简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KIRA Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Abstract:This article is designed to be that complete guide. Our goal is not to promote, but to investigate. We will do a thorough legitimacy check on KIRA, carefully examining its credentials against the essential standards of the financial industry. We will break down its regulatory status, fund safety measures, company transparency, and business claims. The main question we want to answer is simple: Is KIRA a well-hidden scam targeting unsuspecting traders, or is it a regulated, legitimate trading partner for those in the GCC region and beyond? We will not make any quick judgments. Instead, we will present the evidence, piece by piece, allowing you to reach a conclusion based on facts you can verify.

In the huge and often unpredictable world of online trading, asking “Is this broker legitimate?” is not just a good question—it is the most important question you can ask. The digital world is full of opportunities, but it also has risks, with clever scams often pretending to be real brokerages. This makes being careful and doing thorough research your most valuable tools. You have probably heard the name KIRA and are looking for a clear, honest answer about whether you can trust it.

This article is designed to be that complete guide. Our goal is not to promote, but to investigate. We will do a thorough legitimacy check on KIRA, carefully examining its credentials against the essential standards of the financial industry. We will break down its regulatory status, fund safety measures, company transparency, and business claims. The main question we want to answer is simple: Is KIRA a well-hidden scam targeting unsuspecting traders, or is it a regulated, legitimate trading partner for those in the GCC region and beyond? We will not make any quick judgments. Instead, we will present the evidence, piece by piece, allowing you to reach a conclusion based on facts you can verify.

Pillars of a Legitimate Broker

Before we examine any single broker closely, it's important to establish a universal framework for evaluation. Understanding the core pillars of a legitimate brokerage gives you the power not only to assess KIRA but any financial service provider you encounter in the future. Think of this as your personal research checklist, a basic guide to separating professional companies from fraudulent operations. A trustworthy broker is built on four key pillars:

• Regulatory Compliance: This is the absolute foundation of legitimacy. A legitimate broker must be authorized and licensed by a respected government financial authority. These bodies enforce strict rules about capital requirements, business conduct, and client protection. Examples include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Europe, and, importantly for traders in the Middle East, the Securities and Commodities Authority (SCA) in the United Arab Emirates. Regulation is not optional; it is the primary protection for a trader.

• Fund Security: Your money must be protected. The single most important way to do this is through segregated accounts. This is a legal requirement in most regulated areas, requiring that a broker holds all client funds in accounts that are completely separate from the company's own business funds. This ensures that if the broker becomes insolvent, your money is not considered a recoverable asset by its creditors and can be returned to you. Any broker that cannot guarantee segregated accounts should be considered an immediate warning sign.

• Transparency and Physical Presence: Trustworthy brokers operate openly. They are transparent about their fee structures, including spreads, commissions, and swap fees. There should be no hidden charges. Furthermore, they have a verifiable physical address and accessible, professional customer support channels. Anonymous online companies with no physical presence or clear corporate identity are highly suspicious. A real business has a real location and is accountable to its clients and regulators.

• Track Record and Experience: While not a substitute for regulation, a broker's history and the experience of its team can be telling indicators. A long operational history suggests stability and strength. Similarly, a management team with deep, verifiable experience in global financial markets can signal a higher level of expertise and professionalism. However, this experience must always be supported by the solid evidence of proper regulatory licensing.

KIRA Under the Microscope

With our evaluation checklist established, we can now apply it directly to KIRA. This section moves from the theoretical to the practical, analyzing KIRA's public claims and corporate structure against each pillar of legitimacy. Our analysis is based on the factual information available about the brokerage, presented objectively to provide clarity.

KIRA's Regulatory Status

A broker's regulatory status is the first and most critical test of its legitimacy. For KIRA, the claim is that it is regulated within the United Arab Emirates.

Our investigation confirms that KIRA is licensed by the UAE Securities and Commodities Authority (SCA). The specific details of this license are important. KIRA holds a Category 1 license, which is the highest level of authorization granted by the SCA for rolling spot and contracts for difference (CFD) brokerage activities. The license number on public record is 20200000244.

An SCA Category 1 license is significant. It means that the broker has met strict capital requirements and is subject to rigorous and ongoing oversight by the UAE's federal financial regulator. This includes audits, compliance checks, and adherence to strict rules of conduct designed to protect investors. This is not a light registration in an offshore area; it is a top-tier license from a recognized and respected regulatory body within the GCC.

Client Fund Safety

The next critical question is how KIRA protects client deposits. As per the requirements of its SCA regulation and its own stated policies, KIRA holds client funds in fully segregated accounts.

