1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

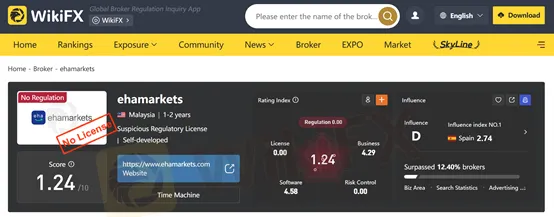

Abstract:ehamarkets review: WikiFX score 1.24/10, no valid regulation, extreme trading risks. Read this warning before investing with ehamarkets.

ehamarkets review: WikiFX score 1.24/10, no valid regulation, extreme trading risks. Read this warning before investing with ehamarkets.

ehamarkets is an online trading broker that has raised significant red flags within the trading community. According to WikiFX, ehamarkets has received a dangerously low score of just 1.24/10, placing it among the highest-risk brokers currently tracked.

In this ehamarkets review, we analyze its regulatory status, WikiFX risk assessment, potential dangers for traders, and how it compares with regulated brokers. Based on available information, traders should exercise extreme caution before engaging with this broker.

A brokers regulatory status is the most important factor in determining its legitimacy and safety.

Regulation Overview

According to WikiFX data, ehamarkets does not hold a valid license from any reputable financial regulator, such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). This lack of oversight means traders do not benefit from fund segregation, investor compensation schemes, or regulatory dispute resolution.

From a regulatory perspective, regulation ehamarkets is either absent or unverifiable, which significantly increases trader risk.

WikiFX has assigned ehamarkets a score of only 1.24/10, which is considered extremely dangerous in broker risk assessments.

Key Factors Behind the Low Score

A score this low usually indicates a broker that fails basic credibility and safety checks. WikiFX explicitly warns traders to stay away from brokers in this score range.

Potential Risks of Trading With ehamarkets

This review ehamarkets highlights several critical risks that traders should be aware of.

Brokers with similar profiles have historically been associated with fund lockups, sudden account closures, and loss of capital.

Information about ehamarkets trading platforms, spreads, leverage, and execution model is either incomplete or inconsistent.

This lack of transparency further reinforces concerns raised in this ehamarkets broker review.

Pros

Cons

| Feature | ehamarkets | Regulated Broker (FCA/ASIC) | Offshore Broker |

| Regulation | None | Top-tier regulation | Weak |

| WikiFX Score | 1.24/10 | 8.0–9.5 | 3.0–5.0 |

| Fund Protection | No | Segregated accounts | Limited |

| Transparency | Very low | High | Low |

| Withdrawal Risk | Very high | Low | High |

| Overall Risk Level | Extreme | Low–Medium | High |

Conclusion from comparison: ehamarkets carries significantly higher risk than both regulated brokers and even many offshore brokers.

Based on regulation checks, WikiFX scoring, and transparency analysis, the answer is clear:

ehamarkets is not considered safe for traders

This ehamarkets review strongly suggests that traders should avoid depositing funds with this broker. The absence of regulation combined with a 1.24/10 risk score places it in a category commonly associated with scams or broker misconduct.

ehamarkets is a high-risk broker with no credible regulatory backing and an extremely low WikiFX score. Traders looking for long-term safety, capital protection, and fair trading conditions should seek properly regulated alternatives instead.

Beginners

Retail traders

Risk-averse investors

Recommended action

Choose a broker regulated by FCA, ASIC, or CySEC

Verify broker information using platforms like WikiFX before investing

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.