简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

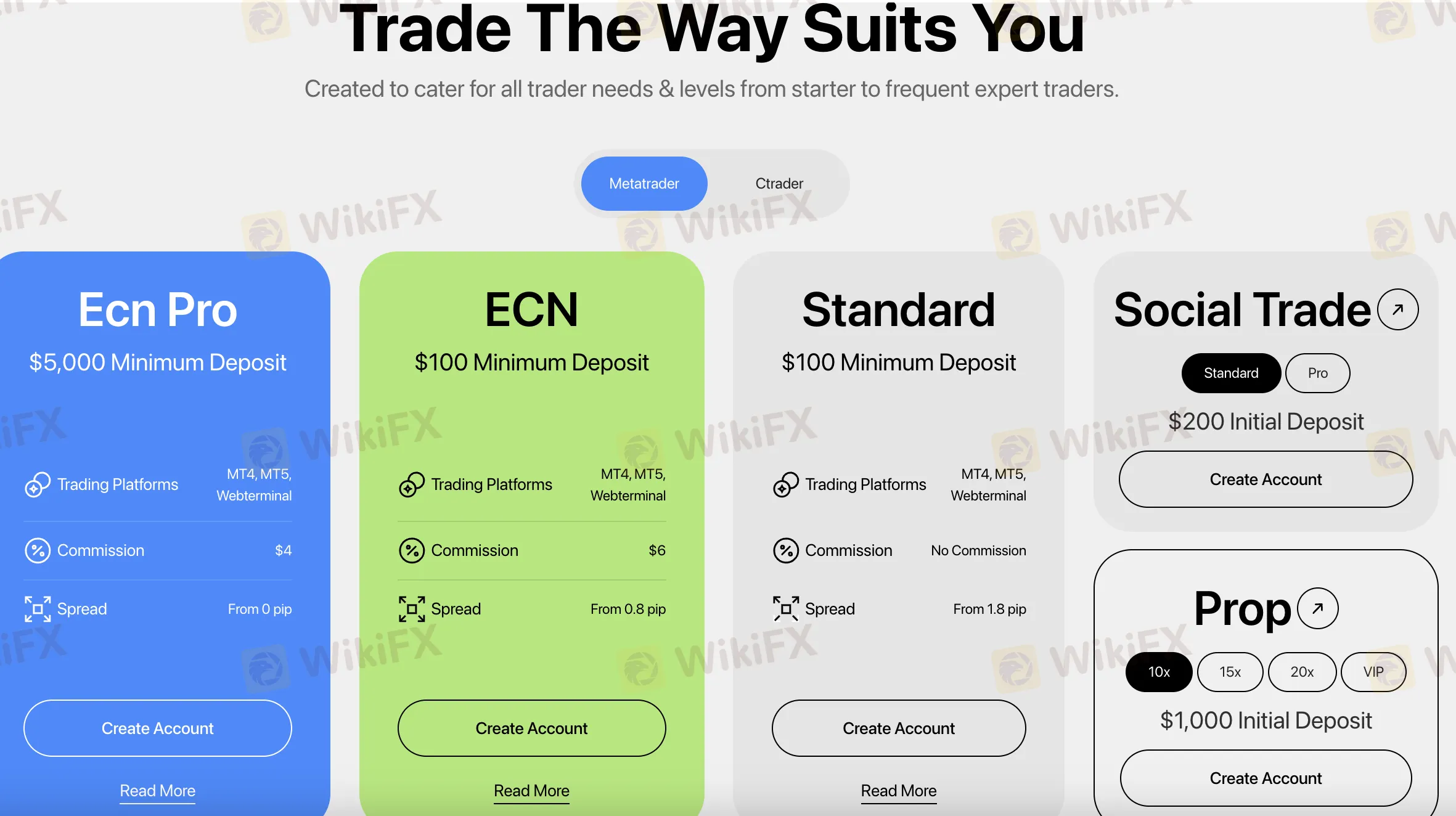

Opofinance Trading Account Comparison and Fees Explained

Abstract:Compare Opofinance trading accounts and fees. Explore ECN, Standard, Copy, and Prop accounts with spreads, commissions, and trading conditions clearly outlined.

