简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AXIORY Review 2025: Institutional Audit & Risk Assessment

Abstract:AXIORY presents a significant divergence between its market influence and its compliance posture. While the broker holds an "A" ranking in terms of global influence—showing strong penetration in markets like the UAE and Switzerland—its safety index conveys a critical warning with a score of 2.44. The primary concern identified in this audit is the unverified status of its claimed Cyprus Securities and Exchange Commission (CySEC) license. Consequently, despite a robust software offering and competitive entry conditions, AXIORY is currently classified as a high-risk entity due to regulatory opacity and recent complaints regarding capital liquidity.

Executive Summary

WikiFX Score: 2.44 / 10

Regulatory Status: Unverified / High Risk

AXIORY presents a significant divergence between its market influence and its compliance posture. While the broker holds an “A” ranking in terms of global influence—showing strong penetration in markets like the UAE and Switzerland—its safety index conveys a critical warning with a score of 2.44. The primary concern identified in this audit is the unverified status of its claimed Cyprus Securities and Exchange Commission (CySEC) license. Consequently, despite a robust software offering and competitive entry conditions, AXIORY is currently classified as a high-risk entity due to regulatory opacity and recent complaints regarding capital liquidity.

Quick Take: Pros and Cons

Operational Strengths

- ✅ Industry-Standard Software: Full support for MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside a proprietary mobile app.

- ✅ Accessible Entry: Minimum deposit requirement of only 10 USD across all six account types.

- ✅ High Leverage Availability: Offers significant purchasing power up to 1:2000 on specific account tiers.

Critical Weaknesses

- ❌ Regulatory Anomaly: The claimed CySEC license is marked as “Unverified” by compliance auditors.

- ❌ Low Safety Score: A WikiFX score of 2.44 falls well below the acceptable safety threshold for institutional-grade brokers.

- ❌ Withdrawal Friction: Documented user reports cite delays in fund repatriation despite instant deposit processing.

- ❌ Software Limitation: The proprietary platform lacks support for Windows, MacOS, or Web-based interfaces (Mobile only).

Regulatory Compliance & Safety Profile

The cornerstone of any financial audit is the verification of regulatory oversight. For AXIORY, the data indicates a critical lapse in verifiable compliance.

License Verification Status

The broker claims association with license number 271/15 under the entity “L.F. Investment Ltd,” purportedly regulated by the Cyprus Securities and Exchange Commission (CySEC). However, current data indicates this license is Unverified.

Risk Warning: Jurisdictional Implications

The inability to verify the CySEC license suggests that AXIORY may be operating largely under its registration in Belize, or without valid oversight entirely regarding the entity presented to retail traders.

- Counterparty Risk: If the broker operates solely under Belize jurisdiction (or without valid oversight), it is likely not bound by the strict capital adequacy rules enforced by Tier-1 regulators like the FCA or ASIC.

- Fund Segregation: In verifiable Tier-1 jurisdictions, client funds must be segregated from corporate capital. With an “Unverified” status, there is no external guarantee that client deposits are not used for operational hedging or expenses.

- Compensation Schemes: Traders are likely excluded from the Investor Compensation Fund (ICF) protections typically afforded to clients of valid CySEC-regulated entities.

Trading Infrastructure & Costs

AXIORY utilizes a competitive, albeit aggressive, trading structure designed to attract high-volume retail traders. The infrastructure audit highlights a focus on low costs and extreme leverage, which aligns with offshore operating models.

Leverage Policy

The leverage offering is exceptionally high, peaking at 1:2000 on the MAX account.

- Risk Analysis: Leverage of this magnitude is mathematically prohibited in strict jurisdictions (e.g., EU/UK limited to 1:30). While this offers traders massive exposure for small deposits, it dramatically increases the probability of “Stop Out” events (total account liquidation) during minor volatility. This supports the hypothesis that the entity operates outside the purview of ESMA (European Securities and Markets Authority) restrictions.

Cost Structure and Pricing

The broker offers a tiered account structure (TERA, MAX, STANDARD, NANO, ZERO, ALPHA) with highly competitive spreads.

- Spreads: The ZERO account boasts spreads as low as 0.0 pips, while the TERA and NANO accounts average around 0.00003.

- Scalability: The pricing model supports scalping and automated strategies (EA allowed), which is advantageous for algorithmic traders. However, the low friction costs must be weighed against the safety risks of the platform.

Software Ecosystem

AXIORY provides a valid “White Label” qualification for MT4 and MT5, ensuring traders have access to standard charting and execution tools.

