Abstract: A trader has recently raised concerns about withdrawal problems on IQ Option, urging the company to take action to resolve the issue. The trader, identified as Dorris, sent a complaint to IQ Option Support after experiencing difficulties retrieving her funds. She also shared a copy of her message with WikiFX, highlighting her frustration and calling attention to the lack of clear communication from the broker.

A trader has recently raised concerns about withdrawal problems on IQ Option, urging the company to take action to resolve the issue. The trader, identified as Dorris, sent a complaint to IQ Option Support after experiencing difficulties retrieving her funds. She also shared a copy of her message with WikiFX, highlighting her frustration and calling attention to the lack of clear communication from the broker.

This case underscores the potential risks associated with investing through IQ Option, especially for users who face obstacles when attempting to withdraw their money.

Unresolved Withdrawal Issue Raises Concerns

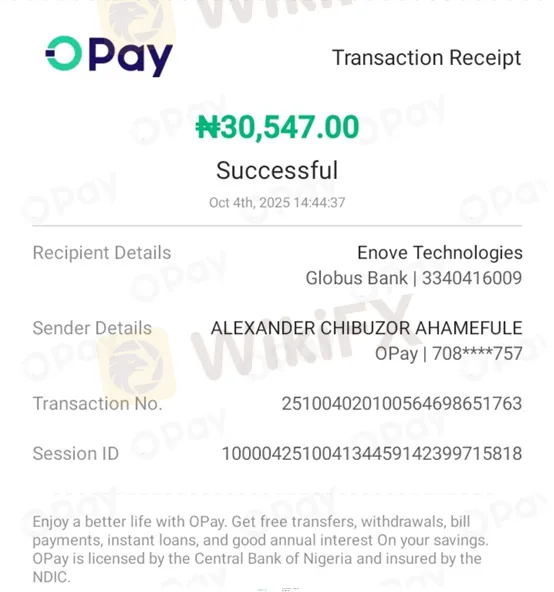

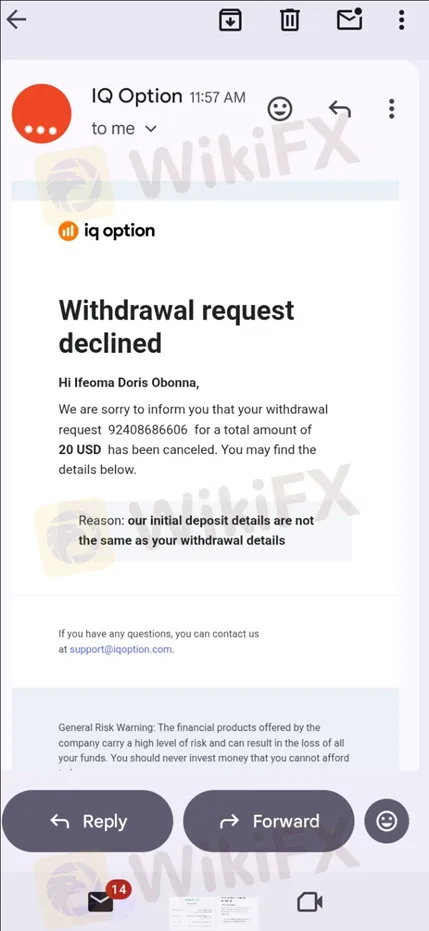

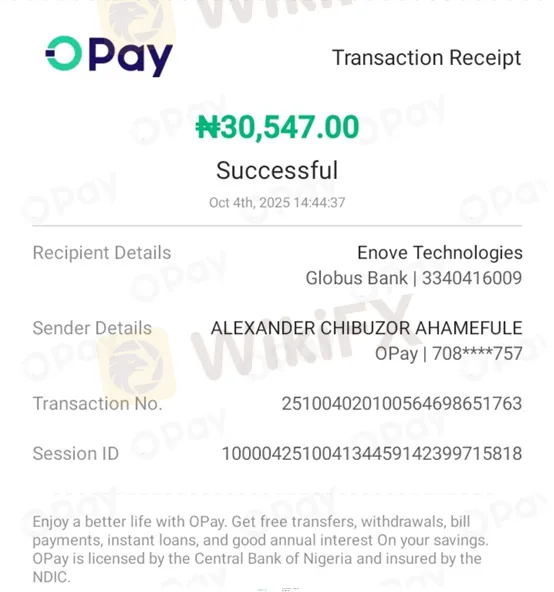

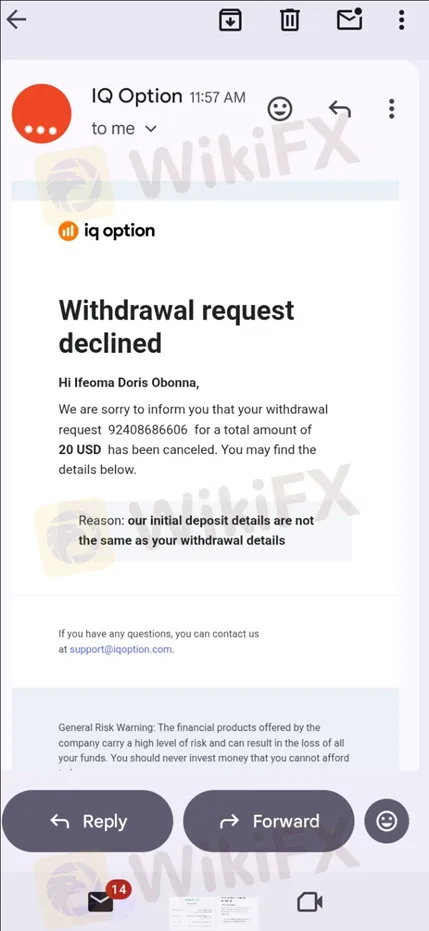

According to Dorris, she initially funded her trading account via bank transfer through an Opay (Paycomm) account. However, when she later tried to withdraw her funds, she discovered that the platform did not provide any withdrawal option using the same method.

