Buod ng kumpanya

| The Capital GroupBuod ng Pagsusuri | |

| Itinatag | 1998 |

| Rehistradong Bansa/Rehiyon | Taiwan |

| Regulasyon | Taipei Exchange |

| Mga Kasangkapan sa Merkado | Stock,Future |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Suporta sa Customer | Address : 11F., No. 156, Sec. 3, Minsheng E. Rd., Distrito ng Songshan, Taipei City 105, Taiwan (R.O.C.) |

| Tel : 886-2-412-8878 | |

| E-mail : service@capital.com.tw | |

Impormasyon ng The Capital Group

Itinatag noong 1998, ang The Capital Group ay rehistrado sa Taiwan at niregula ng Taipei Exchange sa ilalim ng pangangasiwa ng Hindi Inilabas. Nag-aalok ito ng stock at options trading.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Niregula | Kakulangan sa mga instrumento sa trading |

| Demo account hindi available | |

| MT4/MT5 hindi available | |

| Kakulangan ng impormasyon sa Spread | |

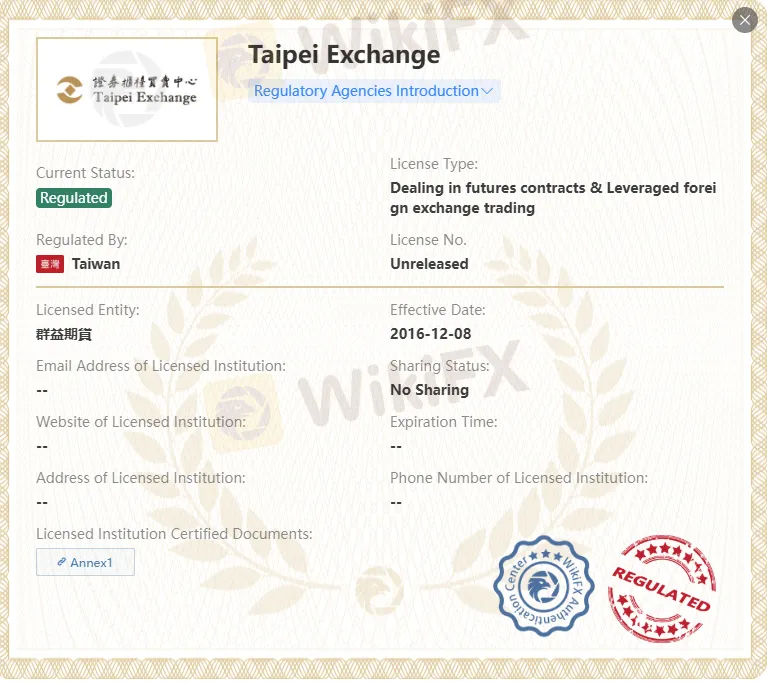

Totoo ba ang The Capital Group?

Oo. Ang The Capital Group ay lisensyado ng Taipei Exchange upang mag-alok ng mga serbisyo.

| Tagapamahala | Kasalukuyang Kalagayan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| Taipei Exchange | Regulated | The Capital Group | Pakikitungo sa mga kontrata sa hinaharap & Leveraged foreign exchange trading | Hindi Inilabas |

