1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

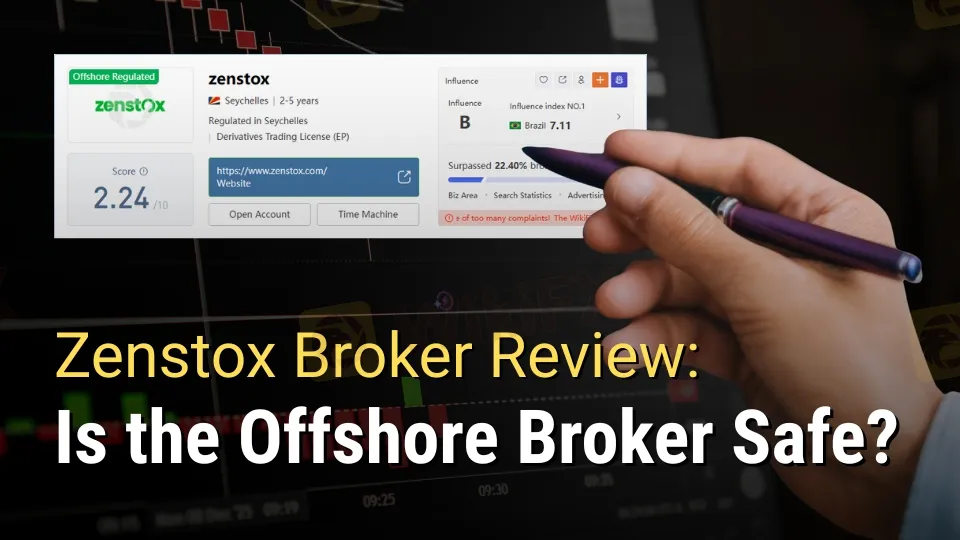

Abstract:Is Zenstox safe or a scam? Learn about its 2.24/10 WikiFX rating, offshore regulation, bonus tactics, and trader reports of blocked or delayed withdrawals.

Zenstox draws traders with promises of high leverage and diverse CFDs, but its offshore setup raises immediate red flags. A WikiFX rating of 2.24/10 underscores persistent doubts about its reliability. Trader complaints paint a grim picture of bonus traps and stalled payouts.

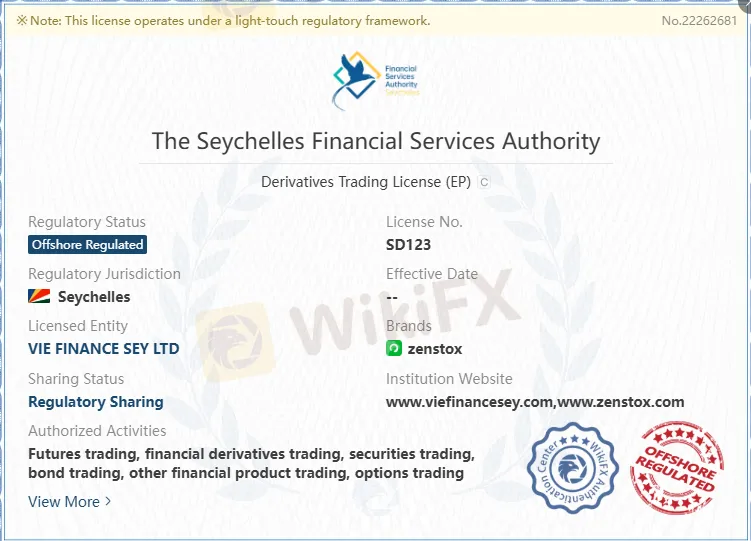

Zenstox operates under a Seychelles FSA retail forex license numbered SD123. This offshore authority offers scant investor safeguards compared to top-tier regulators like the FCA or ASIC. Founded in 2022 and registered in Seychelles, the broker lacks transparency on domain age or office locations, fueling skepticism.

Seychelles oversight demands minimal capital reserves and rarely enforces strict compliance. Traders face elevated risks of fund mismanagement without segregated accounts or negative balance protection details. Offshore brokers like Zenstox often attract scrutiny for prioritizing volume over client security.

Bonuses emerge as a core lure, matching deposits like $180 for $180 or $200 for $650 additions. These incentives come with hidden strings—traders report aggressive advisors pushing risky trades to trigger margin calls. One account spiraled from $180 to demands for $1,980 more, threatening $10,000 in “profits.”

Such tactics mirror patterns in dubious offshore operations, where bonuses lock funds until impossible volume targets. Zenstoxs approach prioritizes deposits over sustainable trading, eroding trust. Beginners fall hardest, mistaking advisor pressure for guidance.

