Buod ng kumpanya

| TorFX Buod ng Pagsusuri | |

| Itinatag | 2004 |

| Rehistradong Bansa | Australia |

| Regulasyon | ASIC |

| Mga Serbisyo | Personal Money Transfers, Business Money Transfers, Forward Contracts, Currency Orders, Market Analysis, Risk Management |

| Suporta sa Customer | AUS: 1800 507 480 |

| AUS: +61 7 5560 4444 | |

| NZ: 0800 441 283 | |

Impormasyon Tungkol sa TorFX

Ang TorFX ay isang serbisyong pangpalitan ng pera sa Australia na nagsimula noong 2004 at lisensyado ng ASIC. Nag-aalok ito ng makatwirang mga rate ng palitan para sa mga mamimili at negosyo, walang bayad sa paglilipat, at espesyalisadong pamamahala ng panganib. Mahusay ito para sa pagpapadala ng pera, ngunit walang anumang produkto sa kalakalan o pamumuhunan.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng ASIC | Suporta lamang sa paglilipat ng fiat currency (walang crypto, stocks, atbp.) |

| Zero komisyon at bayad sa paglilipat | |

| Dedicated account managers para sa personalisadong serbisyo |

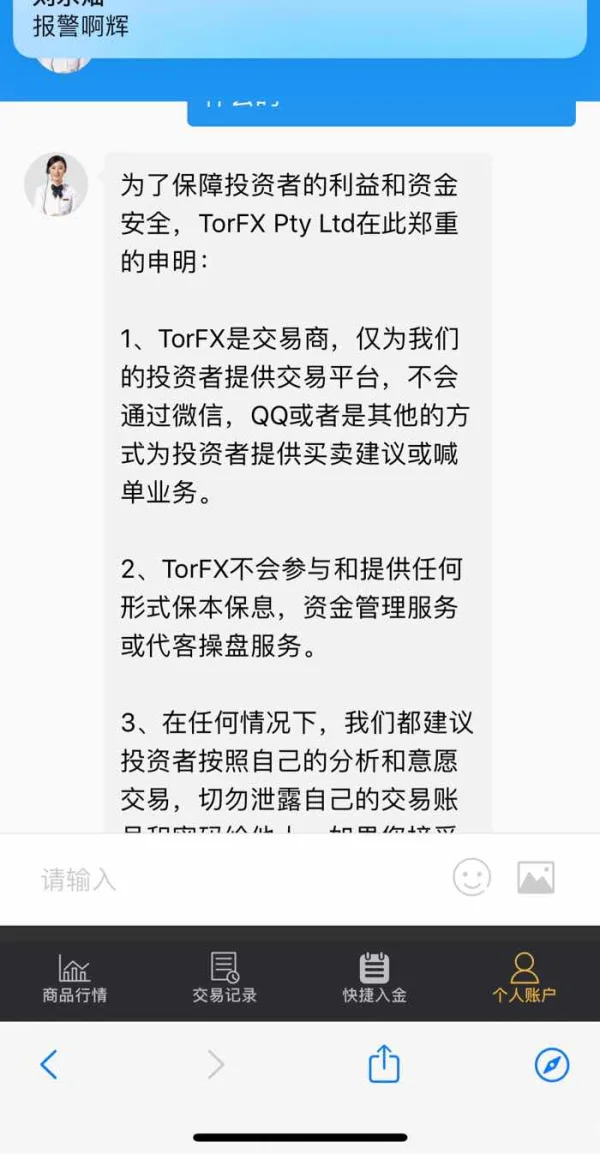

Tunay ba ang TorFX?

Ang TorFX, sa pamamagitan ng kanyang entidad na TOR FX PTY LIMITED, ay opisyal na kinokontrol ng Australia Securities & Investment Commission (ASIC) sa ilalim ng lisensyang Market Maker (MM) numero 246838.

Mga Serbisyo ng TorFX

Ang TorFX ay isang serbisyong pangpalitan ng pera na nakikipagtulungan sa mga indibidwal at negosyo. Layon nito ang mag-alok ng magagandang rate ng palitan, walang bayad sa paglilipat, at mga solusyon sa personalisadong pamamahala ng panganib.

| Mga Serbisyo | Supported |

| Personal Money Transfers | ✔ |

| Business Money Transfers | ✔ |

| Forward Contracts | ✔ |

| Uri ng Order ng Pera | ✔ |

| Pagsusuri sa Merkado ng Pera | ✔ |

| Serbisyong Pamamahala ng Panganib | ✔ |

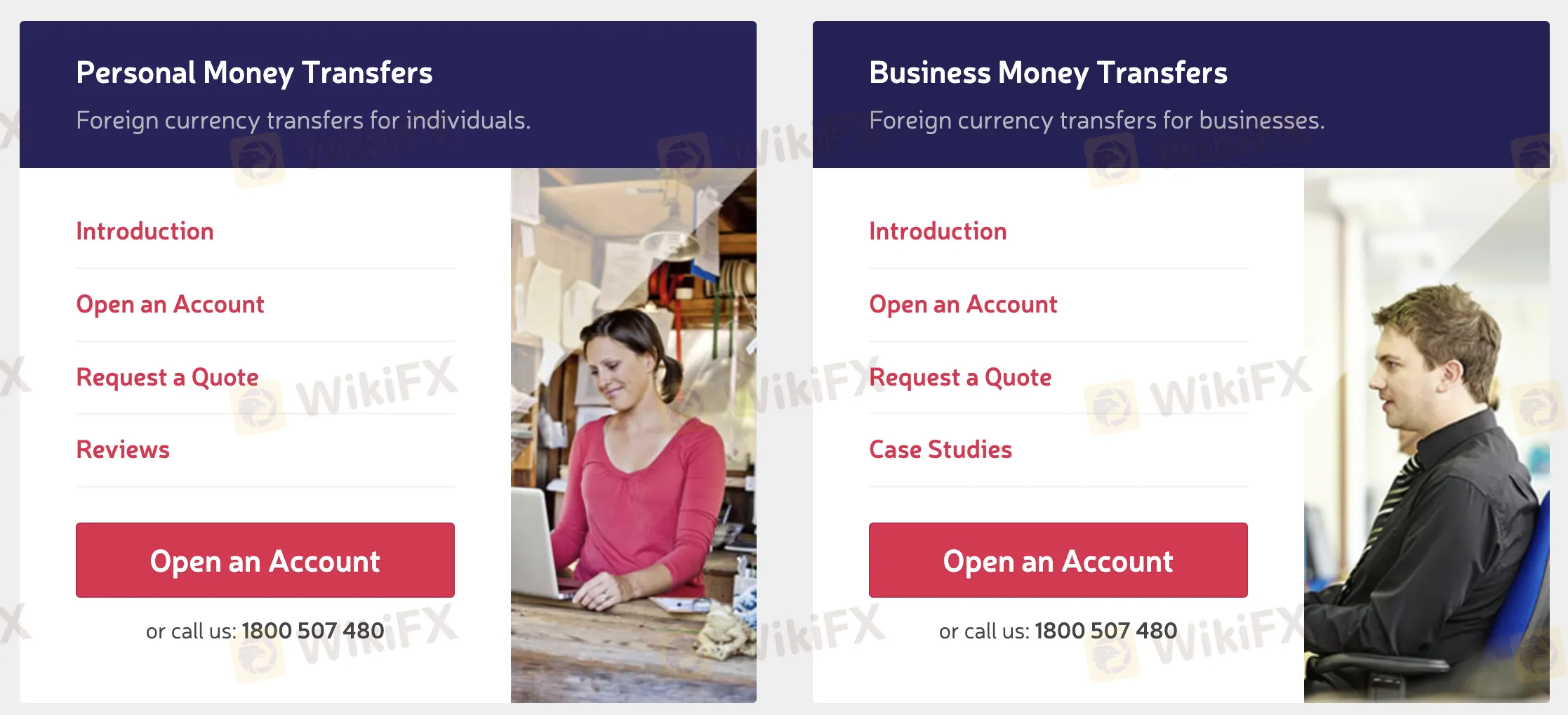

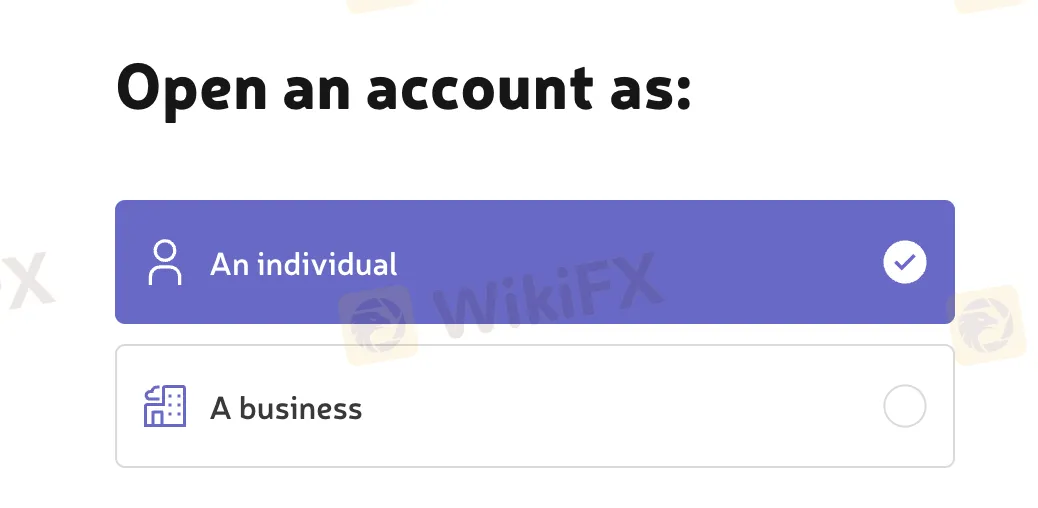

Uri ng Account

May dalawang pangunahing uri ng live accounts ang TorFX: isang Personal Account para sa mga taong nangangailangan ng magpadala ng pera sa ibang bansa at isang Negosyo Account para sa mga korporasyon na kailangang magbayad sa mga empleyado sa ibang bansa, bumili ng mga bagay mula sa ibang bansa, o magpadala ng pera pabalik sa kanilang sariling bansa.