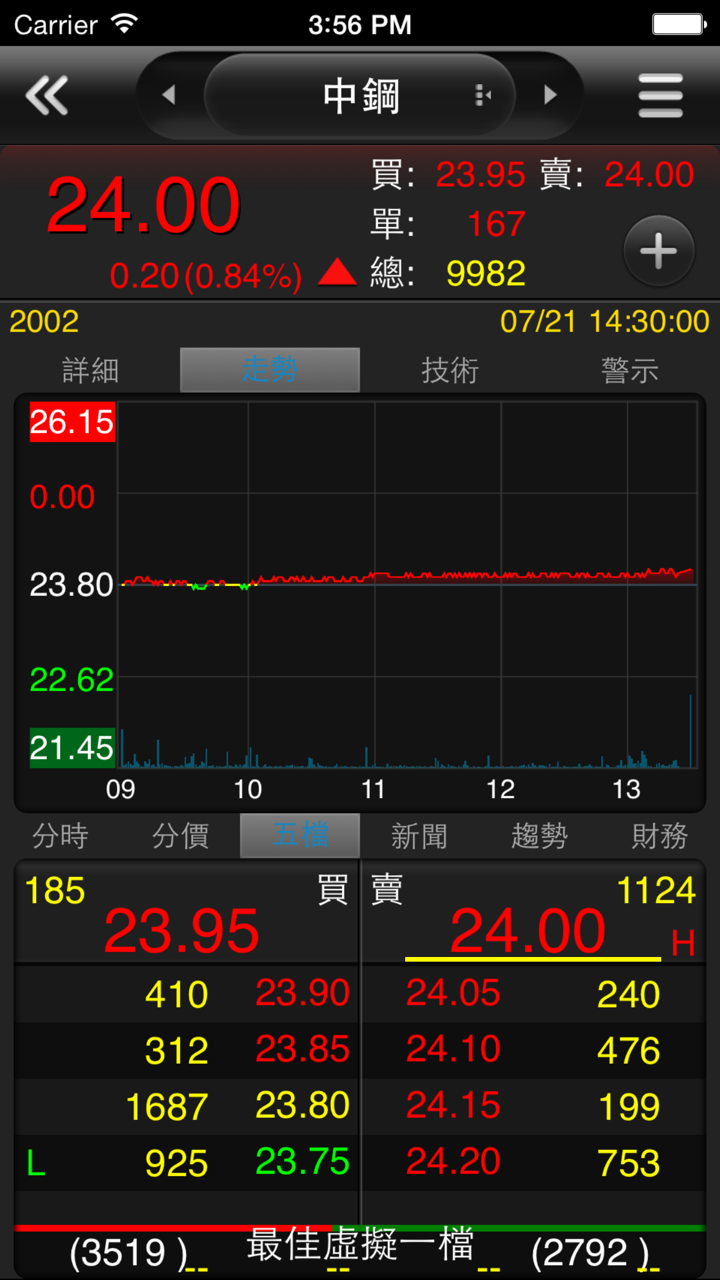

Ano ang Maaari Kong I-trade sa The Capital Group?