The company states these accounts are maintained with a secure UAE bank, separate from KIRA's corporate operational funds. For a trader, this is a cornerstone of security. It means your capital is legally protected and separated from the broker's business activities, debts, and other financial obligations. Should the company face financial difficulties, your funds are not at risk of being used to cover its expenses. This practice of fund segregation is a hallmark of a regulated and responsible brokerage.

Transparency and Identity

Anonymous online companies are a major source of scams. A legitimate broker has a clear and verifiable identity. KIRA is registered and operates as a UAE-based brokerage. Its physical offices are located in Dubai.

Having a verifiable physical address in a major financial hub like Dubai, coupled with local contact information and an official license from the country's regulator, provides a strong signal of legitimacy. It establishes a clear line of accountability. This contrasts sharply with scam operations that typically use P.O. box addresses, non-existent office locations, or operate from unregulated areas with no real-world presence. Transparency in location and corporate identity is a fundamental trust factor that KIRA appears to satisfy.

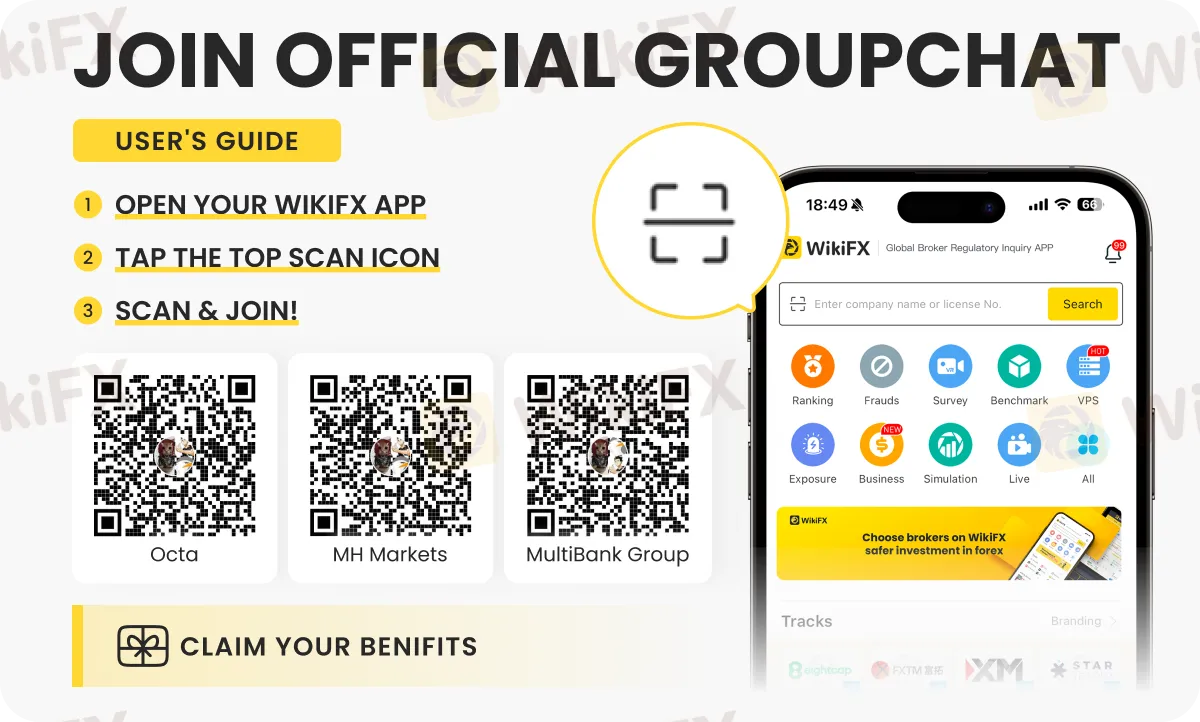

> *Before committing to any broker, it is a vital security measure to independently verify their regulatory status. We recommend using a comprehensive third-party tool like WikiFX to check the license details and read user feedback. This step provides an unbiased view of the broker's history and operations.*

Red Flag Analysis

To directly address the fear behind the “Is KIRA a scam?” query, we can perform a red flag analysis. This involves comparing KIRA's known characteristics against the common tactics employed by fraudulent brokers. This systematic comparison provides a clear, evidence-based perspective on the broker's operational profile.

| Common Scam Red Flag | KIRA's Profile (Based on Public Information) |

| No Regulation or Fake Regulator | Claims to be regulated by the UAE SCA (Category 1) with a verifiable license number (20200000244). This is a recognized, official government body. |

| Guarantees of Unrealistic High Profits | The provided information focuses on platforms, tools, regulation, and market access. There are no mentions of “guaranteed profits” or “no-risk trading,” which are hallmarks of scams. |

| Vague or No Physical Address | Clearly states it is based in Dubai, UAE, a major financial center. A verifiable physical presence is a strong indicator of legitimacy. |

| Pressure to Deposit Funds Immediately | The described onboarding process (“Create account,” “Make deposit,” “Start trading”) is standard for the industry. There is no evidence of high-pressure sales tactics. |

| Lack of Fund Security Measures | Explicitly states that client funds are held in segregated accounts, which is a key regulatory requirement for protecting client money. |

| Opaque Fees and Hidden Charges | The broker's materials claim “Transparent pricing. No hidden charges.” While traders should always verify fee schedules, the public statement itself aligns with legitimate practices. |

