Abstract:If you're asking 'Is IMPERIAL a regulated and safe broker?', you are doing important research. This question is the most important one any trader can ask before putting capital into an account. The answer, based on our detailed study of available information, is clear: IMPERIAL Markets is registered as a company in Saint Lucia but operates without a valid forex trading license from any major financial authority.

This finding immediately raises red flags, placing the broker under the labels of "Suspicious Regulatory License" and "High potential risk." For traders, this means working with IMPERIAL involves a significant level of risk that must be fully understood. This article will break down the details of the company registration, explain what its MetaTrader 5 (MT5) license really means, examine conflicting user reviews, and provide a clear guide for how you can protect yourself from the dangers of trading with unregulated offshore companies.

If you're asking 'Is IMPERIAL a regulated and safe broker?', you are doing important research. This question is the most important one any trader can ask before putting capital into an account. The answer, based on our detailed study of available information, is clear: IMPERIAL Markets is registered as a company in Saint Lucia but operates without a valid forex trading license from any major financial authority.

This finding immediately raises red flags, placing the broker under the labels of “Suspicious Regulatory License” and “High potential risk.” For traders, this means working with IMPERIAL involves a significant level of risk that must be fully understood. This article will break down the details of the company registration, explain what its MetaTrader 5 (MT5) license really means, examine conflicting user reviews, and provide a clear guide for how you can protect yourself from the dangers of trading with unregulated offshore companies.

Breaking Down Regulatory Claims

A detailed look at a broker and its regulatory background is essential. For IMPERIAL, this process reveals a critical gap between being a registered company and a regulated financial services provider. Many traders commit the mistake of confusing these two different statuses, a misunderstanding that can have serious financial consequences. We will clarify this difference with hard facts.

The Saint Lucia Registration

Public records show that the company connected to the broker, Imperial Solutions Ltd, is registered in Saint Lucia. The registration number is `14454559`, and the date of establishment is `2022-11-01`. This registration makes it a legal International Business Company (IBC) in that location. However, it is important to understand what this means. An IBC registration is a company formality, similar to getting a business license to operate an office. It does not involve any financial oversight, monitoring of trading practices, or protection of client funds.

This is like having a business license to sell fruit but not the health and safety certification to prove the fruit is safe to eat. The former allows you to exist as a company; the latter protects the consumer. The following table clarifies the difference.

No Valid Forex Regulation

Our investigation confirms a critical warning: “This broker lacks valid forex regulation. Please be aware of the risk!” Top-tier regulators, such as the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC), enforce strict rules designed to protect traders. These protections include requiring that brokers hold client funds in segregated accounts, separate from the company's operational capital. This prevents the broker from using client funds for its own business expenses and protects it in case of bankruptcy.

Furthermore, regulated brokers often must provide negative balance protection, ensuring traders cannot lose more than their account balance. They are also members of investor compensation schemes, which can reimburse traders up to a certain limit if the broker fails. Due to its unregulated status, IMPERIAL does not appear to be bound by any of these fundamental safety measures. The security of your capital is therefore not guaranteed by any independent authority.

Understanding the “Suspicious” Tag

The “Suspicious Regulatory License” warning is applied for a reason. It typically signals that a broker is operating from an offshore location known for minimal oversight, or that it is presenting a simple company registration as a substitute for a genuine financial license. In the case of IMPERIAL, the tag is a direct result of its Saint Lucia registration being its only claim to legitimacy. This is insufficient for a company handling client funds in the high-stakes forex market. This conclusion is reinforced by the `High potential risk` score and the explicit warning: “Low score, please stay away!” These indicators are not random; they are based on the absence of credible regulatory oversight.

The MT5 License Explained

Many traders see that a broker offers the MetaTrader 5 (MT5) platform with a “Full License” and assume this is a mark of legitimacy and safety. This is a dangerous mistake. Our analysis shows that while an MT5 license is a positive indicator of a broker's technical setup, it has absolutely no bearing on its regulatory status or the safety of your funds.

What is a “Full License”?

