1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:If you are thinking about trading with dbinvesting, you need to be very careful. At WikiFX, we analyze brokers based on facts, licenses, and trader feedback.

Date: 2025/08/29

Broker Name: dbinvesting

WikiFX Score: 2.13 (Danger / High Risk)

Regulation: Seychelles FSA (Offshore)

If you are thinking about trading with dbinvesting, you need to be very careful. At WikiFX, we analyze brokers based on facts, licenses, and trader feedback.

dbinvesting has a very low score of 2.13 out of 10. In our system, a score below 3.0 usually means the broker has serious safety issues. While they do have a license, it is not a strong one. More importantly, in 2025, we have received multiple serious complaints from traders who could not get their money back.

A license is like a driver's license for a broker. It proves they follow the rules. If a broker does not have a strong license, your money is not safe.

According to WikiFX records, dbinvesting holds the following license:

| Regulator Name | Country | License No. | Type | Status |

|---|---|---|---|---|

| FSA (Financial Services Authority) | Seychelles | SD053 | Retail Forex License | Offshore Regulatory |

This is the most important part to understand. dbinvesting is regulated in Seychelles.

The Risk: If dbinvesting goes bankrupt or refuses to pay you, the Seychelles government is unlikely to help you recover your money. There is no compensation fund protecting your account. You are trusting the company's honesty, not the law.

At WikiFX, we look at patterns in complaints. A single complaint might be a mistake, but when many people say the same thing, it is a proven risk. In 2025, the complaints against dbinvesting have become frequent and severe.

The most basic duty of a broker is to return your money when asked. However, recent data shows dbinvesting failing this test.

In August 2025, a trader from India reported that the company simply would not process the withdrawal. When the trader made a profit, the company erased the profits and imposed “unjustified penalties.”

Another case from July 2025 (Account from Jordan) describes a similar pattern. The trader deposited money and lost some. But when they deposited again and finally made a profit, the broker stopped the withdrawal. The broker claimed “AML reviews” (Anti-Money Laundering checks) as an excuse to hold the money indefinitely.

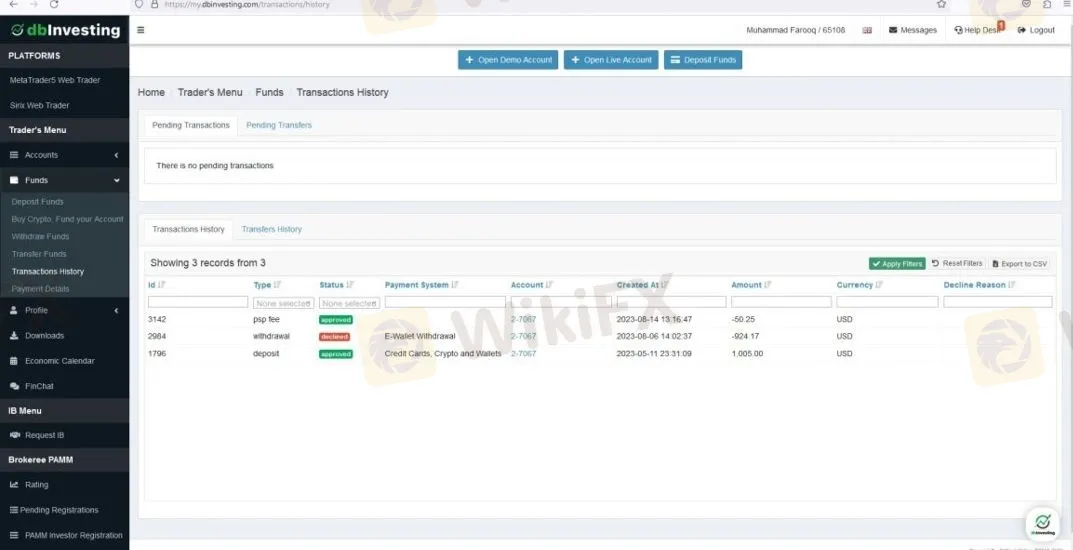

Evidence of Withdrawal Issues (2025):

A very worrying trend in the 2025 complaints is the deletion of profits.

Brokers who do not want to pay often use a tactic called “Bonus Abuse” or “Invalid Trading Methods.”