Mga Bayad ng TorFX

Ang mga rate ng TorFX ay medyo kompetitibo kumpara sa singil ng ibang kumpanya. Hindi sila nagpapataw ng komisyon o bayad sa paglipat sa kahit isang beses o madalas na mga dayuhang pagbabayad, kaya mas mura sila kaysa sa mga bangko, na karaniwang nangang singil ng mga $50 bawat paglilipat.

| Uri ng Bayad | TorFX | Banko |

| Komisyon | $0 | Madalas ~$50 bawat paglilipat |

| Bayad sa Paglipat | Madalas ~$50 bawat paglilipat |

FX1423191169

Hong Kong

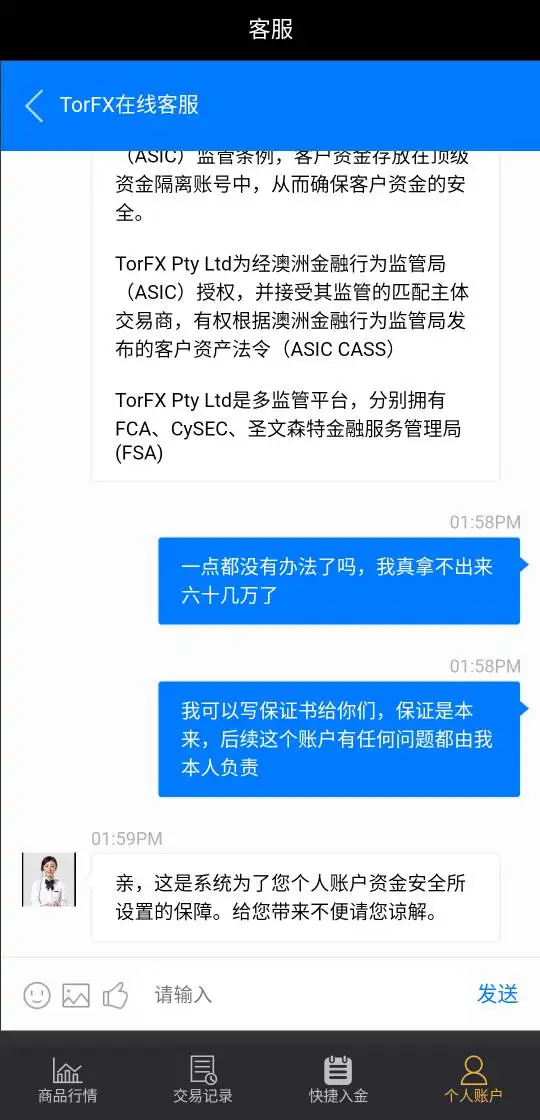

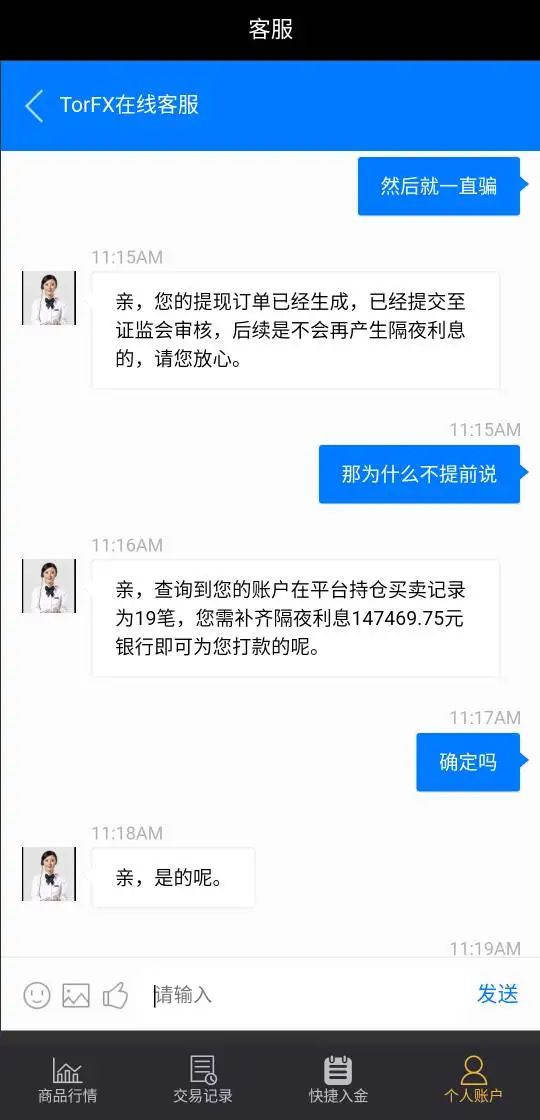

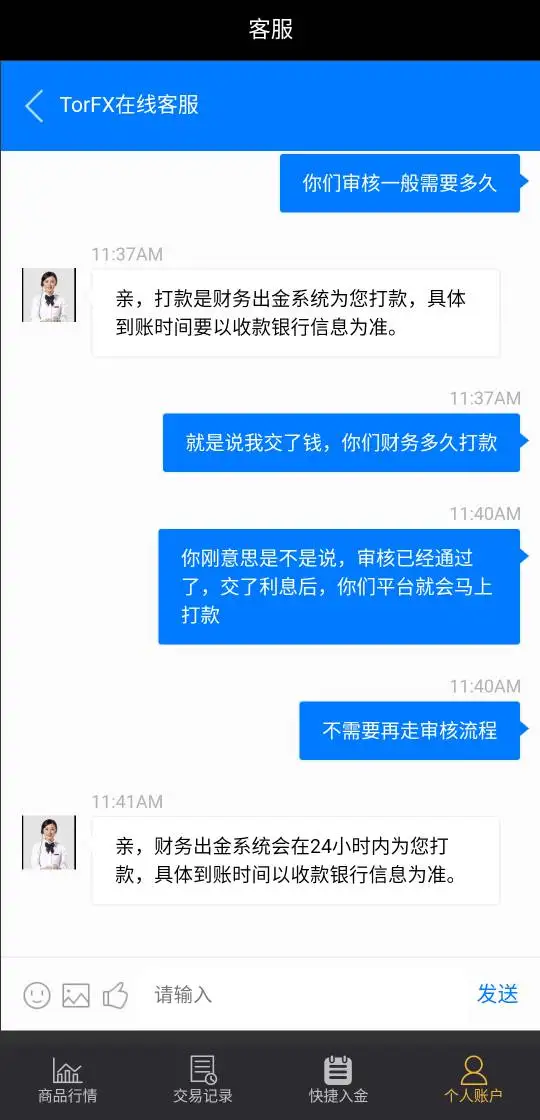

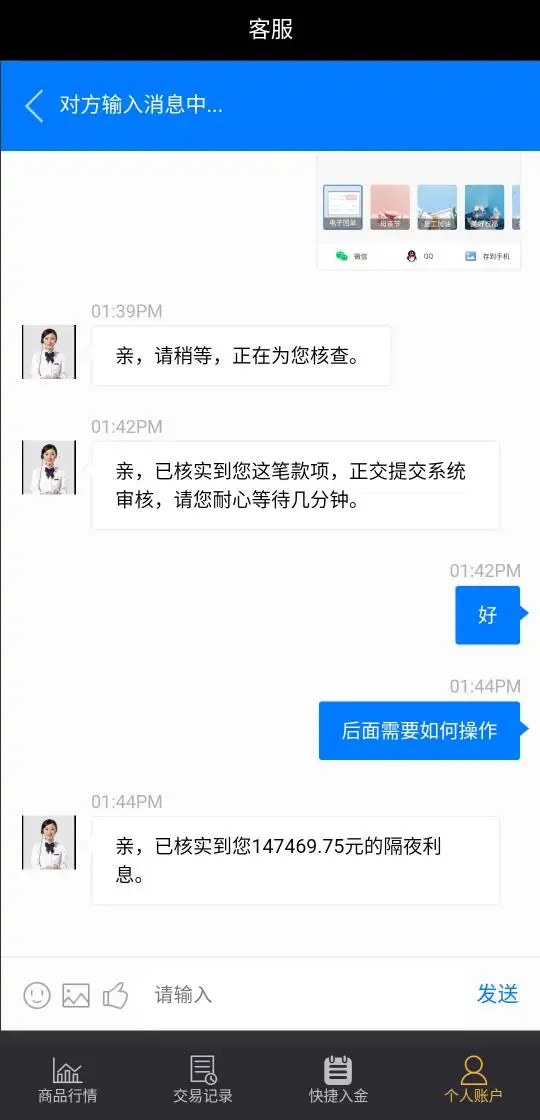

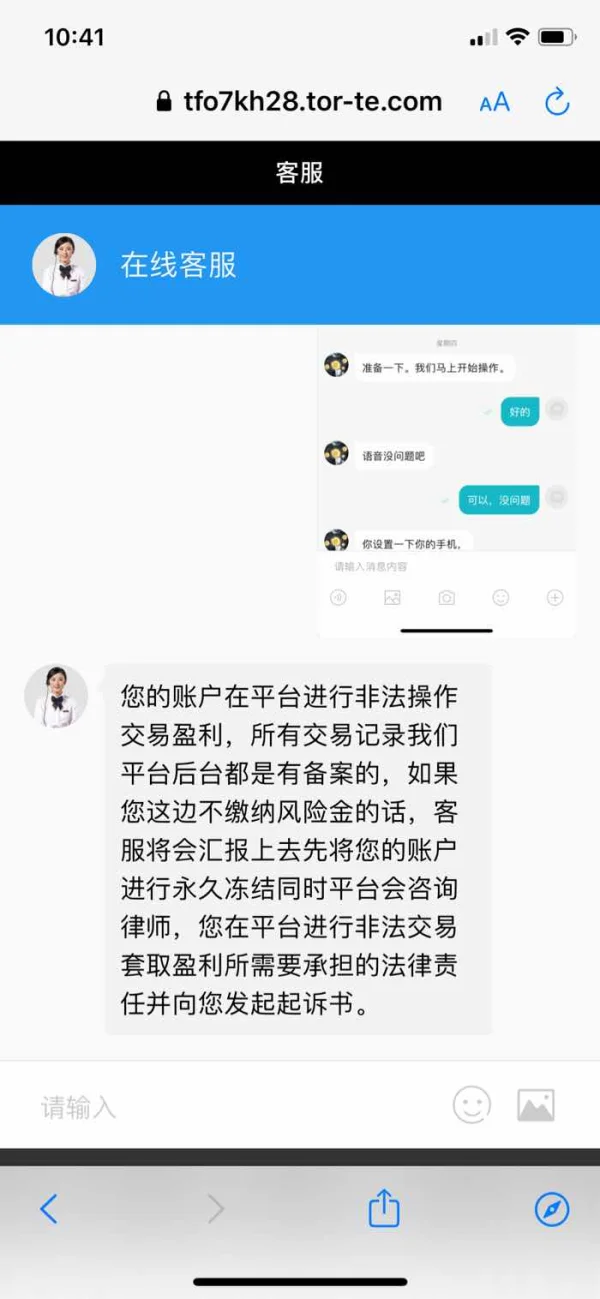

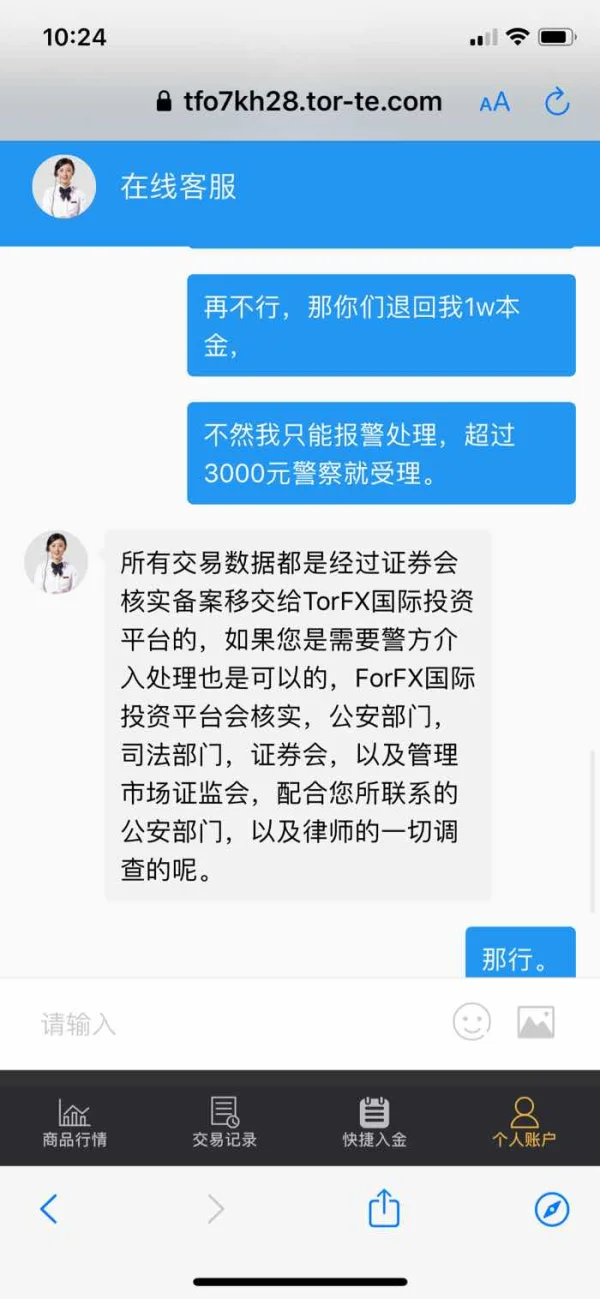

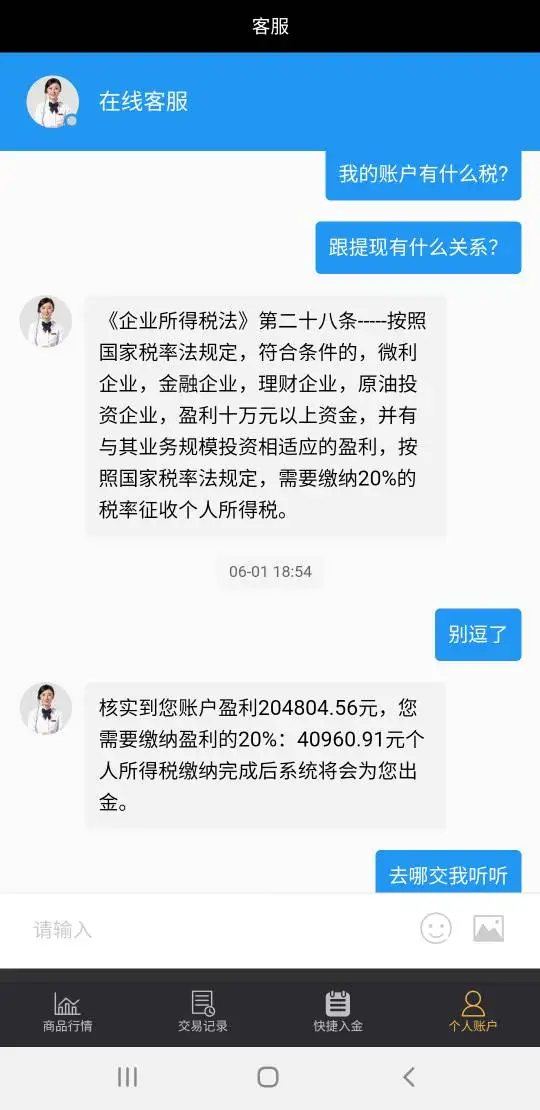

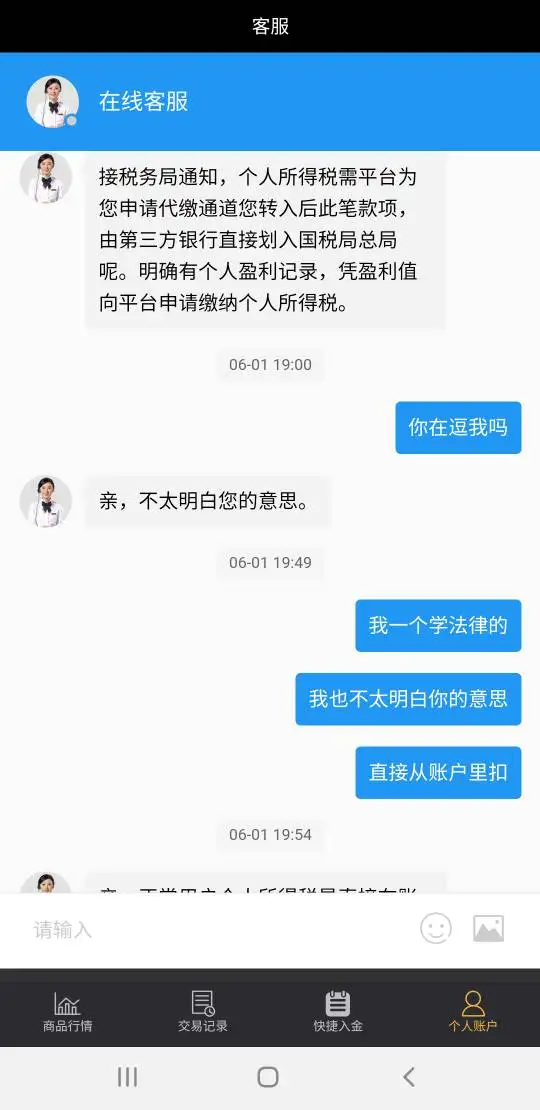

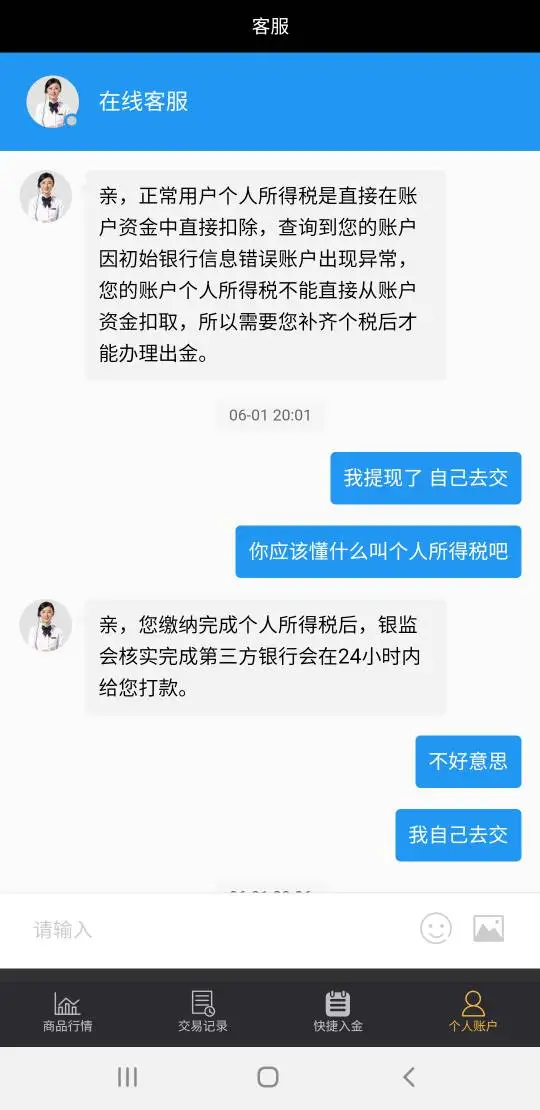

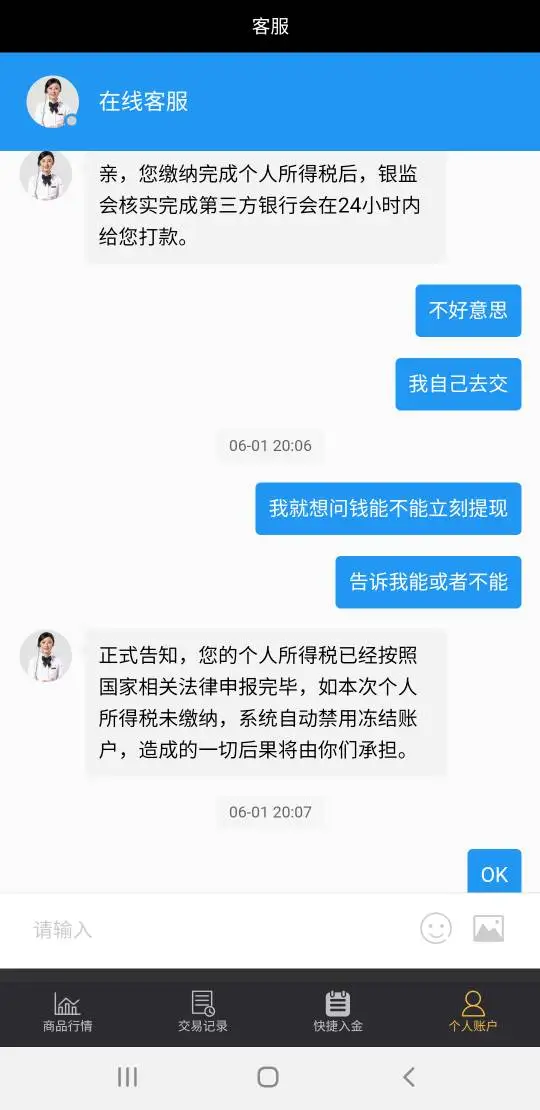

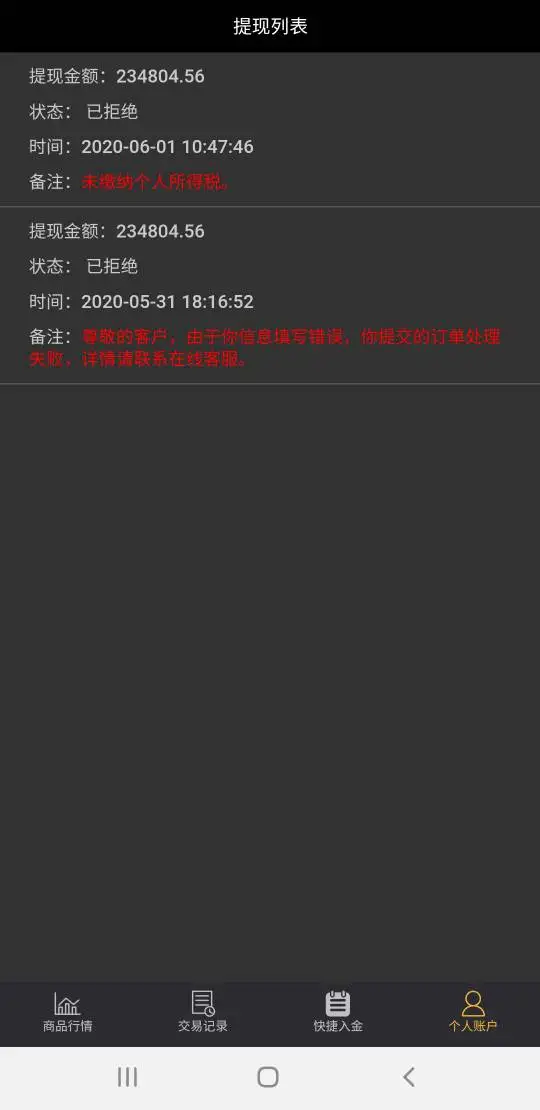

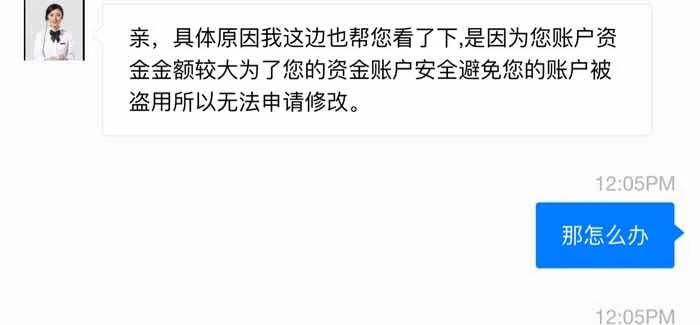