MetaTrader 5 is a world-class trading platform developed and licensed by a software company, MetaQuotes Software Corp. When a broker has a “Full License MT5,” it means it has paid a significant fee to MetaQuotes to use the complete, unmodified version of the platform. This allows it to manage client accounts, process trades, and brand the platform as its own. It is purely a business-to-business software transaction.

Importantly, MetaQuotes is not a financial regulator. Its business is selling software. The company does not conduct background checks on the business models, financial stability, or ethical practices of the brokerage firms that purchase its licenses. Therefore, an MT5 license is proof of a software purchase, not proof of trustworthy operations.

Software vs Broker Regulation

To clarify this point, consider an analogy. Having a full MT5 license is like a taxi company using reliable, high-end cars. It speaks to the quality of their equipment and might provide a better passenger experience. However, it says nothing about whether the company is properly insured, if its drivers are licensed and have passed background checks, or if the business itself is financially stable.

A great platform like MT5 provides excellent trading tools, advanced charting, and support for automated trading strategies. It enhances the trading experience. But it cannot protect your deposits if the broker engages in fraudulent activities, mismanages funds, or goes bankrupt. Only strong financial regulation can offer that protection.

A Look at Server Data

A deeper technical dive provides further context. Our investigation has identified several MT5 servers associated with IMPERIAL, including `ImperialMarkets-Live` and `ImperialSolutions-Live`. Some of these servers are physically located in data centers in France. This is a common practice for brokers who want to ensure low latency for traders in Europe.

However, it is vital to understand that server location does not imply regulation. A broker can host its servers anywhere in the world. The physical location of a server in France does not mean the broker is regulated by the French Autorité des Marchés Financiers (AMF) or any other European regulator. The regulatory jurisdiction is determined by where the company is registered and licensed for financial services, which in IMPERIAL's case, remains the unregulated environment of Saint Lucia.

Analyzing Community Sentiment

User reviews can provide valuable insights into a broker's day-to-day operations, but they must be interpreted with caution. For IMPERIAL, the reviews present a confusing picture of positive service experiences clashing with the hard facts of its unregulated status. A critical analysis is needed to see the full picture.

The Wave of Positives

Across multiple reviews, a consistent pattern of positive feedback emerges. Users from India, Canada, and South Africa have praised IMPERIAL for a variety of operational strengths. Common themes include:

· A “lightning-fast” platform.

· A “knowledgeable and helpful” support team.

· “No issues with withdrawals.”

· “Personal Guidance and support,” including a dedicated account manager.

These reviews, some posted as recently as early 2025, suggest that for a number of clients, the user experience has been satisfactory. They report good platform performance and responsive customer service, which are important aspects of a broker's service delivery. However, a good service experience does not reduce regulatory risk.

A Critical Contradiction

In our analysis of user feedback, we often see a disconnect between a user's perception and a broker's factual status. This is a key area for investigation. A review from a user in South Africa, Dev4046, dated July 2023, lists “1) Regulated broker” as a primary positive point.

This claim is directly contradicted by all available data. As established, IMPERIAL holds no valid forex trading regulation. This discrepancy highlights a significant danger: a user may genuinely believe they are protected by regulation when they are not. This could be an honest misunderstanding, where the user confuses the Saint Lucia company registration with a financial license, or it could be a result of misleading information. Regardless of the cause, it underscores the importance of independent verification over personal stories.

The Neutral Voice

Perhaps the most insightful piece of feedback comes from a neutral review by user FX1209523845 from the Philippines. This user perfectly captures the core dilemma facing potential clients: “Truly, I think Imperial Markets is a good platform... But I don't know if my funds can be withdrawn quickly. You know, many people say offshore brokers are not that safe.”

This statement gets to the heart of the matter. It acknowledges the positive aspects of the trading platform while voicing the fundamental anxiety associated with offshore brokers. It poses the central question every trader must answer for themselves: Is a good user interface and seemingly helpful support worth the immense risk of placing capital with an unregulated entity that offers no legal or financial safety nets?

