Abstract:Investment scams tied to fake forex brokers and crypto exchanges are rising in Asia, exploiting weak KYC rules and targeting cross-border investors.

Fake Forex Brokers Exploit Asias Expanding Markets

Fraudulent investment platforms posing as legitimate forex brokers and cryptocurrency exchanges have become the most pressing financial threat across Asia. Investigators warn that these scams are no longer isolated incidents but part of a coordinated, transnational enterprise.

The schemes rely on advanced social engineering, luring victims through social media and encrypted messaging apps. Once contact is made, scammers present themselves as seasoned traders or financial mentors, offering “exclusive” access to high-yield opportunities.

Recent reports from Vietnam highlight the scale of the problem. In August 2025, authorities dismantled a billion-dollar crypto fraud tied to the Paynet Coin platform. Twenty individuals were arrested on charges ranging from asset misappropriation to multi-level marketing violations. Analysts say this case is only the tip of the iceberg, with dozens of similar operations still active across the region.

How Scam Brokers Build Trust and Extract Funds

Unlike traditional cybercrime, these forex scam brokers operate with corporate-style hierarchies. Researchers describe a distributed model where each actor has a defined role:

- Target Intelligence Teams mine stolen data from the dark web to identify wealthy or investment-minded individuals.

- Promoters craft convincing personas on TikTok, Telegram, and Facebook, posing as entrepreneurs or financial coaches.

- Payment Handlers open and manage bank accounts and digital wallets, exploiting gaps in KYC and KYB verification.

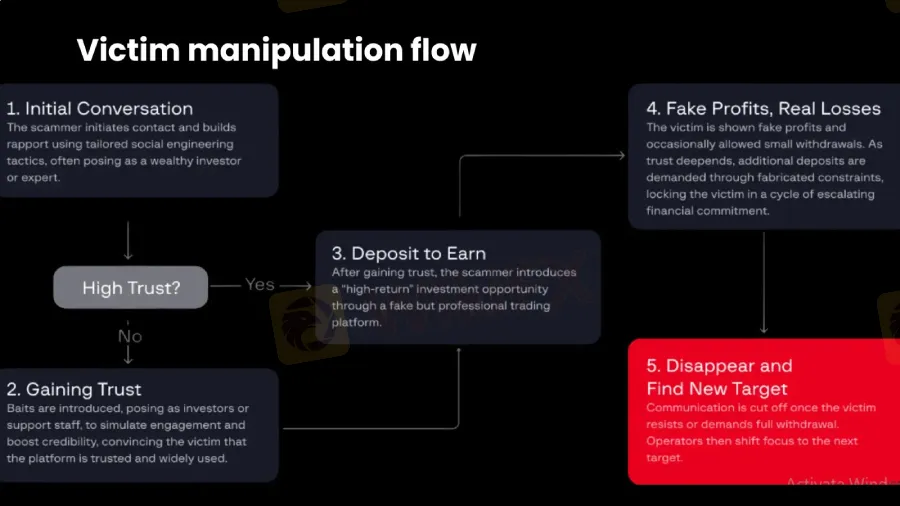

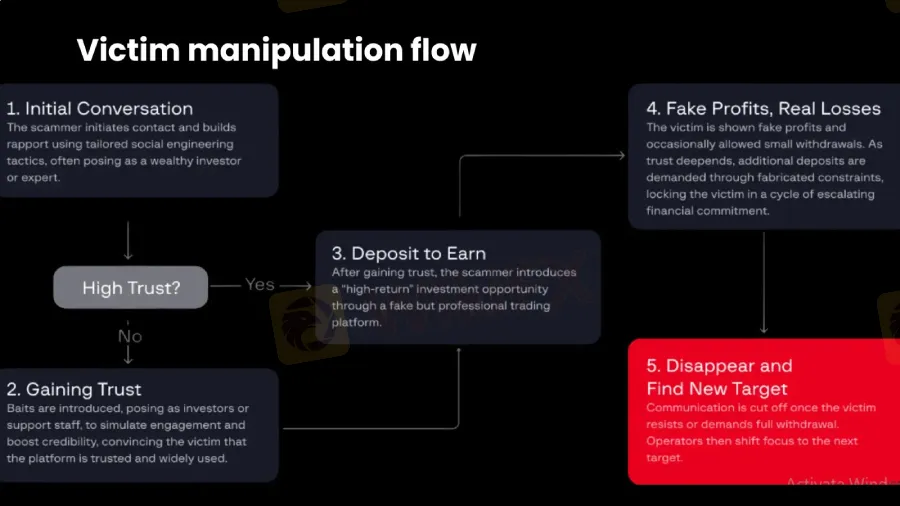

- Backend Operators design fake trading dashboards that display fabricated profits, reinforcing the illusion of legitimacy.The manipulation funnel follows a predictable pattern. Victims are first approached casually, often through a “friendly” introduction. If hesitant, they are shown fabricated testimonials or introduced to fake fellow investors. Once trust is secured, the platform displays simulated profits, sometimes even allowing small withdrawals to deepen credibility.

As deposits grow, withdrawal requests are delayed with excuses ranging from “system upgrades” to “compliance checks.” When victims demand full payouts, communication abruptly ends, and the fraudsters move on to new targets.

Technical analysis shows these scams are not isolated websites but interconnected networks sharing backend infrastructure. Invitation-only access codes tie each victim to a specific promoter, ensuring accountability within the fraud ecosystem.

Regulatory Crackdowns and Criminal Adaptation

Governments are tightening controls, but scam brokers are adapting just as quickly. Vietnams Circular 17/2024, effective July 2025, introduced stricter corporate account requirements, including biometric verification. While this has disrupted some operations, it has also fueled underground markets for forged documents, stolen IDs, and even AI-powered face-swap technology.

Archived scans of dismantled domains reveal recurring code structures and admin panels, suggesting a centralized backend supporting multiple scam brands. Analysts warn that generative AI is increasingly being integrated into fraud infrastructure, from automated chatbots to deepfake onboarding videos.

The sophistication of these operations underscores the urgent need for coordinated international enforcement. Financial regulators across Asia and beyond are calling for stronger KYC standards, cross-border intelligence sharing, and public awareness campaigns to blunt the impact of these scams.