Multiple 2025 cases detail failed payouts despite shown profits. Traders deposited thousands—up to $23,000 in 20 days—only to see requests rejected for “new trades” or outright account closures. Platforms allegedly manipulated balances to display gains, then denied access.

Withdrawal via bank transfer takes 1-3 days, but real-world execution falters. No minimum withdrawal specified, yet complaints highlight systemic barriers. Compared to reliable brokers like IG or OANDA, Zenstoxs process lacks guarantees.

Zenstox lists over 300 CFDs across forex, stocks, indices, commodities, and cryptocurrencies. Leverage peaks at 1:1200 for major forex pairs, gold, silver, and crude oil, dropping to 1:1100 for indices and 1:12 for cryptos. Shares cap at 1:110, exposing users to amplified losses.

Fixed spreads start at 0.50 on crypto CFDs, higher than industry norms. No demo account details confirm accessibility for testing. Variety tempts, but volatility paired with low crypto leverage disadvantages speculators.

Two main accounts cater to different needs, though specifics remain vague. Minimum deposit hits $200 via bank transfer or card, both free and quick. USD-denominated setups simplify for global users, but inactivity fees bite hard.

After 3 months dormant, $500 quarterly charges apply, plus a credit-out rule post-45 days. This punishes casual traders more than established platforms like Pepperstone. No tiered VIP options mentioned, limiting appeal for high-volume players.

Trading costs exceed averages, especially inactivity and crypto swaps. Rollover fees hit 0.02% overnight for most CFDs, ballooning to 0.50 for cryptos. Fixed spreads provide predictability, yet markups inflate during volatility.

Deposits incur no fees, but withdrawals lack clarity on charges. High non-trading penalties deter long-term holding, unlike low-fee rivals such as XM. Overall structure burdens small accounts the most.

| Fee Type | Zenstox Rate | Industry Average | Notes |

| Inactivity (after 3 months) | $500/quarter | $10-50/month | Excessive for offshore |

| Crypto CFD Swap | 0.50 overnight | 0.01-0.20 | Volatility premium |

| Forex CFD Leverage | Up to 1:1200 | 1:30-500 (tiered) | Risk amplifier |

| Deposit (Card/Bank) | Free | Free | Min $200 |

Zenstox Custom Platform runs web-based and desktop, suiting intuitive traders. XCITE Mobile App supports iOS and Android for on-the-go access. Features emphasize simplicity over advanced tools like those in MT4/MT5.

No custom indicators or automation noted, limiting the pros. Mobile flexibility helps beginners, but lags behind cTraders depth at competitors. Reliability is unproven amid complaint volumes.

Support spans email (customer.service@zenstox.com), phone (+97365003849), WhatsApp (+97143118110), and live chat. Multi-channel access beats some peers, yet response quality draws fire. Advisors like Rafael Montoya pushed deposits over resolutions.

Offshore hours may delay aid, contrasting with 24/7 services elsewhere. No verified satisfaction metrics available.

Pros remain limited amid glaring weaknesses.

Cons dominate, echoing trader woes.

Zenstox trails established brokers. IC Markets offers ASIC regulation, MT4/5, and spreads from 0.0 pips with $200 min—far safer. XM provides CySEC oversight, no inactivity fees under 90 days, and true ECN execution.

Offshore peer FP Markets at least discloses segregated funds, absent here. High leverage tempts, but without Tier-1 status, Zenstox exposes more.

| Feature | Zenstox | IC Markets | XM |

| Regulation | Seychelles FSA | ASIC | CySEC |

| Min Deposit | $200 | $200 | $5 |

| Inactivity Fee | $500/quarter | None | €10/month after 90 days |

| Platforms | Custom/XCITE | MT4/5/cTrader | MT4/5 |

| Withdrawal Issues | Frequent complaints | Rare | Minimal |

2025 incidents spotlight patterns. Case 1: Initial $180 deposit ballooned via bonuses and advisor pressure to $1,980 demand, risking $10k “gains.” Case 2: Profits blocked post-deposits.

Case 3: Profit promises led to non-withdrawable funds. Case 4: $23k deposited, balances faked, account shut after rejections. These align with offshore scam hallmarks—aggressive upselling and exit barriers.

While Zenstox holds a Seychelles FSA license, the offshore framework provides minimal investor protection. The combination of:

…makes Zenstox a high-risk broker. Traders should exercise caution and consider alternatives with stronger regulatory oversight.

Zenstox presents itself as a modern CFD broker with over 300 instruments and mobile accessibility. However, the negative trader reports, punitive fees, and offshore regulation overshadow its offerings.

Final Verdict: Zenstox is not a safe choice for traders seeking reliability. The evidence points to systemic issues that compromise trust. Investors should prioritize brokers with Tier-1 regulation and proven track records.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.