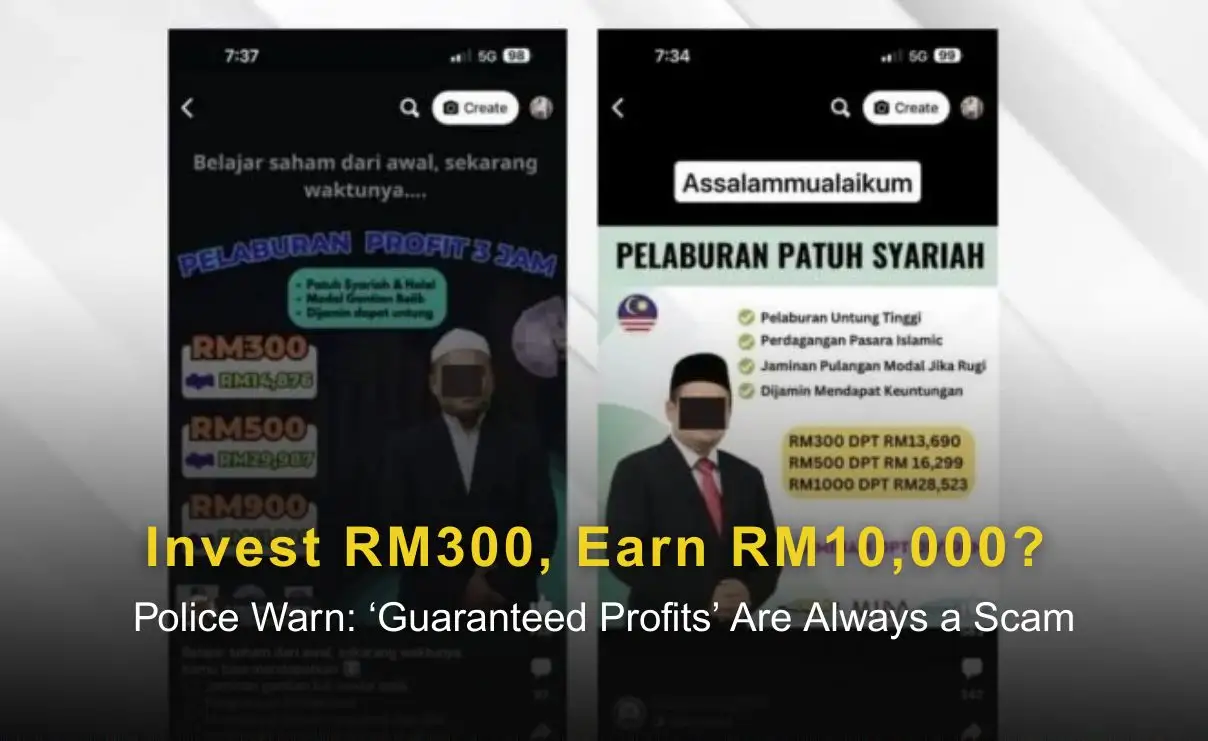

Abstract:A civil servant in Sibu has lost RM44,000 after falling victim to an online investment scam that promised high returns with minimal effort.

A civil servant in Sibu has lost RM44,000 after falling victim to an online investment scam that promised high returns with minimal effort. This is another reminder of how quickly “easy money” can turn into devastating loss.

According to Sibu police chief ACP Zulkipli Suhaili, the victim, a woman in her 40s, came across an investment advertisement on Facebook on 17 October. The post claimed participants could earn substantial profits within a short period. Tempted by the promise of quick financial gains, she reached out to the contact person behind the ad.

The suspect then sent her a link to an online registration form, requesting her personal and banking details. Believing it to be part of a legitimate process, the woman filled in the information and proceeded to make six separate payments totalling RM44,000. The funds were transferred into four different local bank accounts.

At first, the communication appeared convincing. The victim was reassured that her investment was “in progress” and that profits would soon be credited to her account. However, when she was later told that another RM13,000 was required to “rectify an identity card number error” before her returns could be processed, she began to suspect something was wrong.

Uncertain, she consulted a friend, who advised her that she had likely been scammed. Realising the truth, the woman immediately lodged a police report on 6 November.

Police have since launched an investigation under Section 420 of the Penal Code for cheating, which carries a possible sentence of up to 10 years in prison, whipping, and a fine upon conviction.