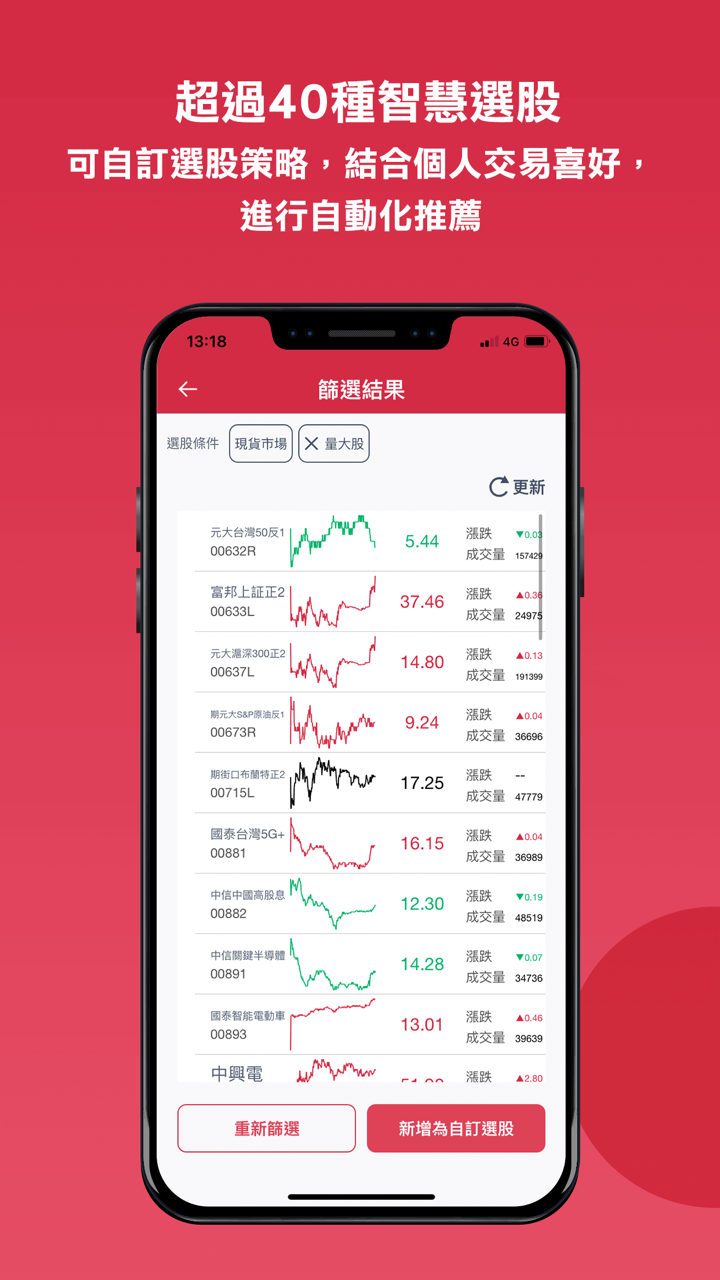

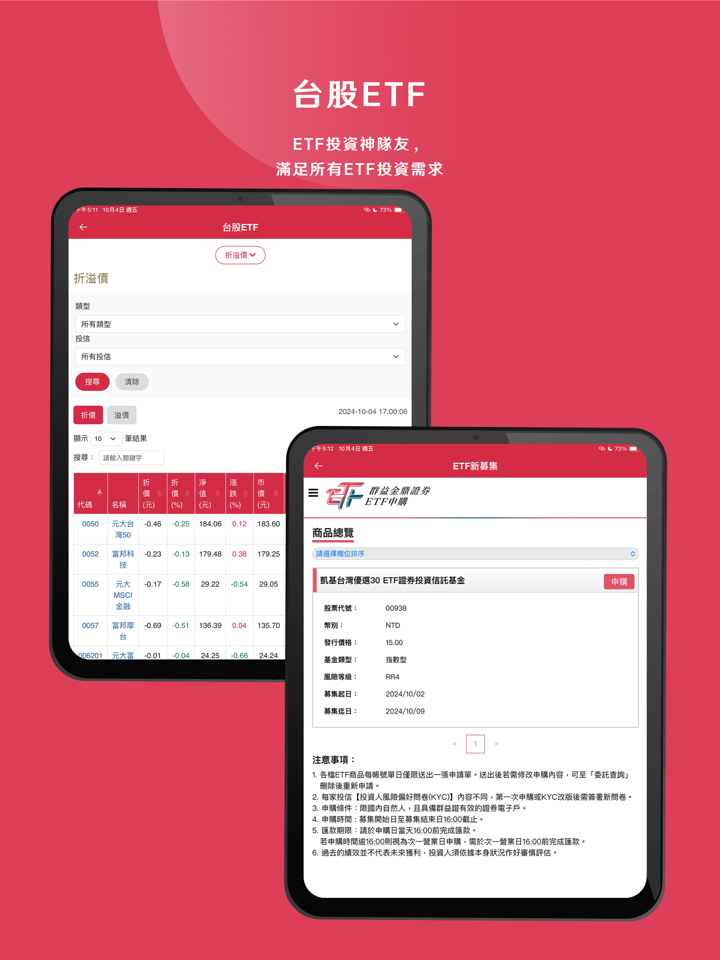

Nagbibigay ang The Capital Group ng mga stock at futures.