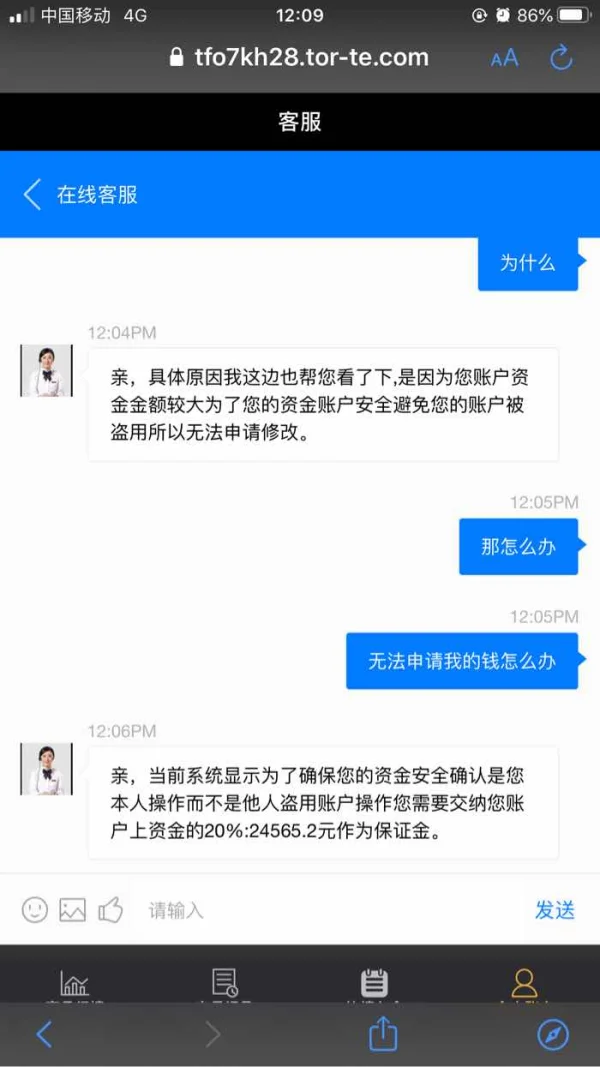

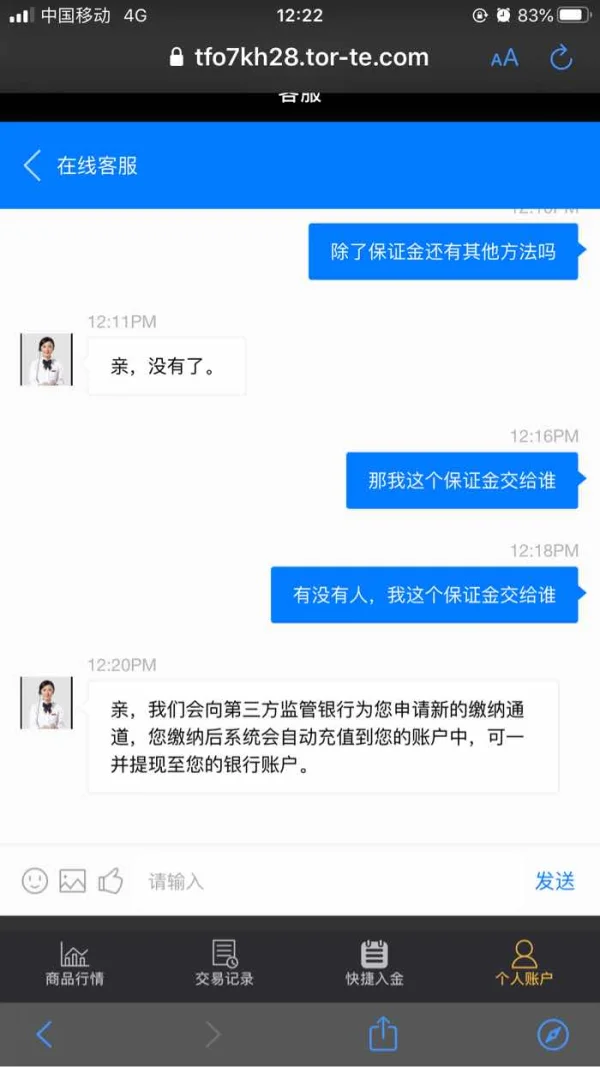

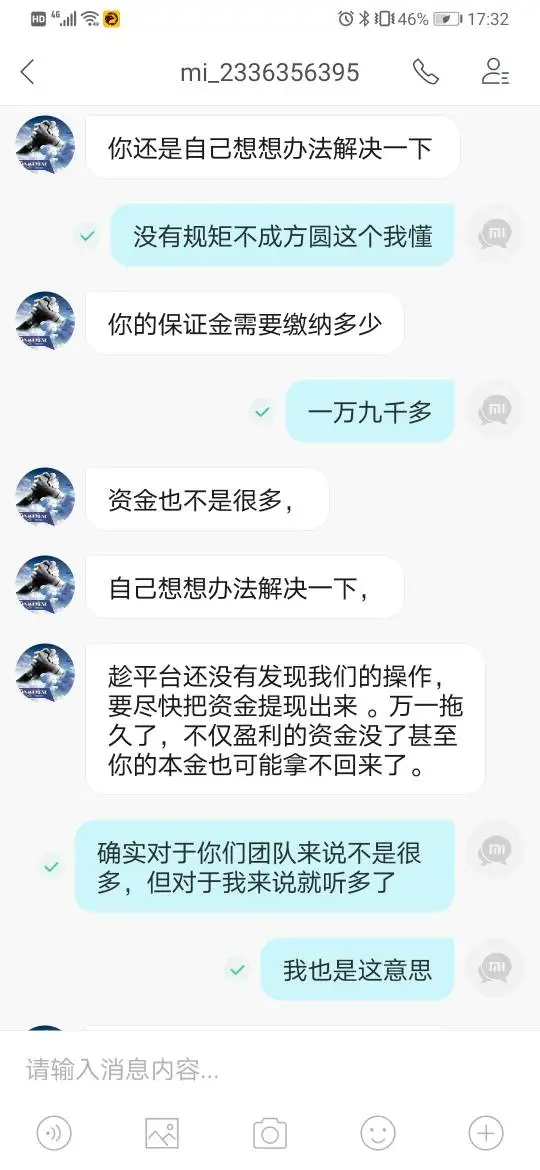

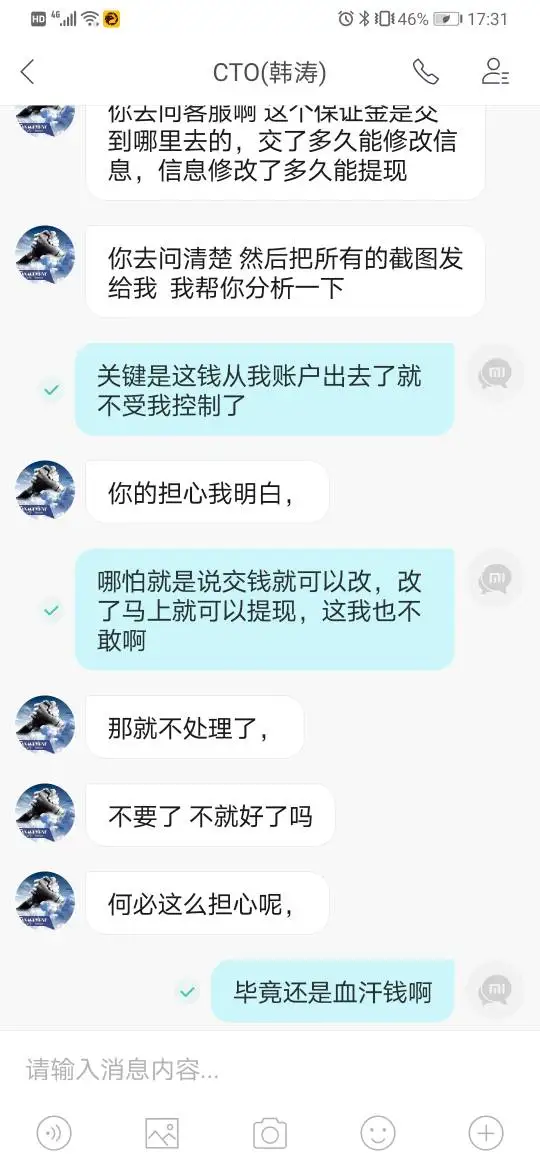

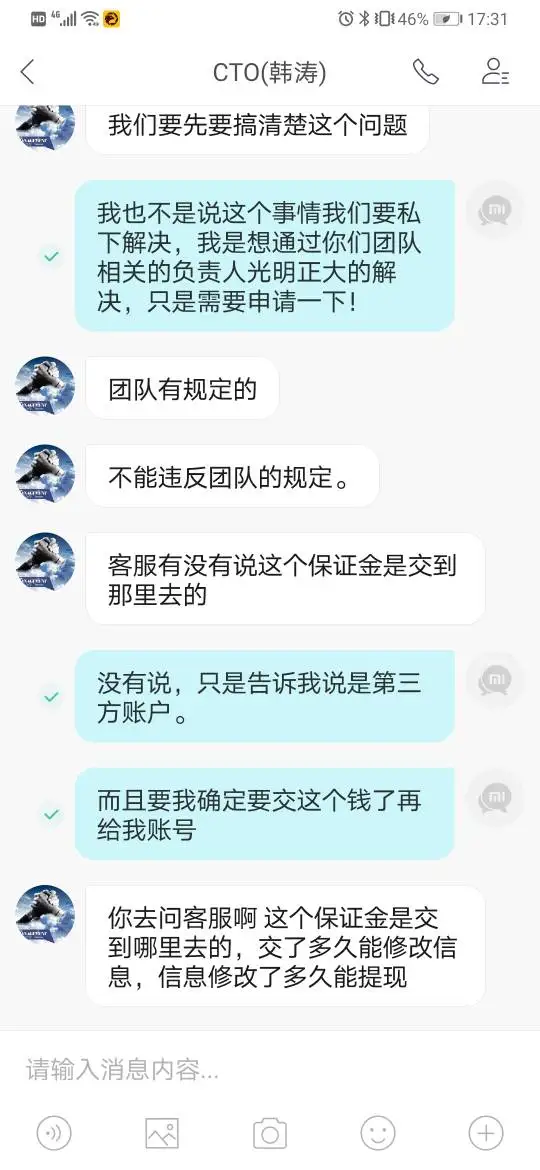

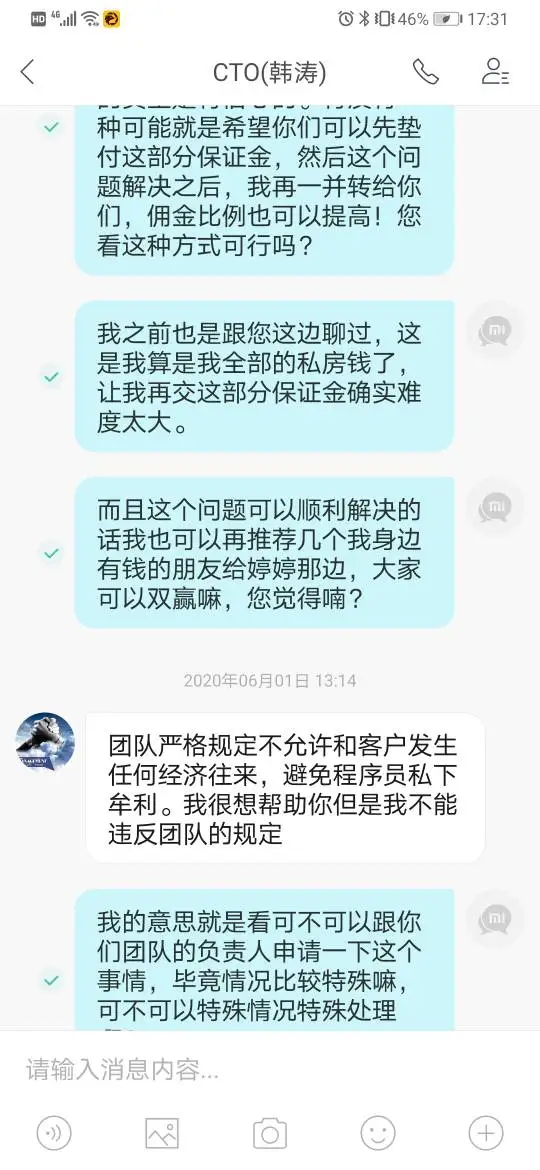

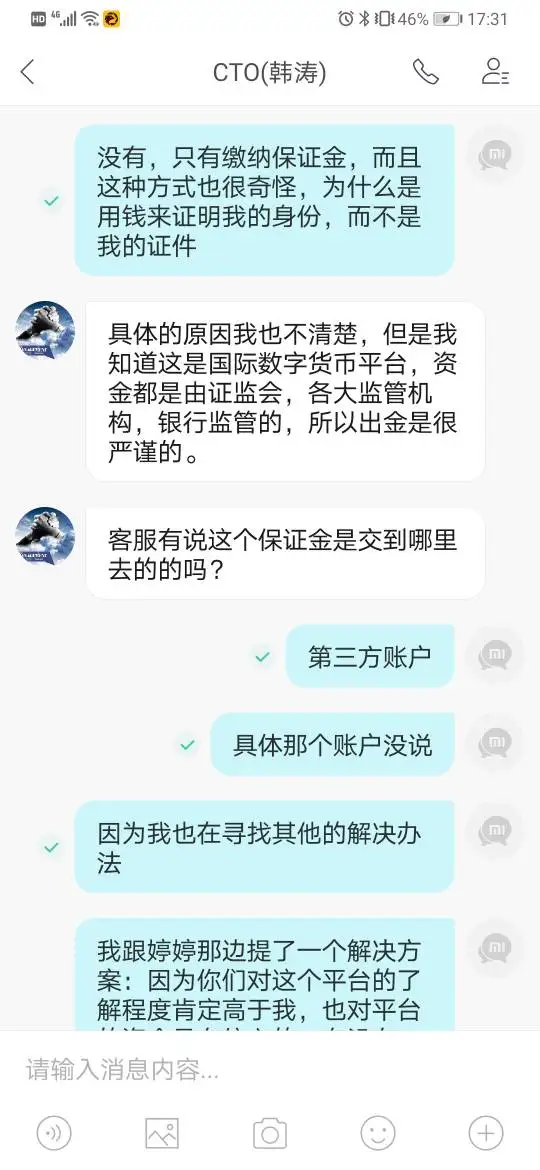

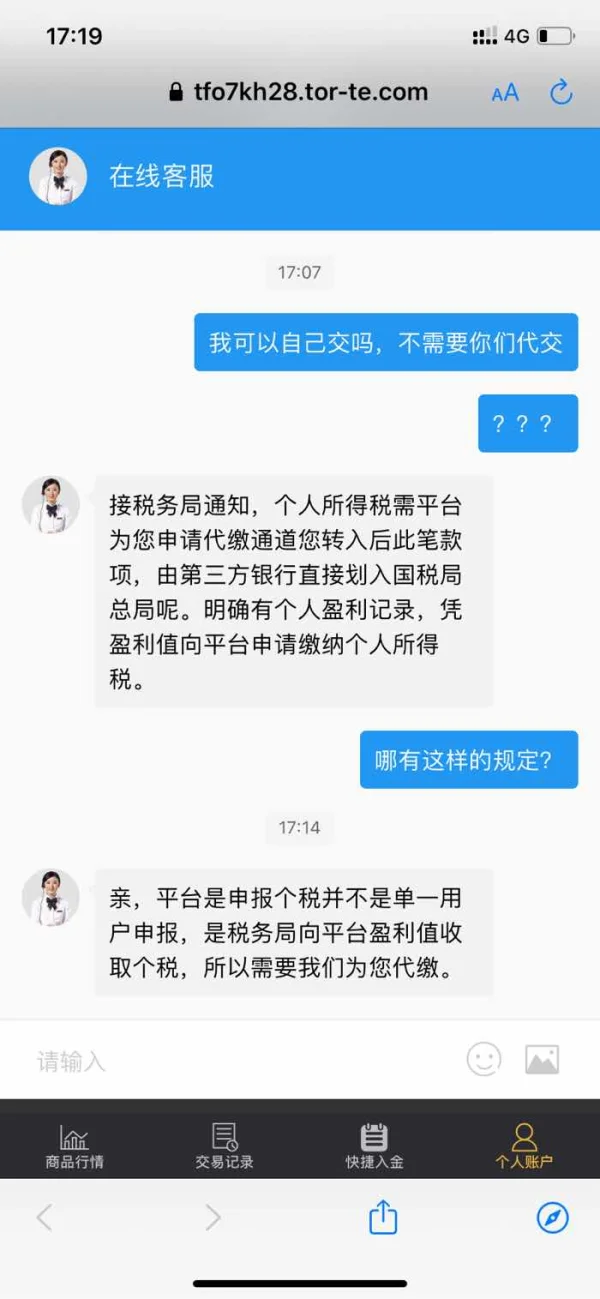

无法出金,一直骗,说交钱保证提现,最后还要交35万强制保险

Paglalahad

made in china58415

Hong Kong

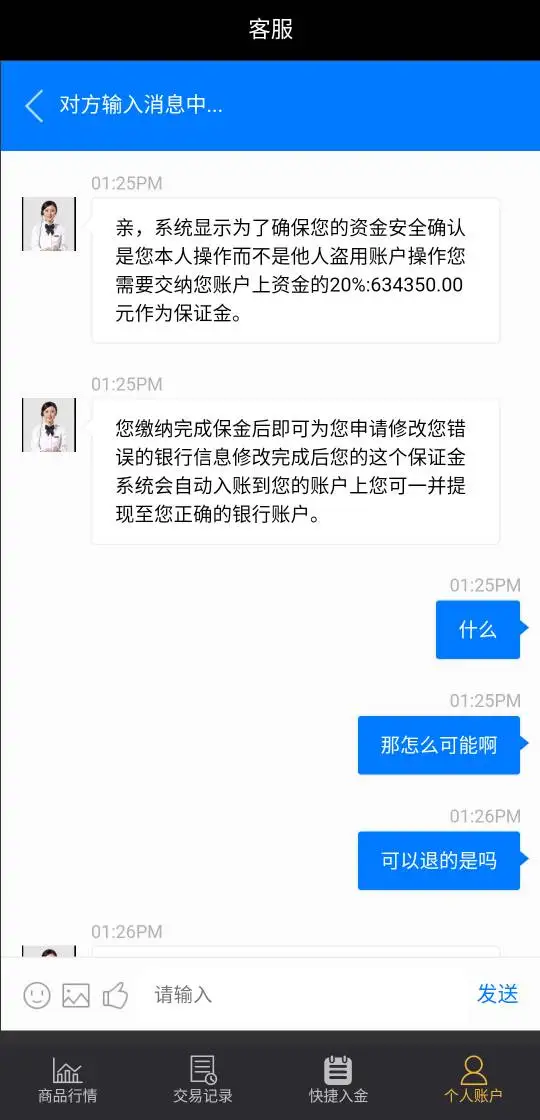