- Mobile Limitations: While they offer a proprietary app (“MyAxiory” and “Axiory” on iOS/Android), the lack of a proprietary desktop or web terminal forces reliance on MetaQuotes software. The audit notes the proprietary software lacks advanced security features, such as 2FA or biometric authentication for enhanced login security.

Market Sentiment: User Complaints

A review of recent case logs reveals operational friction specifically related to the repatriation of funds. Liquidity issues at the withdrawal stage are a primary indicator of broker insolvency or unethical practices.

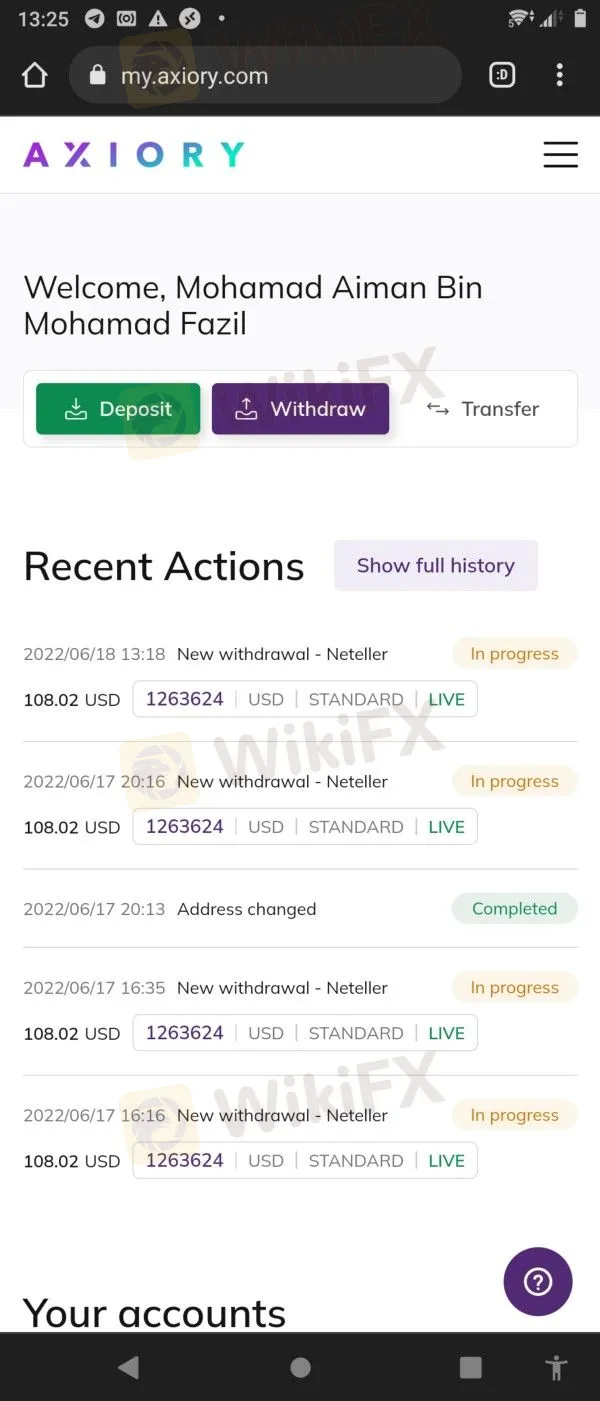

Case ID: Withdrawal Delays (August 2025)

User Location: Turkey

Issue: Asymmetric Transaction Speed

The complainant reports a discrepancy between deposit and withdrawal efficiency. While deposits are processed instantly, withdrawals remain stuck in an “In progress” state for extended periods. The user alleges this is a deliberate tactic to retain funds.

Evidence Exhibit:

Analyst Note: A pattern where deposits are instant but withdrawals are delayed suggests the broker may be utilizing a “client retention” strategy or facing liquidity management issues. In unregulated environments, there is no ombudsman to compel the broker to release these funds.

Final Verdict

Based on the 2025 audit data, AXIORY exhibits the classic profile of an offshore brokerage leveraging high risk for high flexibility. While the inclusion of MT5 and zero-pip spreads creates an attractive trading environment, the WikiFX Score of 2.44 and the Unverified status of its primary claimed license (CySEC) present an unacceptable level of risk for secure capital.

The operational disconnect—evidenced by instant deposits contrasting with stalled withdrawals—further erodes trust. Investors are advised to prioritize brokers with verifiable Tier-1 regulation where dispute resolution mechanisms are legally binding.

For the most current regulatory certificates and real-time blocklisting status, verify AXIORY on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Currency Calculator