Walang trading ng ETFs o bonds. Hindi mo magiging maganda ang halo ng mga pagpipilian sa investment.

| Mga Tradable na Kasangkapan | Supported |

| Futures | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

FX3792673861

Hong Kong

市面上90%的骗局从“荐股”开始的!大多数骗局都是从“荐股”开始,往往那些所谓的“荐股大师”开始推荐的股票都会让你盈利一点点,在直播间或者是在群内推荐股票,慢慢取得你的信任后,开始推荐去做别的。在别的平台开.户操作。往往做别的开始也会让你盈利一点点,但是亏损一两次就会把你之前盈利的钱连本带利全都亏完,这时候老师会以各种理由敷衍你,说操作失误等等之类的话。然后叫你再入金,这时你不入金的话他就会把你踢出群,拉.黑删.除。如果你继续入金的话只会越陷越深!最后的结果也是一样亏空殆尽。 认清平台套路,避免上当受骗: 1、构建虚.假交易平台,不法人员往往是虚建包装成一个高大上的公司平台,给投资者传送模拟的交易软件,软件实际由他们控制。软件里投资产品的行情、价格走势都是他们自行设置,随他们掌控。 2、冻结客户资金,使其不能正常操作:在投资者盈利的时候,冻结投资者账户,使其买入之后不能正常卖出,然后其他操盘手将价格方向拉大,让投资者实际盈利变亏损。 3、在客户盈利时,强行平仓:美名其曰,避免你亏损,因为交易软件他们有后台控制,发现投资者盈利时,强制平仓。投资者因为往往都是网络开通账户,一无合同,二不知公司名称地址,往往被强制平仓后,无能为力,求告无门。 4、操作软件,控制行情:在交易平台中设置虚拟账户,进而对该账户虚拟注.资,进而通过虚拟资金控制交易行情,致使受害人亏损。 5、放大交易杠杆,设置资金放大比例数十或数百倍于受害人的“主力账户”,进而通过放大后的资金优势操作、控制市场行情,使受害人亏损

Paglalahad

欧阳73633

Hong Kong

Hindi maalis ang pondo. Hilingin sa akin na magbayad ng margin na may iba`t ibang mga kadahilanan kapag kumita ako ngunit hindi ako makakakuha ng mga pondo. Nagtataka ako kung bakit hindi ako pinapayagan ng malaking broker na mag-withdraw ng mga pondo?

Paglalahad

FX1460433056

Thailand

Nasakop ka ng Capital Group ng isang grupo ng mga produkto ng kalakalan, mula sa mga stock hanggang sa futures, mga opsyon, at forex. Nangangahulugan ito na maaari mong ikalat ang iyong mga pamumuhunan sa iba't ibang mga merkado at mabawasan ang mga panganib. Ang kanilang mga platform sa pangangalakal ay medyo matamis din, kasama ang lahat ng mga kampanilya at sipol na kailangan mong i-trade at subaybayan ang iyong mga pamumuhunan tulad ng isang propesyonal. Medyo nabigla ako sa hanay ng mga produkto at feature na inaalok nila.

Katamtamang mga komento

S MD

Singapore

Ang Capital Group ay isang mahusay na pagpipilian dahil sa kanilang mapagkumpitensyang mga bayarin at komisyon. Walang mga nakatagong bayad o singil, na isang malaking plus para sa akin. Nag-aalok ang broker ng mababang spread at transparent na pagpepresyo, na ginagawang isang cost-effective na karanasan ang pakikipagkalakalan sa kanila. Pinahahalagahan ko ang katotohanan na hindi ako tinamaan ng mga hindi inaasahang bayad o singil, at madali kong makalkula ang halaga ng aking mga trade.

Positibo

FX1036206024

Argentina

Walang gaanong masasabi, sa tingin ko ang serbisyong ibinigay ng Capital Group ay kasiya-siya para sa akin. Ang seguridad ang pinakamahalagang bagay kapag pumipili ako ng broker, at ligtas ang pera ko sa ngayon.

Positibo