Your Pre-Trade Verification Checklist

Navigating the world of online brokers requires a healthy dose of skepticism and a commitment to doing your homework. To make informed and safe decisions, we have developed a simple but powerful protocol. This checklist can be used not just for IMPERIAL, but for any broker you consider.

A 3-Step Verification Protocol

1. Question Everything, Verify Independently

Never take a broker's claims about its regulation, location, or safety at face value. A slick website, a smooth deposit process, or a friendly account manager are marketing tools, not substitutes for regulatory protection. Always seek independent, third-party confirmation of any claims a broker makes.

2. Use a Third-Party Verification Tool

The most efficient and reliable way to cut through marketing claims and get to the facts is to use a dedicated broker verification platform. Before depositing funds with any broker, especially one with a complex offshore profile like IMPERIAL, we strongly recommend you visit a comprehensive verification site. For an exhaustive check on any broker's regulatory status, license details and operational history, you can use a tool such as WikiFX. Such platforms gather data from global regulators, check company records, and collect a wide pool of user reviews, providing a crucial layer of security for your decision-making process.

3. Understand and Accept the Risk

If, after conducting your investigation, you still consider trading with an unregulated, offshore broker, you must do so with a full and conscious acceptance of the risks involved. These risks are not theoretical; they are practical and severe:

· Your funds are likely not held in segregated accounts, meaning the broker could use your capital for its own expenses.

· You have no access to an investor compensation fund. If the broker becomes insolvent, your capital is likely lost forever.

· Dispute resolution is nearly impossible. Without a regulatory body to appeal to, you have little to no recourse in cases of withdrawal problems, price manipulation, or other fraudulent activities.

Final Verdict on IMPERIAL

To conclude, our deep dive into IMPERIAL Regulation reveals a stark reality. The broker offers an advanced MT5 platform and has garnered some positive user feedback regarding its service and execution. However, these operational positives are completely overshadowed by the critical and undeniable fact that it is an unregulated offshore broker registered in Saint Lucia.

The decision to trade with any broker ultimately rests with the individual. But decisions that involve financial risk should always be grounded in verifiable facts, not just service experience or user testimonials. When choosing a broker, prioritize safety, transparency, and credible regulation above all else. For a detailed check on any broker's regulatory status and IMPERIAL License, always consult a trusted verification tool.