This analysis suggests KIRA's public profile does not align with the typical characteristics of a financial scam. The presence of top-tier regulation, stated fund protection measures, and a physical location are significant differentiators. However, a trader's research should not stop here. Cross-referencing user experiences and operational history on independent platforms can provide valuable real-world insights into a broker's day-to-day business practices, withdrawal processes, and customer service quality.

KIRA's Trading Environment

Assuming a broker is legitimate, the next logical question for a trader is: “What do they offer, and is it right for me?” A factual overview of KIRA's services, platforms, and account features helps determine if it is a potential fit for your specific trading style and needs.

Platforms and Markets

The trading platform is a trader's primary tool. KIRA provides access to two industry-leading platforms: MetaTrader 5 (MT5) and CQG. MT5 is globally recognized as a powerful and versatile platform, favored by traders for its advanced charting tools, technical analysis capabilities, and support for automated trading through Expert Advisors (EAs). CQG is a high-performance platform known for its market data quality and direct market access, often preferred by professional and institutional traders. Offering both provides flexibility for different types of traders.

In terms of market access, KIRA provides an extensive range of tradable instruments as Contracts for Difference (CFDs). This allows traders to speculate on price movements without owning the underlying asset. The available markets include:

• Total Instruments: 10,000+

• Stock CFDs: 7,000+

• Forex Pairs: 330+

• Commodities: 110+

• Indices: 90+

• ETFs: 2,000+

This wide selection, particularly the large number of stock CFDs and forex pairs, indicates a robust infrastructure and broad market connectivity.

Accounts and Features

KIRA structures its offerings across three main account tiers: Standard, Pro, and Premium. The Standard account is positioned for new traders, while the Pro and Premium tiers cater to full-time, high-volume, and institutional traders with features like dedicated relationship managers.

Importantly for its target audience, KIRA offers features specifically tailored to traders in the GCC region. These include:

• Islamic Accounts: The availability of swap-free accounts is essential for traders who must adhere to Sharia principles. These accounts do not incur overnight interest charges, aligning with Islamic finance laws.

• GCC Focus: With a physical base in Dubai and the provision of Arabic language support, the brokerage is clearly structured to serve the local market. This local presence can be a significant advantage for traders seeking support and understanding of regional market dynamics.

Evaluating Experience and Support

While technology and regulation are vital, knowing there is an experienced team and accessible support can be the difference between a frustrating and a successful trading journey. The “human factor” behind a brokerage adds a qualitative layer to its evaluation.

KIRA's public materials claim its team possesses over 30 years of collective experience in global financial markets. While this is a marketing statement, it points to an emphasis on expertise. A team with a deep understanding of market complexities is better equipped to build a stable platform and provide relevant support.

The support structure itself is a more tangible measure. KIRA offers 24/5 customer support, which is the industry standard, aligning with the hours of global market operation. The availability of multilingual support, including Arabic, is a practical benefit for its core client base in the Middle East. For traders on its Pro and Premium account tiers, the offering of a Dedicated Relationship Manager and Sales Trader provides a higher-touch service model, suggesting a focus on client retention and personalized support for serious traders. This combination of claimed experience and a structured, accessible support system contributes positively to the broker's overall profile.

The Verdict and Your Final Step

In summary, our investigation into KIRA's legitimacy reveals that it presents the key characteristics of a regulated and legitimate brokerage. Based on its public information, the evidence points away from the profile of a typical scam. The broker's authorization under a UAE SCA Category 1 license, its stated use of segregated accounts for client fund protection, and its verifiable physical presence in Dubai are all strong indicators of a compliant and accountable operation. Furthermore, its profile does not exhibit the common red flags associated with fraudulent financial schemes, such as guarantees of profit or a lack of transparency.

However, the final and most critical step in your research process is your own. The responsibility for protecting your capital ultimately rests with you.

> Our analysis indicates that KIRA operates as a regulated entity. However, the final and most critical step in your research is personal verification. Before opening an account or depositing any funds with *any* broker, we strongly advise you to visit a trusted third-party verification service like WikiFX. There, you can independently confirm the license, check for any public complaints, and read reviews from other traders. This is the best way to protect yourself and trade with confidence.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Currency Calculator