In January 2025, a trader from Hong Kong deposited nearly $10,000. After making profits, they applied to withdraw $16,900. The broker rejected the request, claiming the trader “abused the bonus.” The trader stated they traded normally. The broker deducted the profits regardless.

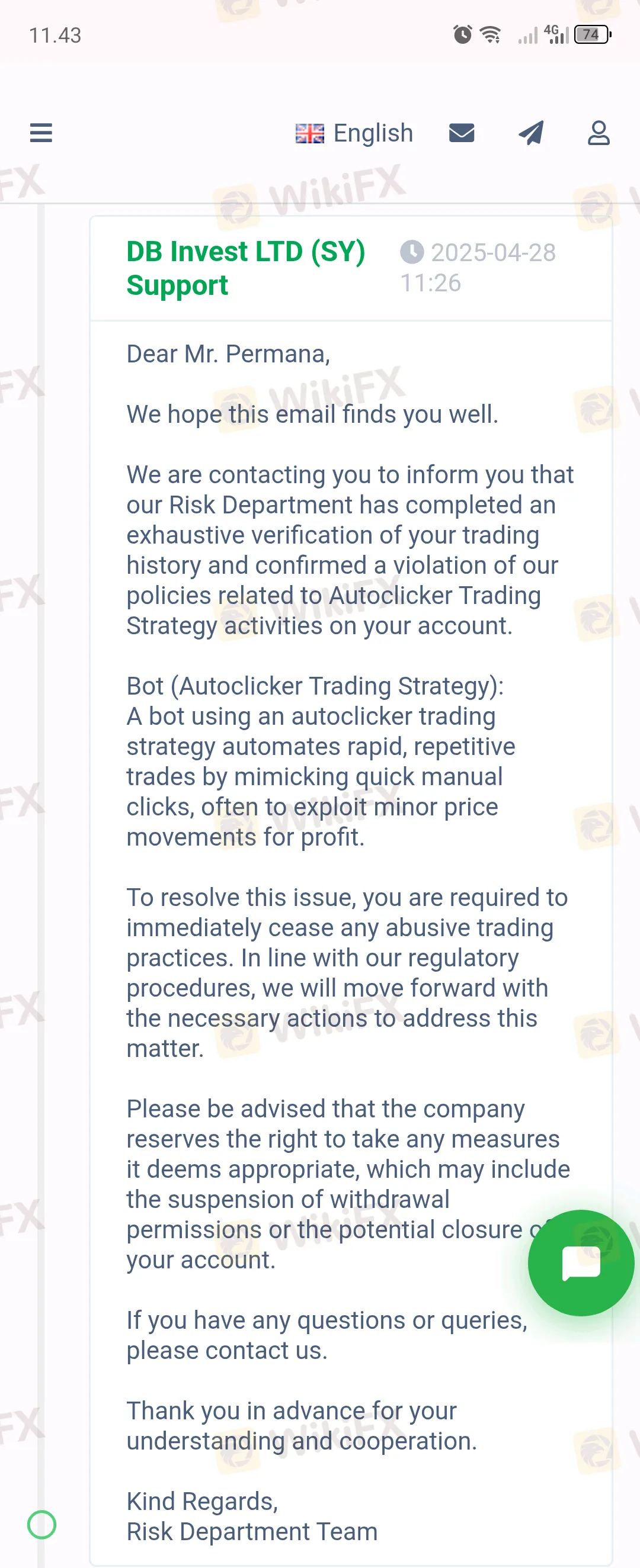

In May 2025, a trader from Indonesia was accused of using an “autoclicker bot.” The trader argued this was impossible because their balance was drained, but the broker had already deleted the profits.

Evidence of Profit Deletion (2025):

You might see some 5-star reviews online saying “Best Broker” or “Fast Support.” We advise caution.

Based on the 2.13 low score and the 2025 complaint data, keeping your money with this broker is High Risk.

WikiFX Recommendation:AVOID / HIGH RISK.

Disclaimer: This review is based on data and user complaints available in the WikiFX database as of August 2025. Trading Forex and CFDs involves significant risk and is not suitable for all investors. Ensure you understand the risks before trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.