Despite multiple attempts to contact IQ Option‘s support team, the trader received unsatisfactory responses and no effective solution to recover her money. She described the platform as “user-unfriendly and unresponsive”, expressing disappointment over IQ Option’s lack of alternatives or flexibility in handling withdrawal-related issues.

The trader also claimed that IQ Options withdrawal policies were not clearly disclosed during the deposit process, which left her unaware of potential limitations or restrictions. Her experience reflects a broader concern among traders about opaque operational practices and delays in fund processing.

Transparency and Accountability

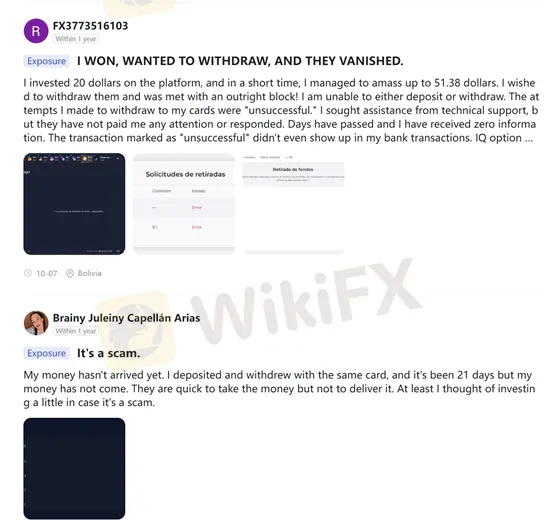

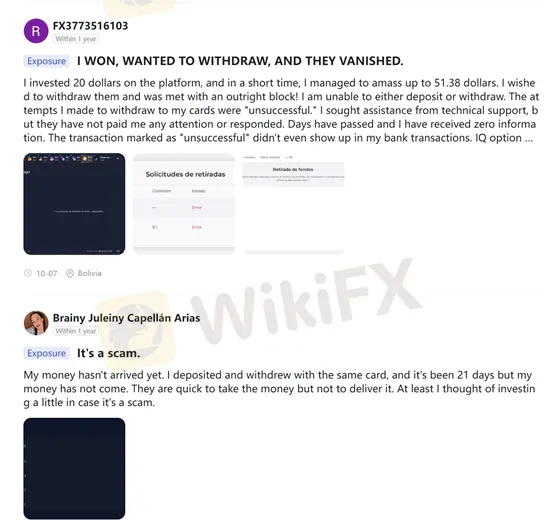

Cases like this raise important questions about how brokers communicate their policies and manage customer requests. Traders rely on brokers to provide transparent withdrawal procedures, but when these are unclear or inconsistent, investor confidence can quickly erode.

On the other hand, the unresolved withdrawal cases can damage a brokers reputation, especially in the competitive online trading world, where trust and accessibility are keys.

Potential Risk for Investors

While IQ Option promotes itself as a reliable trading platform offering forex, CFD, and cryptocurrency trading, incidents like this highlight the need for traders to exercise caution. Before investing, users should always verify the brokers regulatory status, review withdrawal policies, and ensure that customer support channels are responsive and transparent.

Regulatory Summary & WikiFX Rating for IQ Option

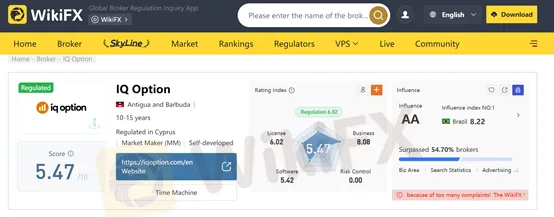

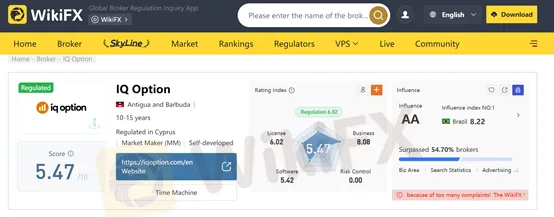

According to WikiFX:

- IQ Option Europe Ltd holds a licence from the Cyprus Securities & Exchange Commission (CySEC) under license number 247/14.

- However, WikiFX assigns IQ Option a risk rating of 5.47/10 (as of Nov 2025) . A relatively low score that suggests “under-the-hood” concerns despite formal regulation.

- WikiFX further reports about 90 user complaints relating to withdrawal issues, account verification delays, and customer support responsiveness.

In summary, although IQ Option is regulated in Cyprus for its European business, the overall picture is mixed. The low rating and numerous complaints point to possible systemic issues.

Conclusion

Based on the above, WikiFX advises investors to:

- Check the specific entity and licence you are using (e.g., IQ Option Europe Ltd vs other global arms).

- Ensure your jurisdiction is covered by the regulated license and confirm whether deposit/withdrawal methods are clearly stated.

- Test withdrawals with modest amounts before committing larger funds—make sure the same-method rule, processing times, etc., are acceptable.

- Maintain full documentation: proof of deposit, receipt, communication with support, screenshots of withdrawal attempts, etc.

- Be aware that user complaints are rising and ratings suggest elevated risk even for what appears to be a “regulated” broker.