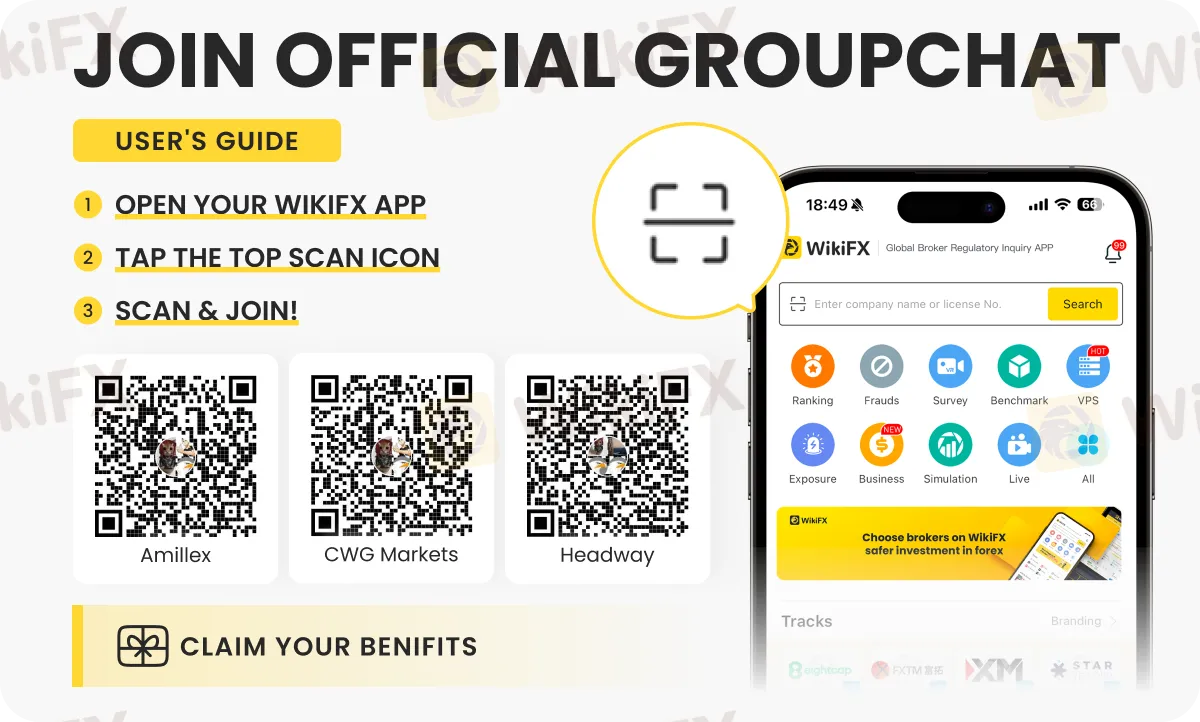

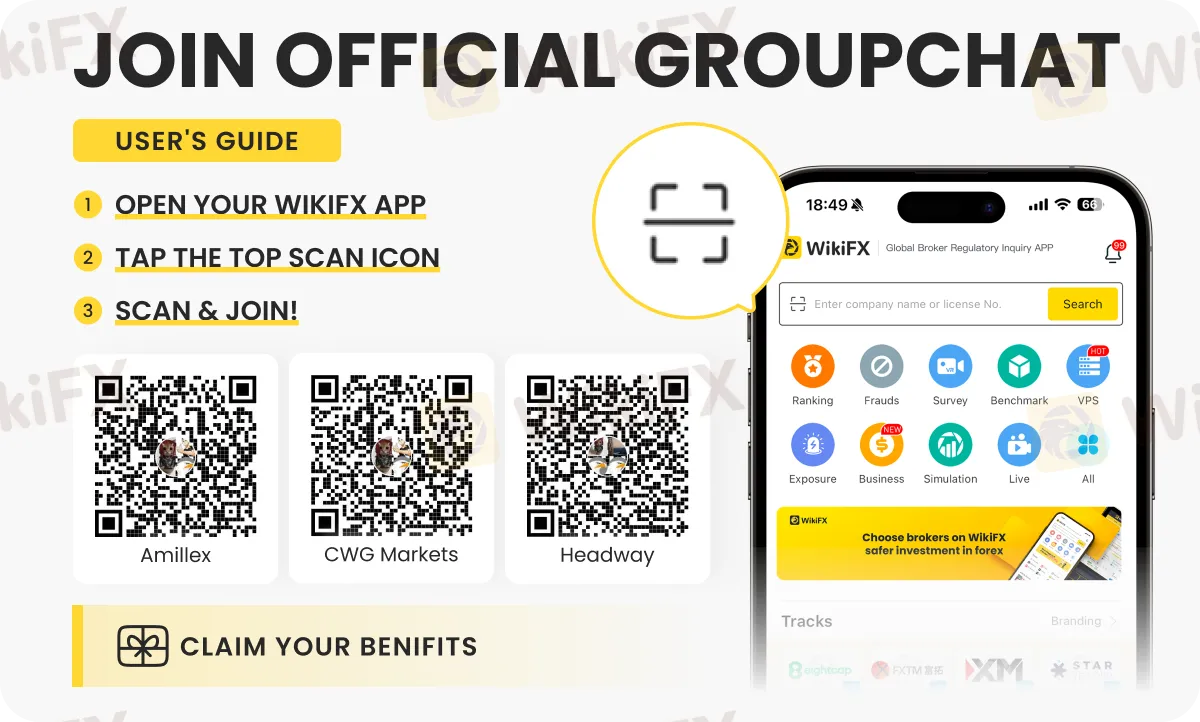

Want to stay away from forex scam? Be updated about every forex broker on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join the group/s today by following the instructions shown below.