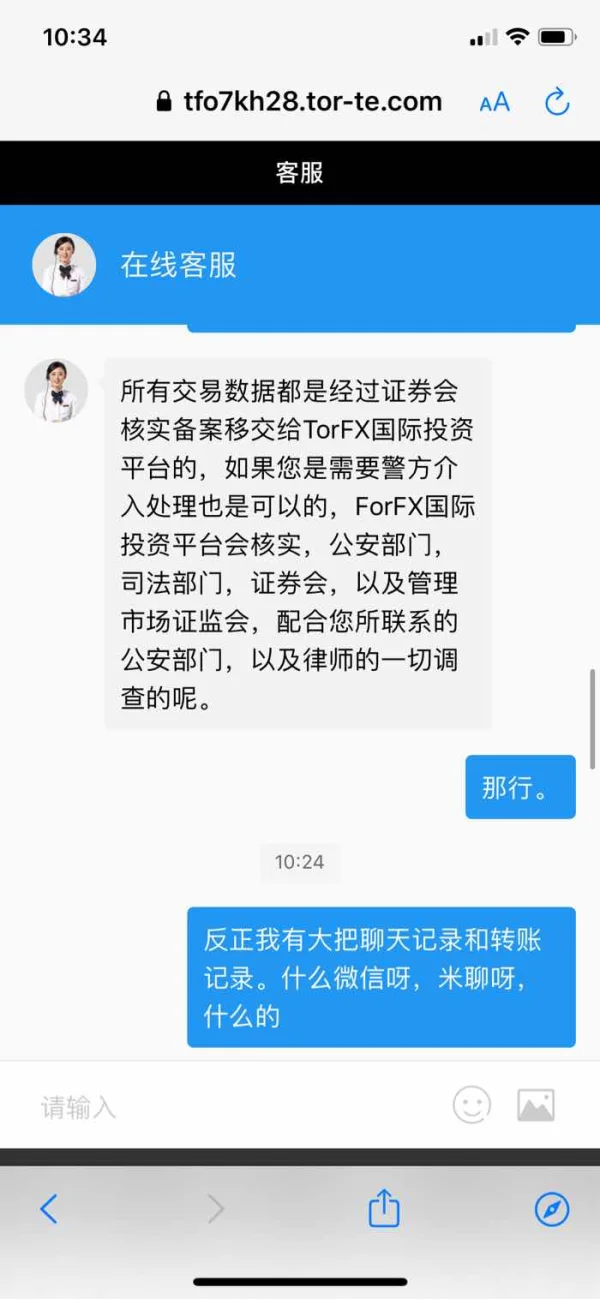

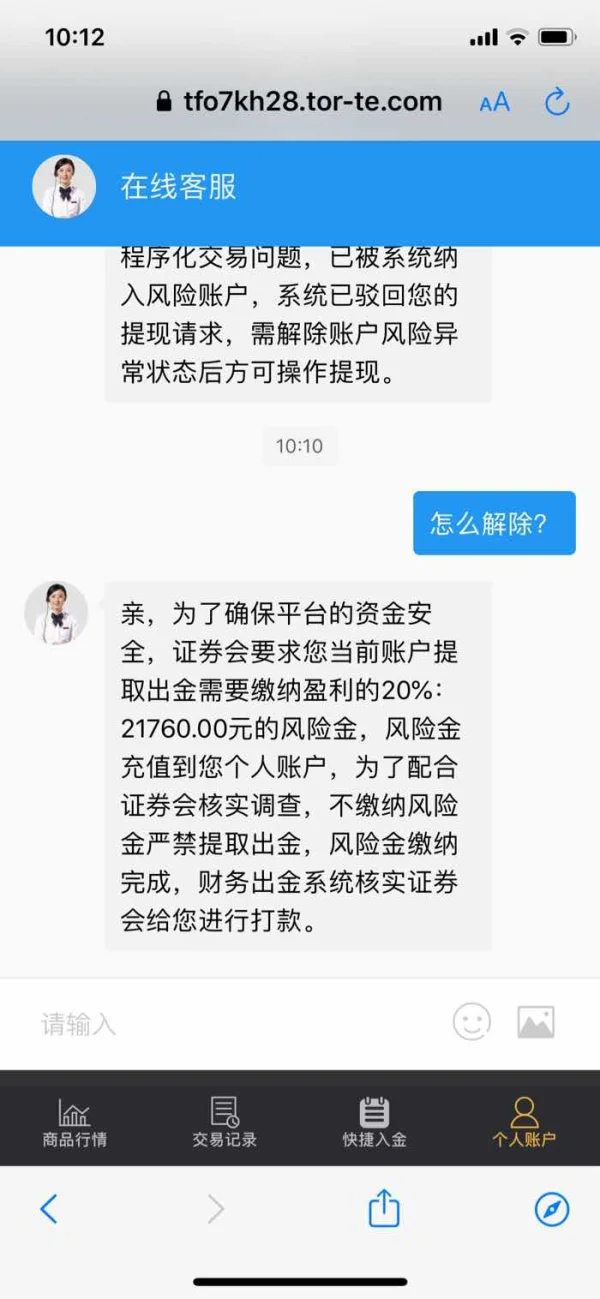

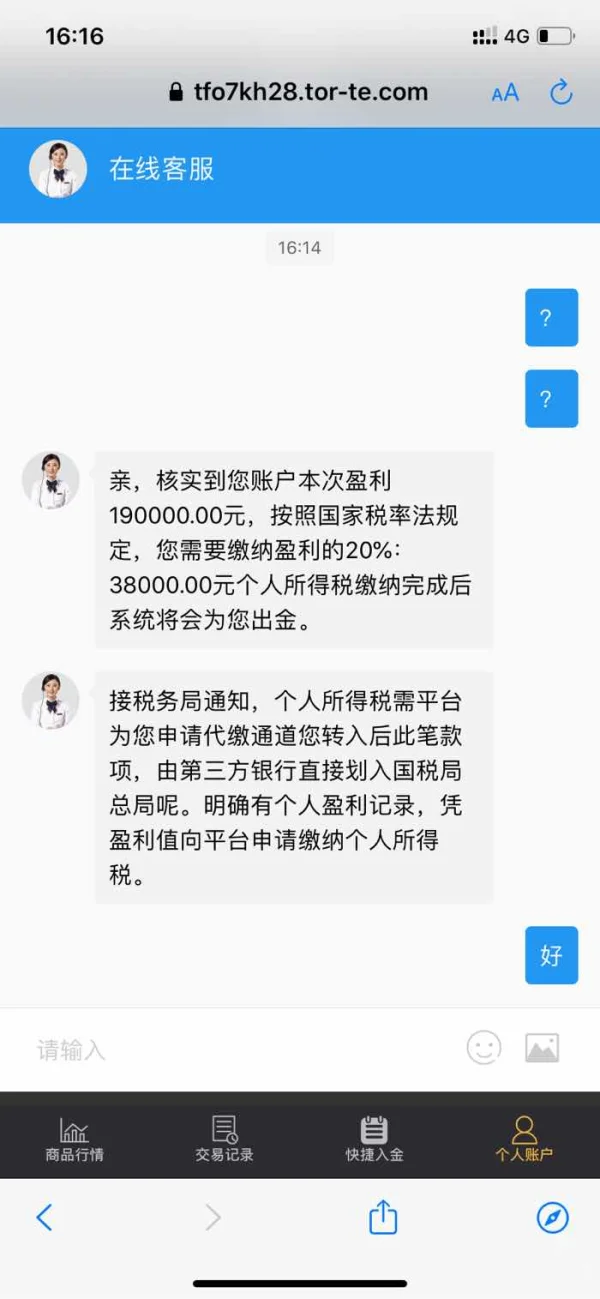

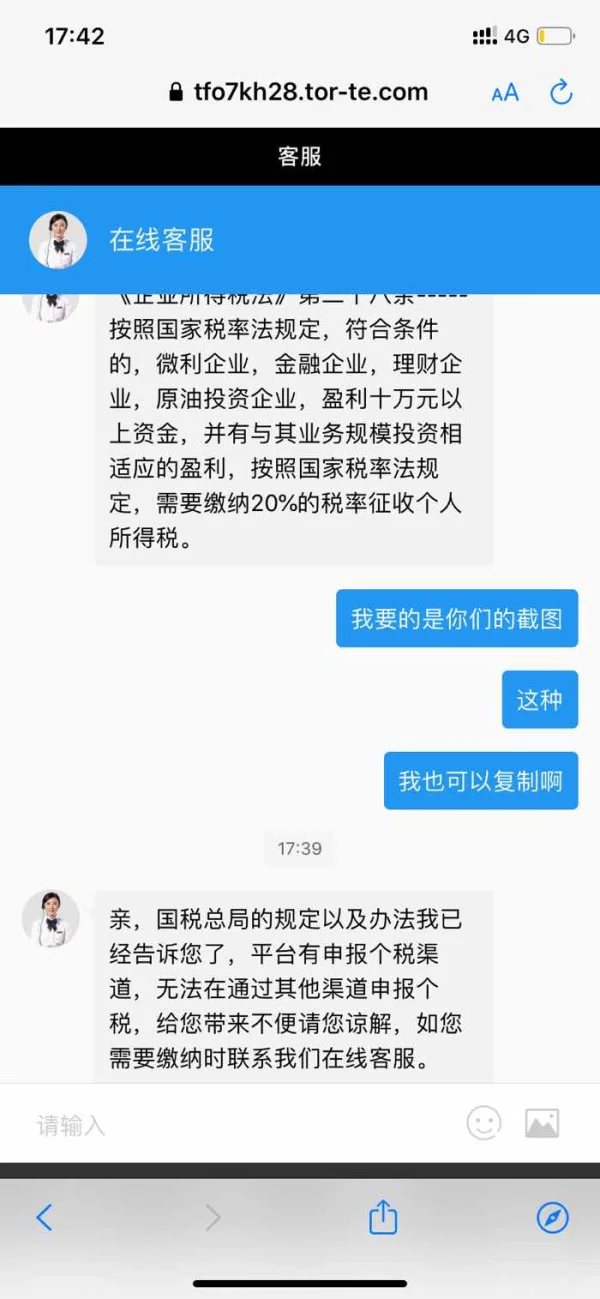

盈利了提现不了,说什么风险过高,需要交20%的入金钱才能解除,这就是诱惑你一步一步的入金,到最后还是无法提现

Paglalahad

L.An

Hong Kong

骗子 合伙骗 提现各种原因提不出 希望各位不要上当

Paglalahad

掌门

United Kingdom

Tinutulungan ako ng isang napakatulunging staff na gumawa ng currency exchange mula sa United Kingdom patungo sa Australia. Nag-aalok sila ng mapagkumpitensyang halaga ng palitan at ang mga transaksyon ay walang kaguluhan at mabilis. Para sa sinumang nangangailangan ng serbisyo sa pagbabayad, inirerekumenda ko ang platform na ito.

Positibo

FX1019808757

Hong Kong

Narinig ko ang broker na ito mula sa isa sa aking mga kaibigan. I entered into TorFX's official site and just want to see how it works..Sadly, the site seems not to work.. it load for more than 5 minutes pero hindi lumalabas..Masyado bang masama ang wifi ko? O may mali ba sa website ng broker na ito?..

