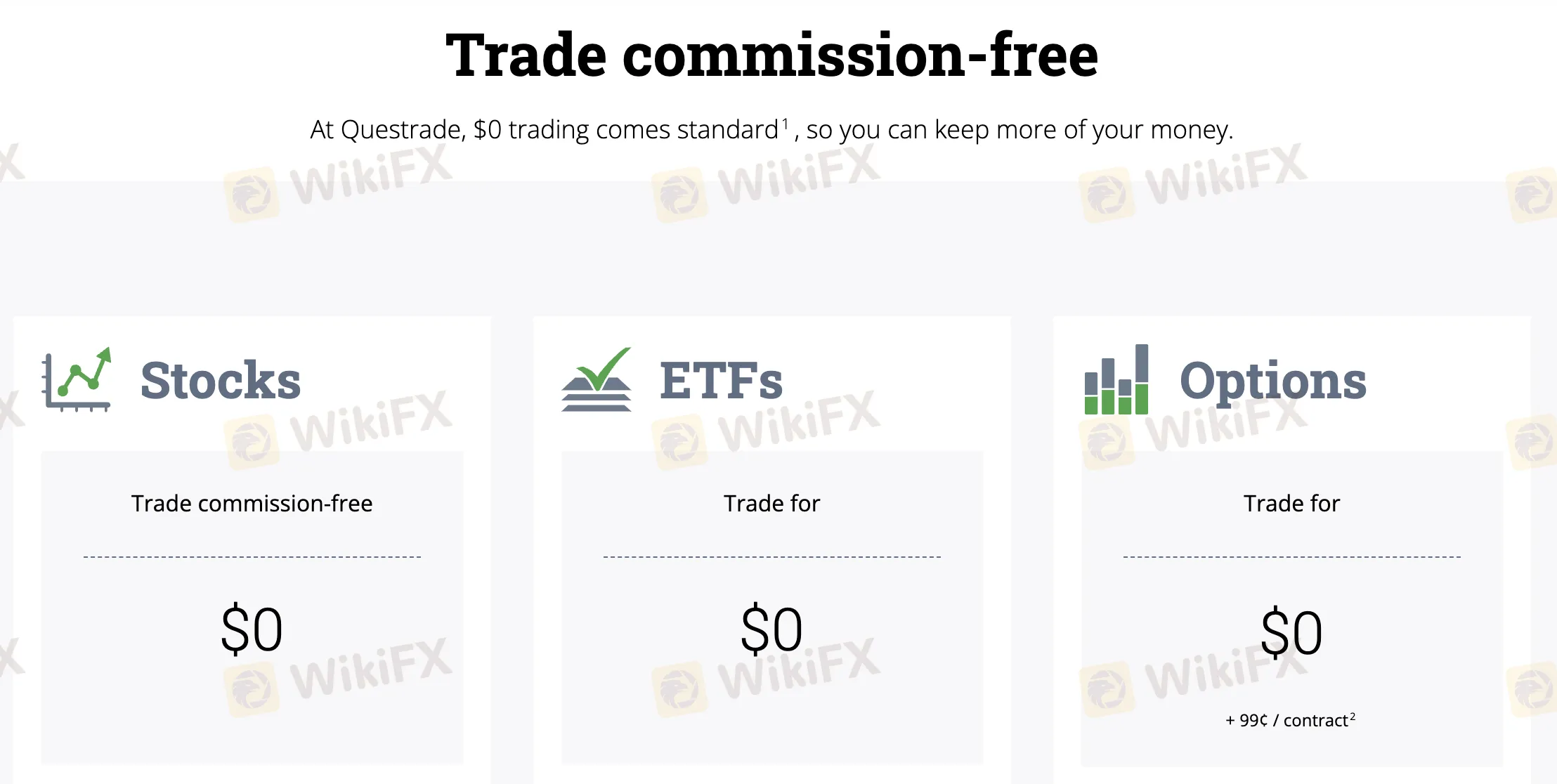

Questrade's fee structure is competitive, with zero commission on stocks and ETFs. For other assets such as options, forex, CFDs, and international equities, specific fees apply.

Questrade Account Types: A Head-to-Head Comparison

| Account Type | Suitable for | Fees (Overview) |

| TFSA (Tax-Free Savings) | Tax-free growth & withdrawals | $0 commission on stocks & ETFs. Other fees may apply for mutual funds, bonds, and options. |

| RRSP (Retirement) | Retirement savings with tax benefits | Similar fee structure as TFSA. Additional fees for withdrawal, if applicable. |

| RESP (Education) | Parents saving for children's education | Fees for mutual funds or bonds may apply. Options and ETFs are commission-free. |

| FHSA (Home Savings) | First-time homebuyers saving for a down payment | No commission for stocks & ETFs. Other investment vehicles may have fees. |

| Corporate Accounts | Businesses managing funds | Higher fees on certain transactions and products. |

| Forex/CFD Accounts | Active forex and CFD traders | Spreads from 0.08 pips; additional fees for specific products. |

| Margin Accounts | Traders using leverage | $0 for stocks & ETFs. Interest fees on borrowed funds for margin trading. |

Fees for Specific Products

- Stocks and ETFs: $0 commission on trades.

- Options: $0 + 99¢ per contract.

- Forex (FX): Spread from 0.08 pips.

- CFDs: Fees may vary based on the product.

- Mutual Funds: $9.95 per trade; deferred sales charge if withdrawn early.

- International Equities: Minimum $195 + exchange/stamp fees, approximately 1% of trade value.

- Bonds: Minimum $5,000 purchase.

FAQs about Questrade Account Types & Fees

- Are there fees for opening an account?

No, Questrade does not charge fees to open an account.

- What are the fees for options trading?

Questrade charges $0 plus 99¢ per contract for options trading.

- Can I open a TFSA account with a $10 deposit?

Yes, you can open a TFSA account with a minimum deposit of just $10.

- Does Questrade charge withdrawal fees?

No, Questrade does not charge any fees for withdrawals.

- What is the fee for trading international equities?

Trading international equities incurs a minimum fee of $195, plus exchange and stamp fees, typically around 1% of the trade value.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

XTB Review 2025: Pros, Cons and Legit Broker?

Cabana Capital Review 2025: Safety, Features, and Reliability

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Common Questions About OtetMarkets: Safety, Fees, and Risks (2025)

Currency Calculator