1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

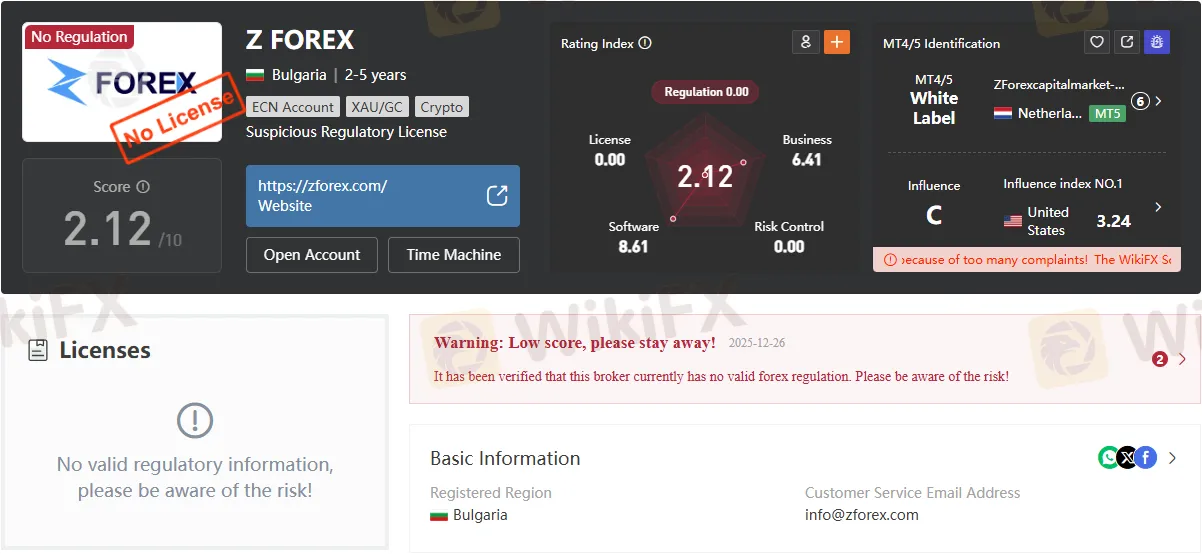

Abstract:ZForex Review highlights the lack of regulation, risky leverage, and withdrawal issues reported by traders worldwide.

ZForex, founded in 2006 and registered in Bulgaria, presents itself as a multi-asset broker offering forex, stocks, indices, commodities, metals, and cryptocurrencies. Despite its longevity in the market, the broker operates without valid regulatory oversight, a fact confirmed by multiple independent sources. This absence of regulation raises immediate red flags for traders concerned about transparency, fund safety, and dispute resolution.

The brokers official domains include zforex.com and zglobaltrade.com, with servers hosted in the United States and the United Kingdom. While ZForex promotes advanced trading platforms such as MetaTrader 5 (MT5) and cTrader, its operational framework is undermined by questionable licensing claims and a WikiFX score of just 2.12/10, signaling high risk.

The most pressing issue in this ZForex Review is the brokers unregulated status. According to WikiFX data “No valid regulatory information, please be aware of the risk!” Traders should note that ZForex has been flagged for suspicious regulatory licenses and operates without oversight from any recognized financial authority.

In contrast, reputable competitors such as XTB or IG Markets hold licenses from tier-one regulators like the FCA (UK) or CySEC (Cyprus), offering far greater investor protection. ZForexs lack of regulation means clients have no recourse in cases of fraud, withdrawal disputes, or platform manipulation.

ZForex claims to provide access to a wide range of instruments:

The broker supports MetaTrader 5 (MT5) and cTrader, both recognized platforms in the industry. However, it reveals that ZForex operates white-label servers, which often lack the stability and technical support of fully licensed MT4/MT5 providers. Average execution speed is listed at 184 ms, but without regulatory audits, these figures remain unverifiable.

ZForex offers three live accounts alongside a demo option:

| Account Type | Minimum Deposit | Leverage | Commission | Spread |

| Standard | $10 | 1:1000 | $0 | 1.2 pips |

| ECN | $10 | 1:1000 | $7 Forex / $15 Metals | From 0 pips |

| Swap-Free | $2,500 | 1:500 | $10 Forex / $15 Metals | 0.7 pips |

While the low minimum deposit of $10 may attract beginners, the extremely high leverage exposes traders to significant risk. Competitor brokers typically cap leverage at 1:30 (EU) or 1:50 (US), aligning with regulatory standards to protect retail investors.

The broker advertises same-day withdrawals and multiple payment methods, including credit cards, wire transfers, e-wallets (SticPay, Jeton, Fasapay), and cryptocurrencies. However, user reports series of claims:

These cases highlight a pattern of withdrawal issues, undermining ZForexs credibility. By comparison, regulated brokers are required to segregate client funds and process withdrawals transparently.

Pros:

Cons:

Despite listing a Bulgarian address, the brokers lack of regulatory registration in Bulgaria or the EU raises transparency concerns. Competitors like RaiseFX or Assexmarkets provide verifiable licensing details, which ZForex fails to match.

Based on the reported cases recieved, 59 user reviews, with multiple exposures highlighting serious issues:

These cases align with common warning signs of unregulated brokers: delayed withdrawals, lack of communication, and arbitrary account closures.

This ZForex Review underscores a broker operating outside regulatory frameworks, with a history of withdrawal disputes and unverified licensing claims. While the platform offers attractive features such as MT5 support, diverse instruments, and low entry deposits, these benefits are overshadowed by serious risks.

Traders seeking security and transparency should consider regulated alternatives. Brokers licensed by authorities such as the FCA, ASIC, or CySEC provide far stronger safeguards, including fund segregation, compensation schemes, and audited operations. ZForex, by contrast, remains a high-risk choice with limited accountability.

Final Verdict: ZForex is not safe for traders. The lack of regulation, risky leverage, and repeated withdrawal complaints make it unsuitable for anyone prioritizing fund security and fair trading conditions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.