Katamtamang mga komento

TIMMY洲

Hong Kong

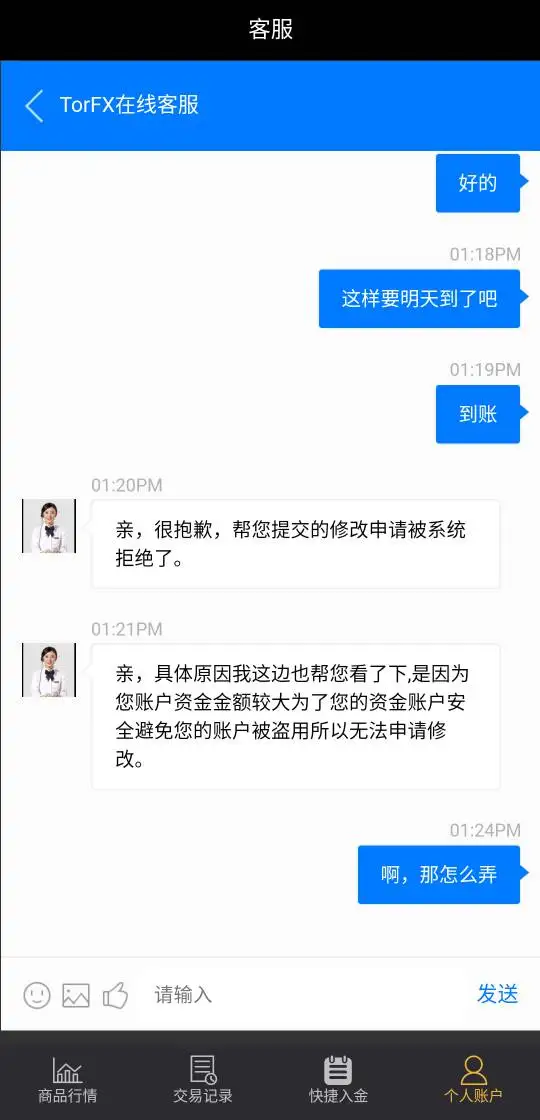

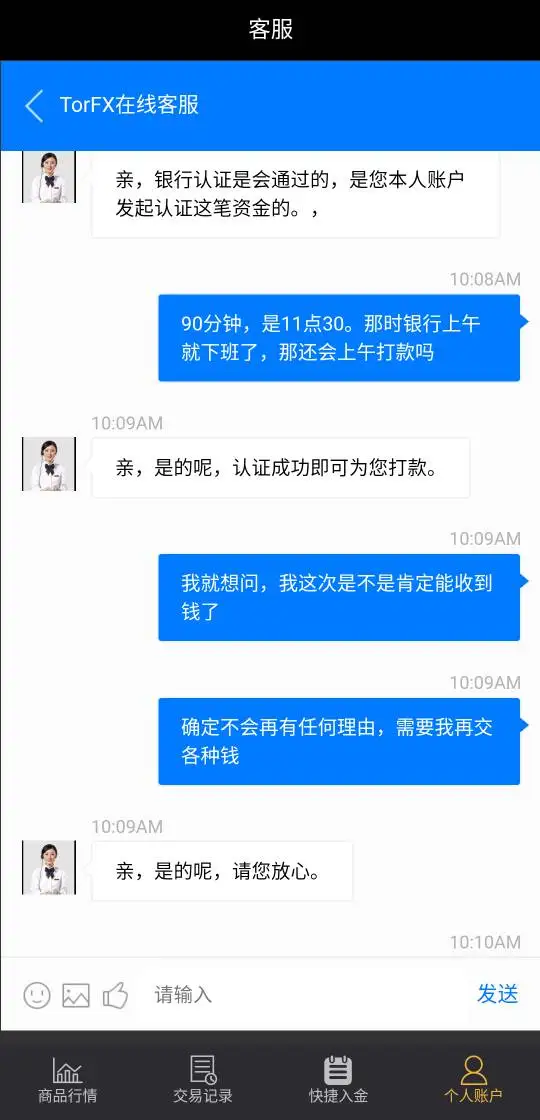

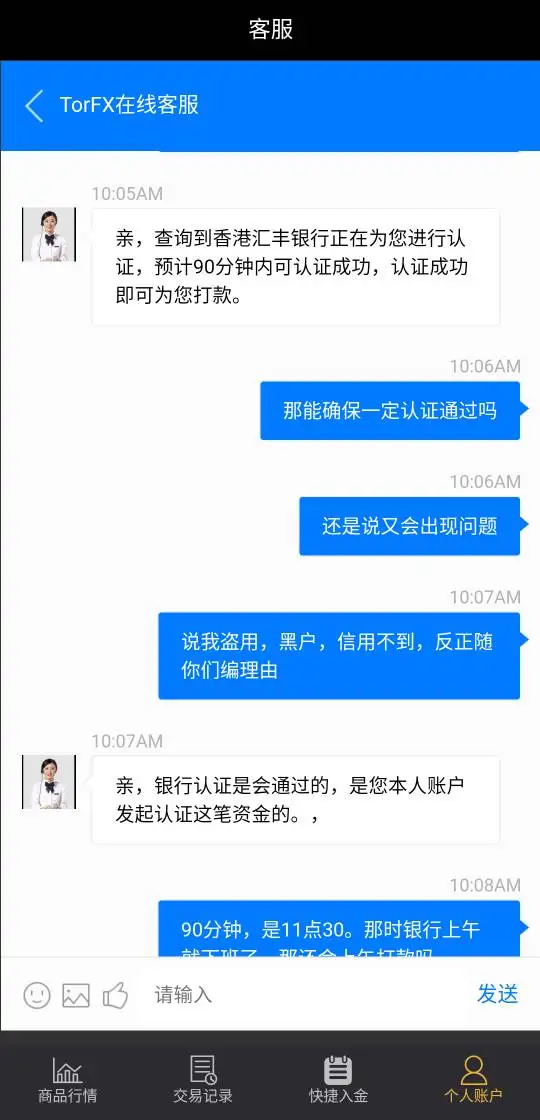

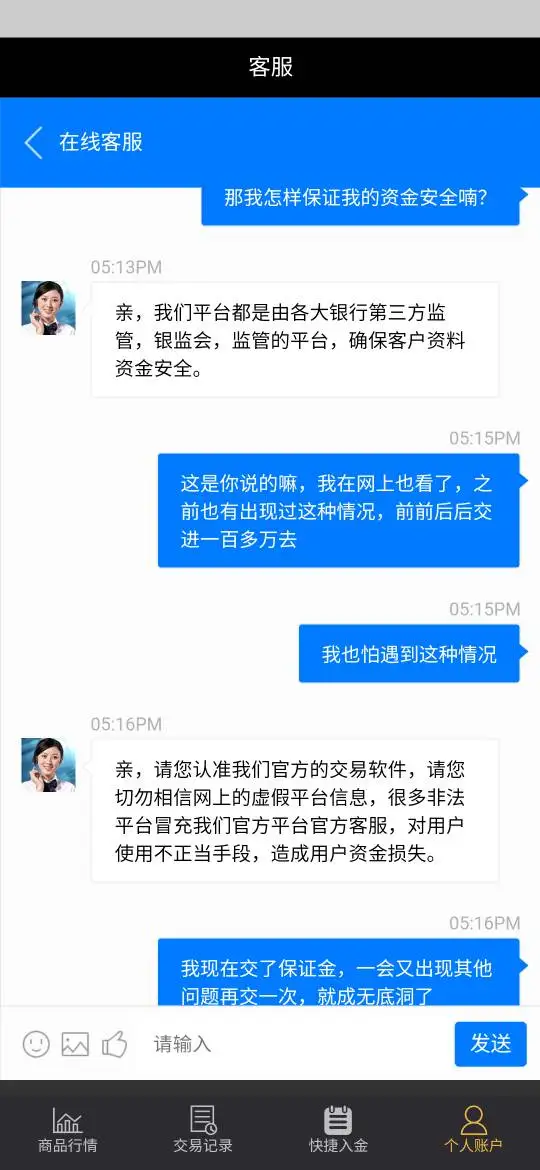

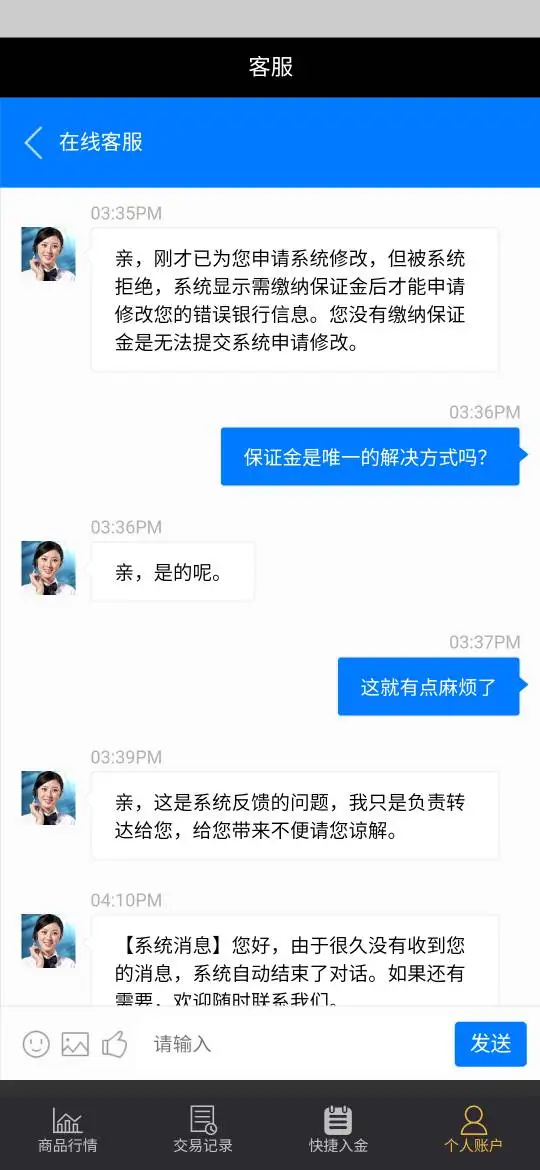

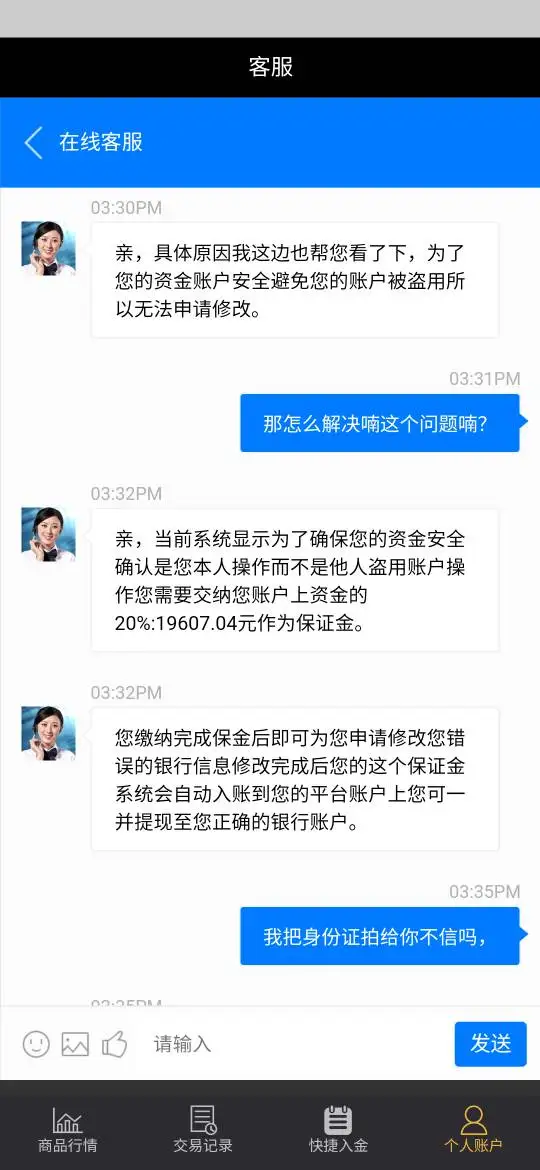

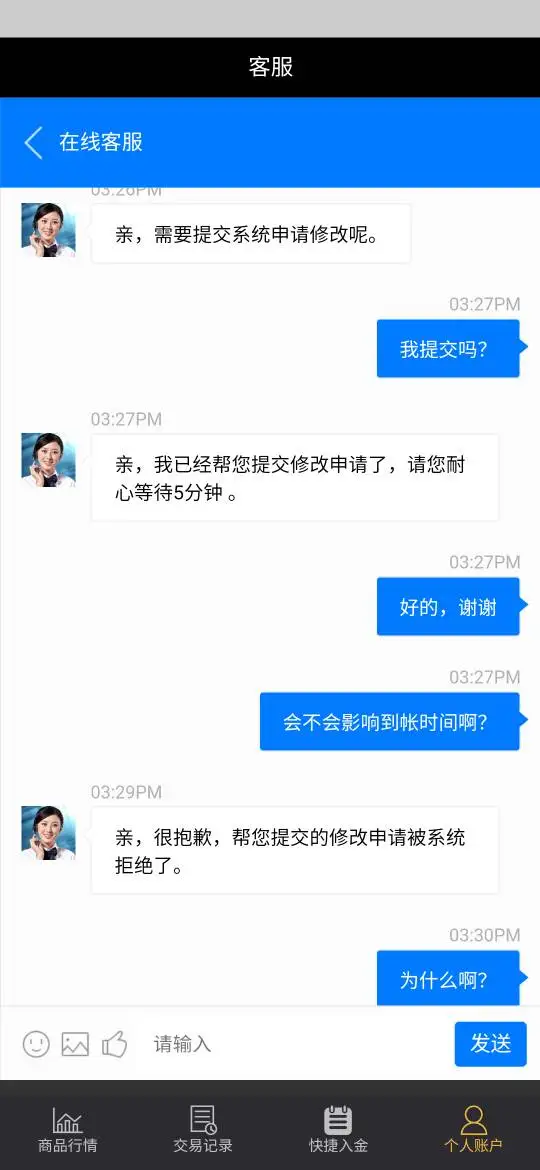