Opofinance Account Types: Tailored for Every Trader

Opofinance offers a diverse selection of account types to serve different trader profiles — from beginners to professionals and prop traders. Here's a breakdown:

🔹 Standard Account

- Minimum Deposit: $100

- Spreads: From 1.5 pips

- Commission: None

- Leverage: Up to 1:2000

- Best For: Beginners looking for a commission-free account

🔹 ECN Account

- Minimum Deposit: $500

- Spreads: From 0.0 pips

- Commission: $6 per lot round turn

- Leverage: Up to 1:2000

- Best For: Traders seeking tight spreads and fast execution

🔹 ECN Pro Account

- Minimum Deposit: $5,000

- Spreads: From 0.0 pips

- Commission: $4 per lot round turn

- Leverage: Up to 1:2000

- Best For: High-volume and institutional traders

🔹 Copy Trading Account

- Platform: MT4, MT5, cTrader, OpoTrade

- Purpose: For users who want to follow and copy top-performing traders

- Profit Sharing: Customizable; strategy providers may set commission rates

🔹 Prop Account (via FORFX Partnership)

- Evaluation Needed: Yes (one-stage challenge)

- Payout: Up to 90% profit share

- Leverage: 1:30

- Scaling Up: Up to $300,000 under management

- Drawdown Limit: 8% max

- Platform: MT5

- Best For: Traders with strong discipline seeking funded capital

Trading Fees & Spreads Breakdown

Fees vary based on account type and asset class. Heres what traders can expect:

| Account Type | Spread (EUR/USD) | Commission | Swap-Free Option | Min Deposit |

| Standard | From 1.5 pips | No | Yes | $100 |

| ECN | From 0.0 pips | $6/lot round turn | Yes | $500 |

| ECN Pro | From 0.0 pips | $4/lot round turn | Yes | $5,000 |

| Copy Trading | Depends on master trader | Revenue share | Yes | Variable |

| Prop Account | No spreads (eval) | None on funded | No | $55+ eval fee |

Additional Notes:

- No deposit or withdrawal fees imposed by Opofinance

- Swaps apply unless swap-free is selected (Islamic option)

- Commission is only charged on ECN accounts

Evaluation Accounts: Get Funded to Trade

Opofinance's Prop Trading program (via FORFX) offers a chance to trade real capital after passing a single evaluation stage. Key features:

- Evaluation starts from $55 with targets and limits clearly defined

- Earn real payouts during evaluation — not just after

- Receive up to 90% of profits on funded account

- No ongoing fees after evaluation success

- Ideal for experienced traders looking for scaling capital without risking their own funds

FAQs About Opofinance Trading Accounts & Fees

Q1: What is the minimum deposit for Opofinance accounts?

A: It starts at $100 for a Standard account, $500 for ECN, and $5,000 for ECN Pro.

Q2: Are there any commission charges?

A: Yes, ECN accounts charge $6 per lot (round turn), and ECN Pro charges $4. Standard accounts are commission-free.

Q3: Can I open an Islamic (swap-free) account?

A: Yes, swap-free options are available upon request for Standard and ECN accounts.

Q4: Does Opofinance support copy trading?

A: Absolutely. Traders can follow signal providers and pay performance-based commission under the Copy Account type.

Q5: What is the FORFX Prop Account and how does it work?

A: Its a funding model where you pass a challenge, trade a funded account, and receive up to 90% profit split — even during the evaluation.

Q6: Are there hidden fees or charges?

A: No. There are no hidden fees. All costs (spread, commission, swaps) are transparently published.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

Evest Broker Review: Regulated, but Complaints Persist

Is Eightcap Safe or Scam? Eightcap User Reputation : Looking at Real User Reviews

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

Currency Calculator