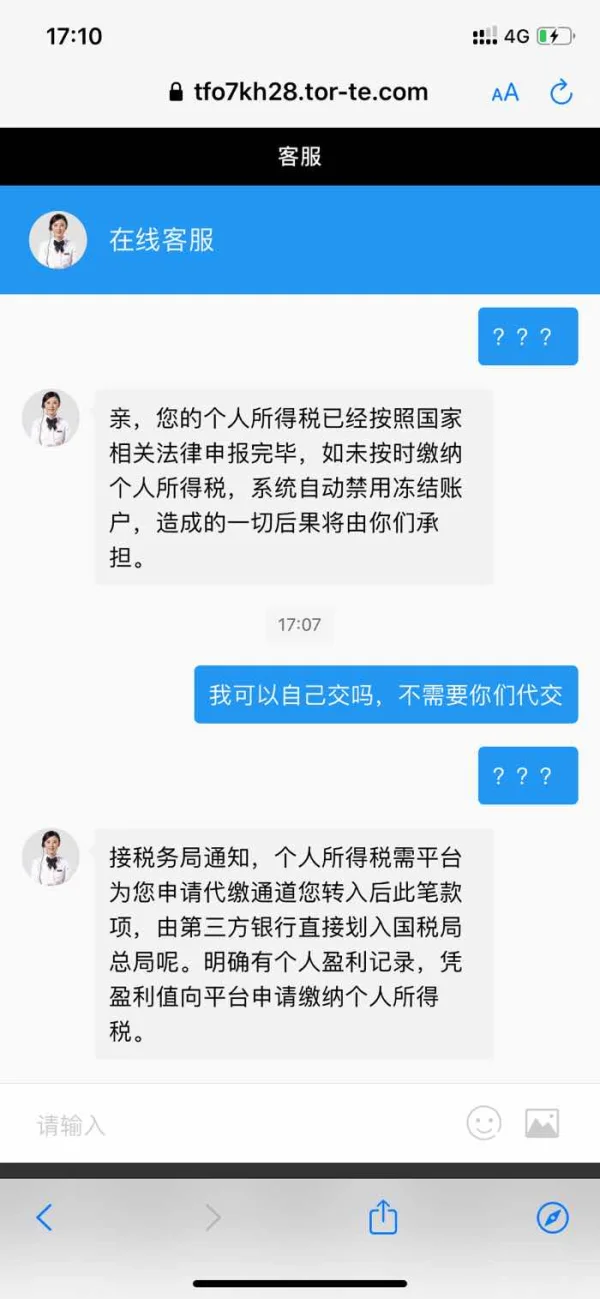

和之前那个曝光的人一样,说我银行卡信息错误无法提现,任何证件都不能证明身份必须缴纳百分之二十保证金,缴纳了以后又说我没有备注,又要我再继续交一遍,和周围亲戚朋友说了之后果断报警,之前就查看了和我这个一样套路的诈骗手段,被骗两万多,骗子不得好死

Paglalahad

惔薄亽苼

Hong Kong

无法出金,一步一步套牢,典型的骗局套路,切勿相信!

Paglalahad

迷人又坏@

Hong Kong

团队合作,骗人,入金,她们最低要30000入金,最后20000也给做了,最后还提不出金……

Paglalahad

周刚

Hong Kong

平台一直出金拒绝;多次联系无结果;望给予曝光;

Paglalahad